Net 30 Meaning: What Is It and How Does It Work?

Net 30 is a credit term. The vendor offers credit and sends the products or performs a service first and then requests payment by a certain later date. For example, if an invoice is dated January 1 and says “net 30,” the customer must remit payment on or before January 30. It indicates when the vendor wants to be paid for the service or product provided. In this case, net 30 means the vendor wants to be paid within 30 days of the invoice date.

Key Takeaways

- Net 30 is a term included in the payment terms on an invoice.

- Net 30 on an invoice means payment is due thirty days after the date.

- Payment terms like net 30 are essential to include on an invoice because they clarify when you want to be paid.

- You can extend net 30 to net 60 or net 90 as a courtesy to clients who always pay on time.

In this article, we’ll cover:

Should I Use Net 30 in my Business?

Pros and Cons of Net 30 Payment Terms

What are the Alternatives to Net 30 Terms?

Streamline receiving payments with FreshBooks

Net 30 Meaning

“Net 30” is a pretty standard payment term for many industries that is often used on invoices. It means that businesses should expect payment within 30 days after the invoice date. For example, if an invoice is dated January 1st, then it would be due on January 31st. discounts

How Does a Net 30 Work?

As a new customer or business, you might be required to pay invoices immediately. When a vendor extends a Net 30 payment period, they are essentially offering you credit, trusting that you will pay the invoice in full within 30 days.

Offering Net 30 terms to your customers can encourage them to establish a positive payment history and develop a habit of making monthly payments. It also increases the likelihood of receiving payment on time. To ensure clarity, consider writing “payment is due in 30 days” instead of “Net 30” in your payment terms. Always strive for clear and concise invoice terms, and maintain consistency across all your invoices.

Managing Net 30 Terms

Payment terms like net 30 are essential to include on an invoice because they clarify when you want to be paid. This ensures clarity resulting in timely payments.

It also increases your chances of being paid on time. Instead of “net 30,” you may want to write “payment is due in 30 days” in your payment terms. This makes matters even more apparent to the customer. Your payment terms should always be as clear and concise as possible, and try to include consistent terms from invoice to invoice.

Net 30 Payments and Discounts

Businesses can offer early payment discounts to encourage customers to pay sooner, which can help improve cash flow and reduce the risk of late payments.

For example, a business may offer a 2% discount for payments made within 10 days of the invoice date. This not only benefits the customer but also helps the business to receive timely payments and maintain a healthy cash flow.

Also, if payments are not received after the specified period, sellers may escalate the matter and consider legal action to ensure compliance.

Credit and Accounts

Businesses must carefully evaluate their customers’ creditworthiness before offering net 30 payment terms. This involves assessing the customer’s payment history, credit score, and financial stability to determine their ability to pay within the specified timeframe.

By offering net 30 payment terms to creditworthy customers, businesses can build trust and establish long-term relationships. However, it’s essential to have a system in place for managing accounts receivable and tracking payments to avoid cash flow problems and potential bad debt.

Should I Use Net 30 in my Business?

Small business owners don’t use the same payment terms with every client. You may extend net 30 or even more generous payment terms like net 60 or 90 to trusted clients who pay on time. With many businesses, excellent customer loyalty can extend their payment period.

New clients who would like a credit line or who want to build business credit with a credit application can have their history checked with credit bureaus like Equifax business. Usually, pay immediately, and net 10 or net 15 is offered to new or late-paying clients. Net 10, 30, and 60 are the most common net terms.

A small business can also offer a discount to incentivize clients to pay earlier than the requested date.

“For example, an invoice with credit terms of net 30 can offer a 5% discount if the customer pays the invoice within 5 days. This is written as “5/10, net 30.”

If you want to use a premade net 30 invoice template, you’re in luck! To save you time, FreshBooks offers a free download of invoice templates. You’ll find a variety of templates and styles to suit your business.

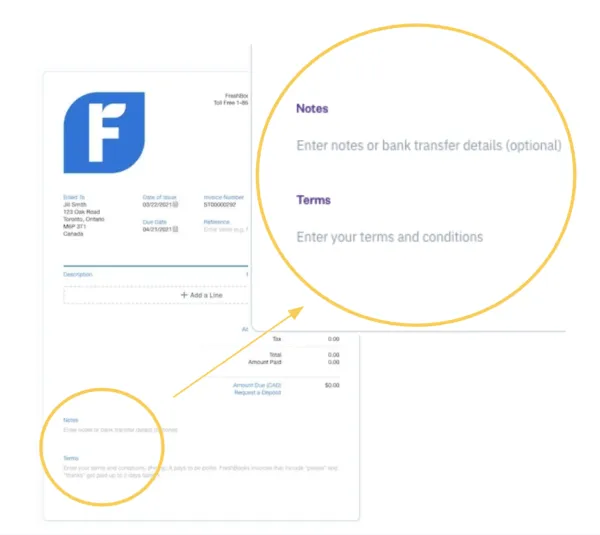

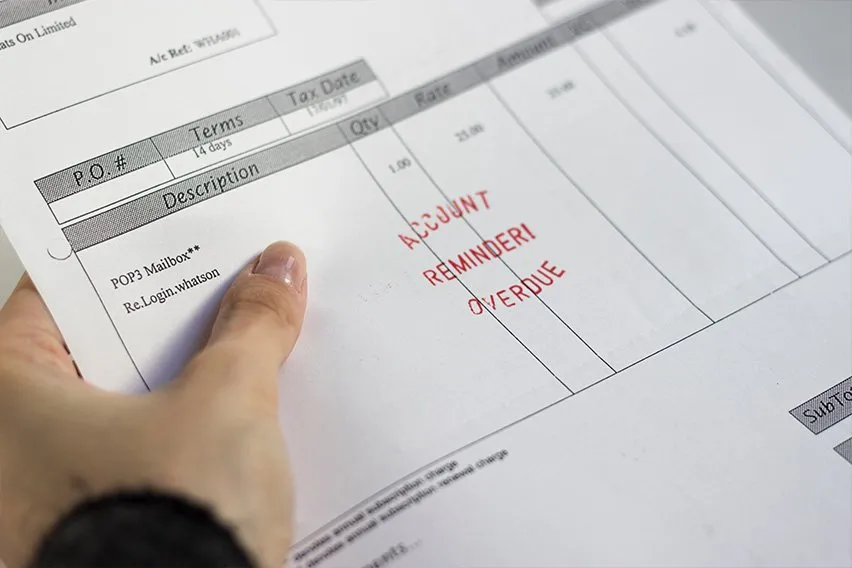

Where Do I Put Net 30 on an Invoice?

Credit terms may have their own section at the top or be added to the terms and conditions section at the bottom. In the below example, net 30 can be placed in the “terms” section at the bottom. However, there is also a “due date” at the top that clarifies what day payment is due.

Pros and Cons of Net 30 Payment Terms

Just like anything, net 30 payment terms have their pros and cons.

Pros:

- It’s easier to work with larger companies. You’ll find that relaxing your payment terms will be more conducive to working with companies that have multiple levels of payment processes or strict payment dates.

- Attractive payment terms and flexible billing can help gain you more customers.

- Offering credit terms can encourage customer loyalty and build solid business relationships.

Cons:

- The possibility of not having enough capital in the bank to pay your suppliers

- The lack of paid accounts can create slow cash flow problems, potentially causing problems for payrolls and important bills.

- Sometimes invoices aren’t paid at all. Extending credit to customers can backfire if the customer’s business is not stable or credit-worthy.

What Are the Alternatives to Net 30 Terms?

You can decide on any alternative to net 30 terms, such as extended payment terms, when you are the vendor. That is your prerogative if you want to make a net 20 term to improve your cash flow dates.

When you are a customer, you initially need to take the terms the supplier offers. As you create a relationship with that business and prove that you can pay earlier and on time, you build business credit and can request better terms.

Streamline receiving payments with FreshBooks

A solid grasp of payment terms like Net 30 is vital for your business’s financial health. By setting clear expectations for when you’ll be receiving payment, you can improve your financial planning and stability. FreshBooks accounting software can help streamline this process by automating invoices and sending reminders, making it easier to manage your accounts receivable and ensure timely payment from your clients.

By using accounting software and automating payment reminders, businesses can streamline their payment process and reduce the risk of cash flow problems. Additionally, offering early payment discounts can incentivize customers to pay sooner, improving cash flow and reducing the risk of late payments.

FAQs on Net 30

What Is Net Amount on an Invoice?

Net amount on an invoice is the cost of products or services before sales tax or any other fees like a discount or outstanding balance. The invoice total, including tax and additional fees, is an invoice’s gross value.

Some companies only include a net number because they are tax-exempt. For example, if an American business buys something from Europe, the vendor may only charge them the net amount, pay for VAT (tax) themselves and then apply for a refund. This saves the American company from paying taxes and applying for a refund.

A net amount is also useful to show a customer how much they’re paying for products and services purchased before any additional fees and taxes.

What Does Net Mean on an Invoice?

Net can mean two different things on an invoice.

- Net can apply to payment terms. For example, “net 15” means full invoice payment is due, at the latest, fifteen days from the invoice date.

- Net can also apply to the total due on an invoice. The net value of goods or services itemized on an invoice is their value before tax or other fees. The net value tells the customer or client how much they’re paying for an item or service before tax.

What Does Net 10 Mean on an Invoice?

On an invoice, net 10 means that full payment is due 10 days after the invoice date, at the very latest. Net 10 is a credit term, meaning services and products are sold in advance, and the client pays later.

A small business may use shorter payment terms, like net 10, with new customers or customers that tend to pay late. Once the customer starts paying on time, the business may extend longer payment terms like net 30 or net 60.

What Does Net 15 Mean on an Invoice?

On an invoice, net 15 means that full payment is due 15 days after the invoice date, at the very latest.

Net 15 is part of a company’s payment terms. Instead of asking a client for immediate payment after a product has been delivered or service performed, the customer pays the invoice within the time set by the company. In the case of net 15, the client has 15 days to pay the invoice.

Net 10, 30, and 60 are the most common payment terms. Net 15 is relatively short. A small business may use these terms for new clients or existing clients who haven’t paid their invoices on time in the past.

How do you qualify for net 30?

Ask your supplier or vendor to speak to their credit department and ask to establish an account. You may be required to fill out a credit application. This is often the first step in qualifying for net 30 terms.

What Is Trade Credit?

Trade credit is a financial arrangement between businesses that allows a buyer to purchase goods or services without making immediate payment. Instead, the buyer agrees to pay the seller at a later date, typically within a specified period, such as net 30, net 60, or net 90 days. By offering trade credit, suppliers can build stronger client relationships and encourage customer loyalty.

Reviewed by

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

How to Get a Client to Pay an Invoice: 8 Effective Tips

How to Get a Client to Pay an Invoice: 8 Effective Tips How to Write an Invoice Letter: A Small Business Guide

How to Write an Invoice Letter: A Small Business Guide 8 Tips to Write an Overdue Invoice Letter That Will Get You Paid

8 Tips to Write an Overdue Invoice Letter That Will Get You Paid How To Print An Invoice? Step By Step Guide

How To Print An Invoice? Step By Step Guide What Is a Vendor Invoice?

What Is a Vendor Invoice? How Much Interest To Charge On Overdue Invoices

How Much Interest To Charge On Overdue Invoices