Get 70% off for 4 months

Risk Free. 30-Day Money Back Guarantee

Monthly Plans

Get 70% off a Lite, Plus or Premium plan for 4 months. After the 4-month promotional period, you will be billed at full price for the plan you have selected.

Yearly Plans

The total price for a yearly plan is billed at time of purchase. It includes both the monthly discount outlined above, as well as an additional 10% discount for selecting a yearly plan.

Promotional offers for both monthly and yearly plans are for a limited period. New customers only. Cannot be combined with other offers. No free trial period is included when availing this promotional discount. FreshBooks reserves the right to change this offer at any time.

30-Day Money Back Guarantee

Buy now and save on a FreshBooks plan, with a promise that if you aren’t satisfied you can contact us anytime within the first 30 days after purchase for a full refund.

Save an Extra 10%

- Show All Plans

- Freelancers

- Self-Employed

- Businesses With Contractors

- Businesses With Employees

Why Business Owners Love FreshBooks

“We had a record year this past year. Could we have done it without FreshBooks? I don’t know how we would have.”

“I found FreshBooks to be so intuitive. I was easily able to do time tracking, expense tracking, and invoice customers.”

“The competitve pricing of FreshBooks and the user interface, it’s just very user-friendly. For someone in branding and marketing PR, that’s important.”

- Lite

- Plus

- Premium

- Select

|

Unlock all features for 30 days

Unlock all features for 30 days

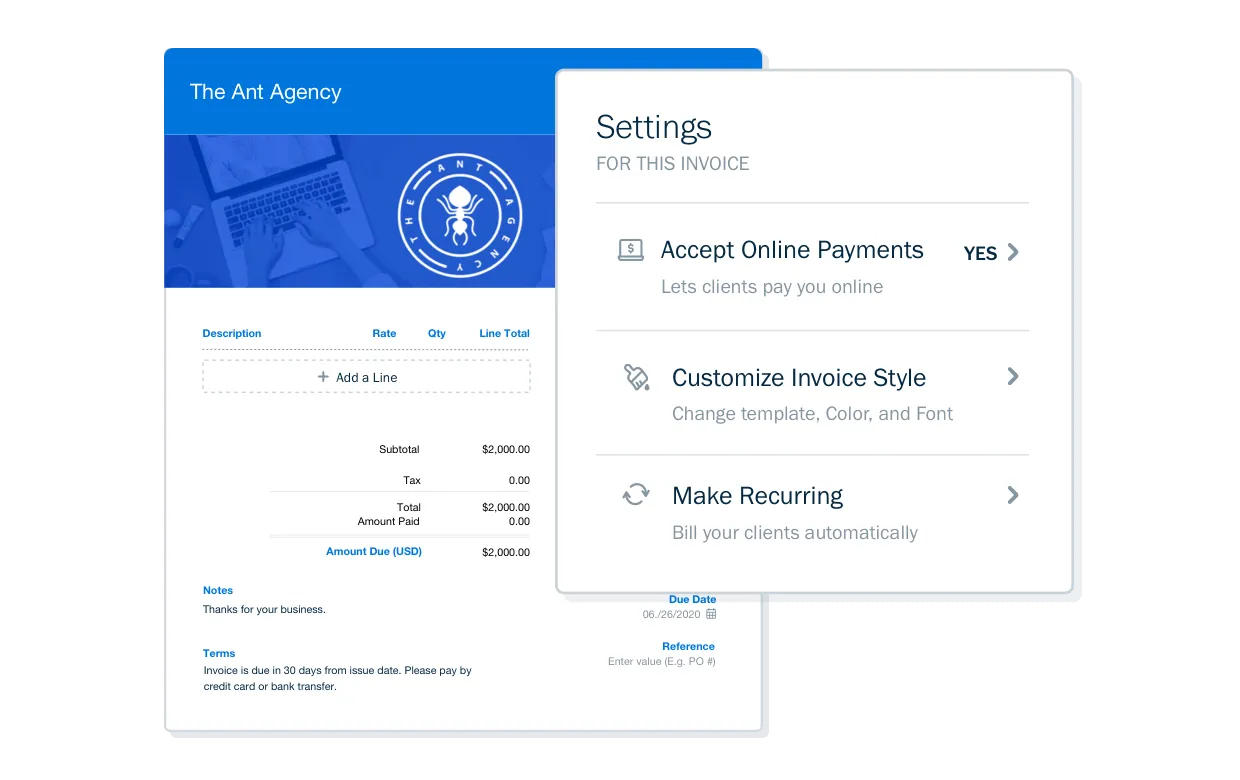

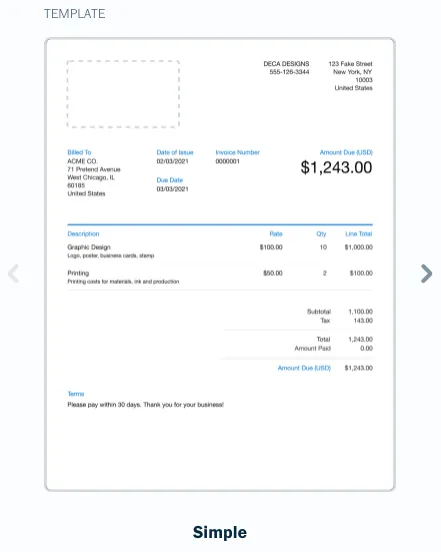

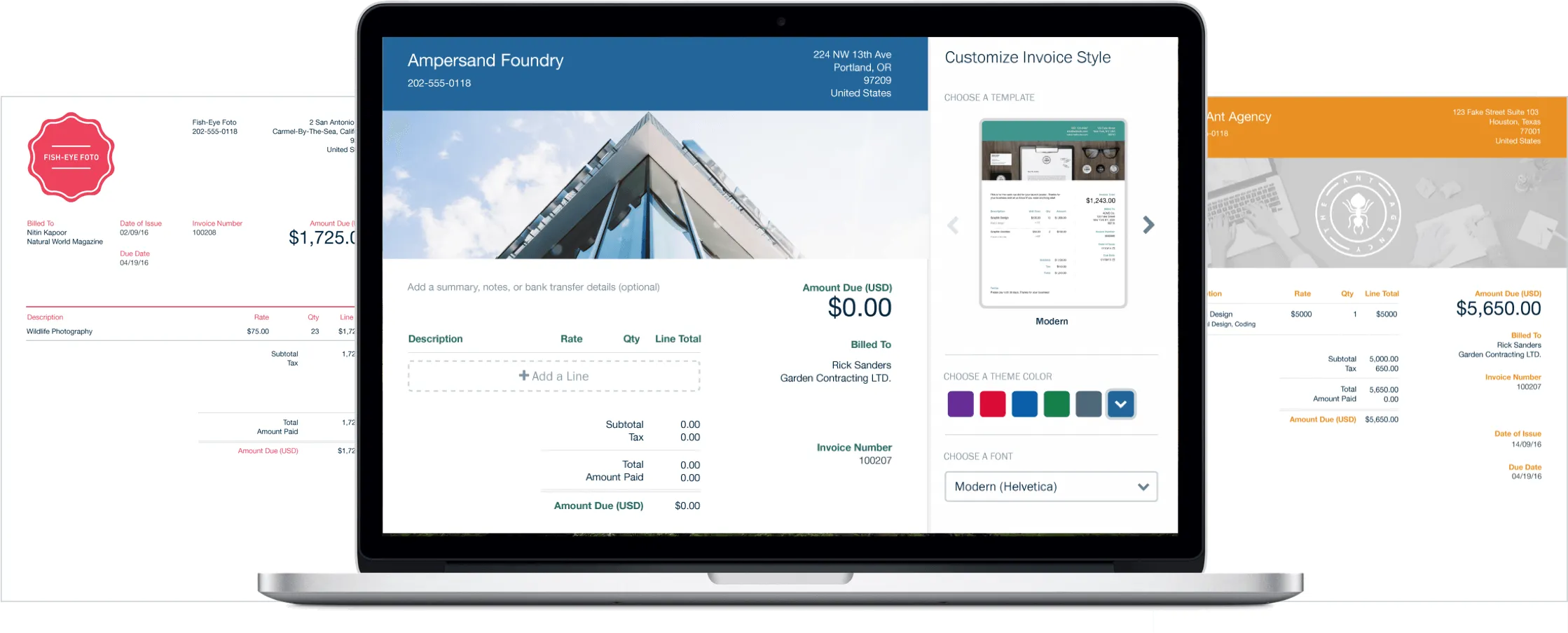

FreshBooks Product:

Try It Free for 30 Days

|

|---|

| TRACK AND ORGANIZE CLIENT INFO | ||||

|---|---|---|---|---|

|

Billable Clients |

5 Clients | 50 Clients | Unlimited | Unlimited |

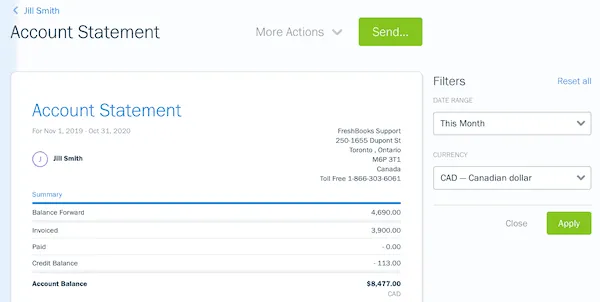

| Client Profiles and Account Statements i |

|

|

|

|

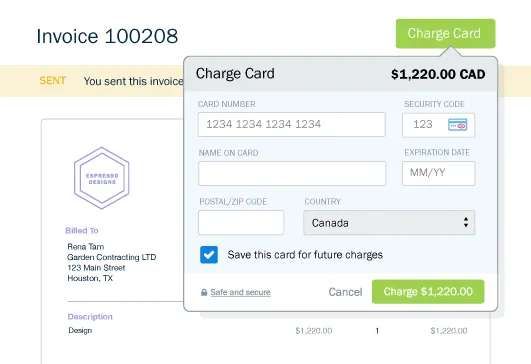

| Clients Can Store Credit Card Info i |

|

|

|

|

| Client Account Portal i |

|

|

|

|

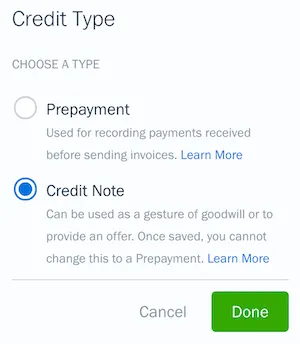

| Client Credits i |

|

|

|

|

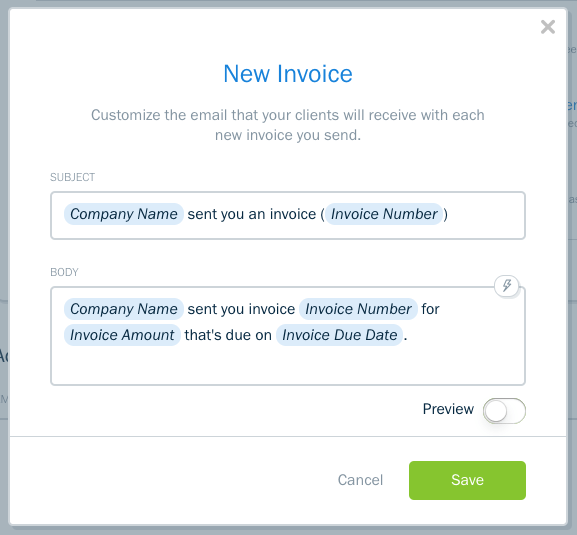

| Customized Email Templates and Signatures i |

|

|

||

| Automated Client Emails with Dynamic Fields i |

|

|

||

| Remove FreshBooks Branding from Client Emails i |

|

|||

| ADD-ONS | ||||

|---|---|---|---|---|

| Advanced Payments i | $20/mo | $20/mo | $20/mo | Included |

| Team Members (per person) i | $11/mo | $11/mo | $11/mo | $11/mo |

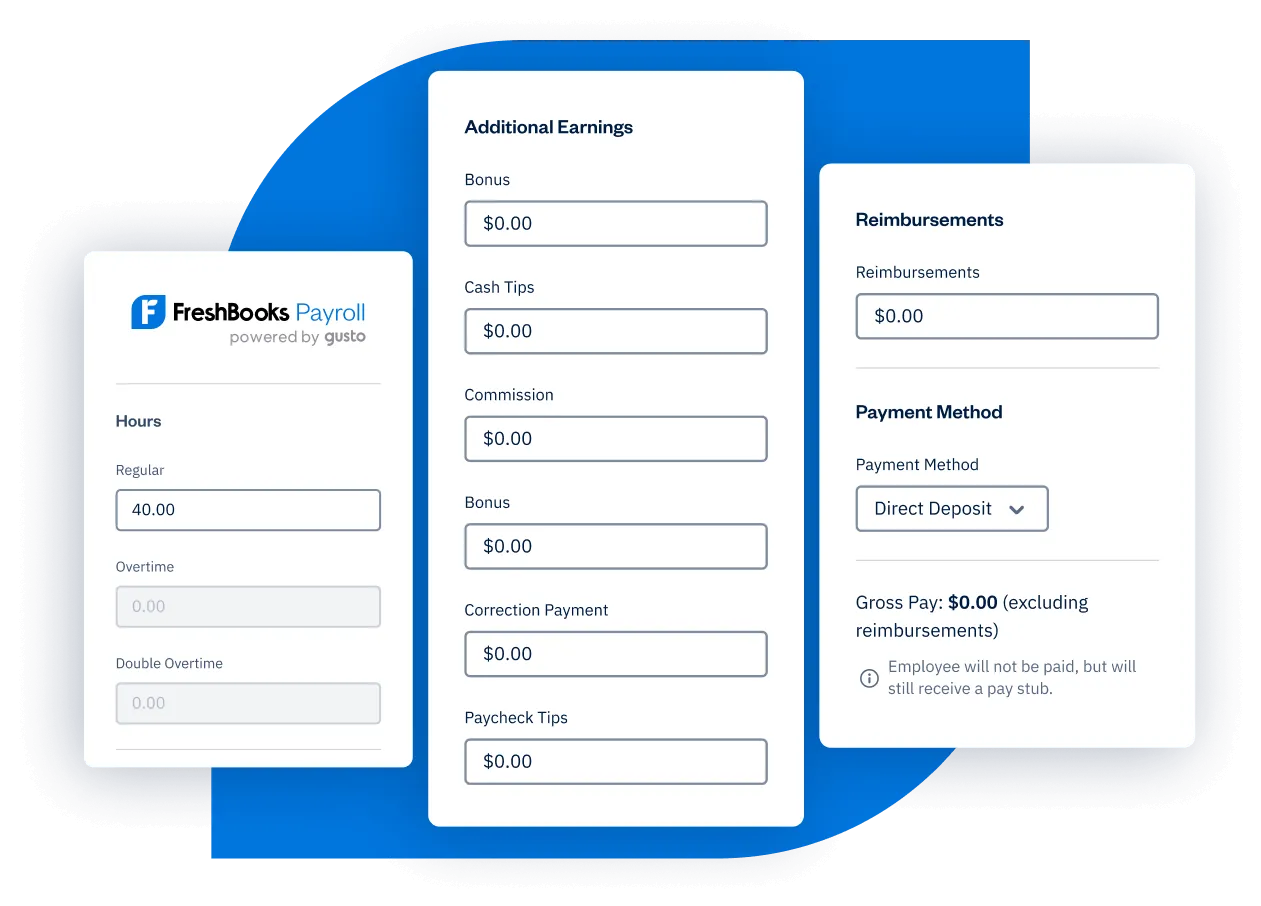

| FreshBooks Payroll i | ($40 + $6/per person each month) | ($40 + $6/per person each month) | ($40 + $6/per person each month) | ($40 + $6/per person each month) |

or Try It Free

Award Winning Support

Our support staff is with you every step of the way, starting the moment you make the switch from spreadsheets or any other accounting software.

100% Safe and Secure

FreshBooks protects your personal info and your client’s info with industry-standard SSL and encryption so everything is always safe and secure.

Satisfaction Guarantee

Start a free 30-day trial today, no credit card required. Or buy now and save on a FreshBooks plan, with a promise that if you aren’t satisfied you can contact us (customersuccessteam@freshbooks.com) anytime within the first 30 days after purchase for a full refund.

Frequently Asked Questions

Try it, it’s on us. As a small business owner, you get unlimited access to FreshBooks accounting software through our 30-day free trial, with no contracts and no credit card required. You even get free phone and email support in case you have questions about setting up your account.

That’s right, the free trial period gives you access to all of our unlimited invoicing features, expense features, project management tools, the FreshBooks mobile app, business finance reports, and as many billable clients as you need. Basically, all the features growing businesses need to keep growing are available to try out.

Need more answers? Check out this great article on the FreshBooks blog: How to Make the Most of Your Free 30-Day FreshBooks Trial

With the free trial, you can use FreshBooks at no charge for 30 days (no credit card required).

After your trial is up, you can choose from one of several FreshBooks pricing plans. Each plan has different workflows and accounting solutions for businesses at different stages, as well as client limits or unlimited billable clients, depending on your specific needs.

If you’re not ready to subscribe, no problem. Your invoices, expenses, bank transactions, and other data will be securely stored in case you decide to upgrade later on. If you had a bank account connected to your account, the connection will be severed until you resume using it.

If you’re wondering “how much does FreshBooks cost?” Just take a peek above for all FreshBooks pricing plans.

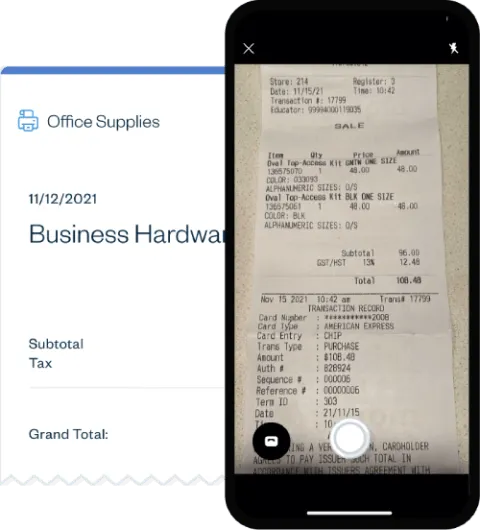

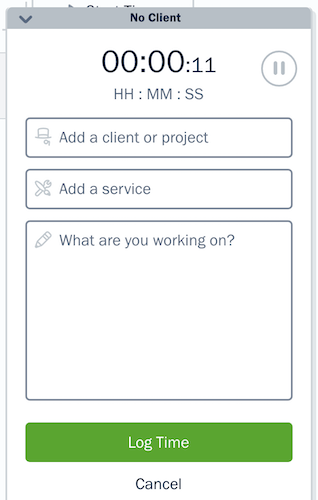

FreshBooks and all FreshBooks features are 100% web-based, meaning you can access them anywhere. There’s no accounting software to install on your computer. You can even use FreshBooks accounting software on your mobile device.

However, if you want to access FreshBooks accounting software on your mobile device you will need to install the iOS or Android app. Your account will sync with the app, so everything you see on your phone is the same as on your desktop. You can do basically all of the same business and accounting tasks on the go that you can do on your desktop.

FreshBooks protects your personal information. For security of transactions, we use the Secure Sockets Layer (SSL) protocol, which encrypts any information such as credit card number and billing information that you send us electronically. The encryption process protects your information by scrambling it before it is sent to us from your computer. In addition, your data is backed up automatically and is accessible from any device, so you can always stay connected and up-to-date.

Want to learn more? Check out this article from our blog: How Secure Is Your Data in the Cloud?

We are not going anywhere. Since 2003, over 30 million people have used FreshBooks to send, receive and pay invoices. Today FreshBooks has paying customers in over 160 countries and is the #1 cloud accounting solution designed for small business owners. We help everyone from the most fragile of businesses (many of them one person, first-time owners) to the most vibrant service-based small businesses.

If you need help setting up your account, or have any questions about using FreshBooks, one of our Account Specialists is ready to spring into action. It’s the kind of support you always wished you had, and guess what? It’s free forever.

Toll Free North America (9 AM – 5 PM EST)

Toll Free Outside USA/Canada (8 AM – 4 PM GMT)

The client limit on each of FreshBooks plans refers to the number of both active and archived clients in your account. If you’re no longer billing or working with a client, you can delete them to free up spots for new clients. Deleted clients’ invoices and information will still remain accessible to you, and you can always undelete clients at a later date.

Here’s a quick breakdown of billable clients in FreshBooks:

– Lite: 5 billable clients

– Plus: 50 billable clients

– Premium: Unlimited billable clients

– Select: Unlimited billable clients (+ custom pricing plans)

The short answer is YES, it will!

Here’s the long answer:

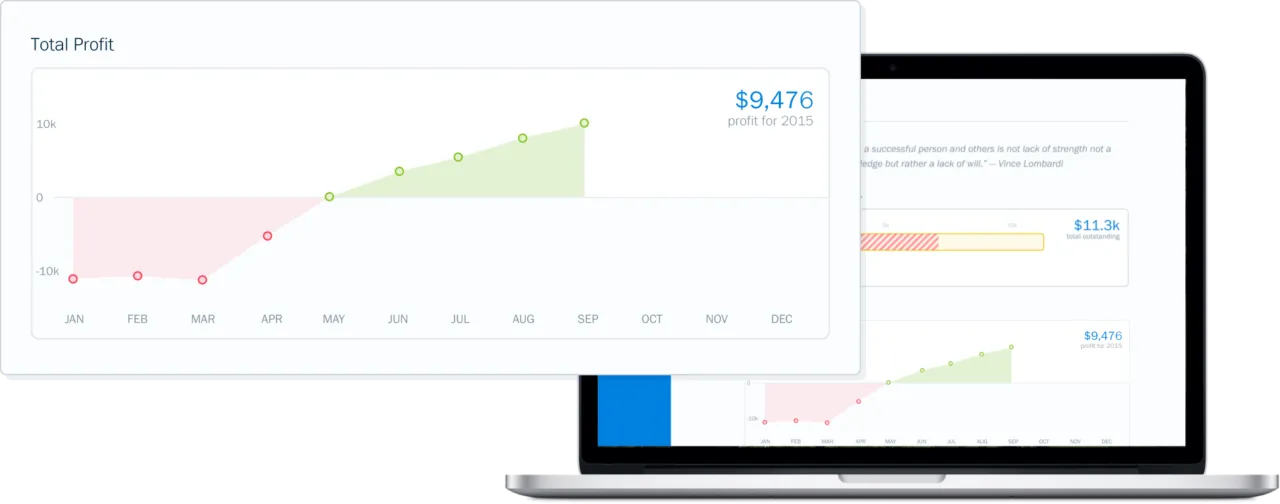

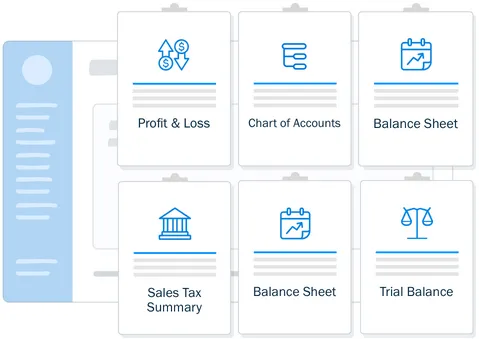

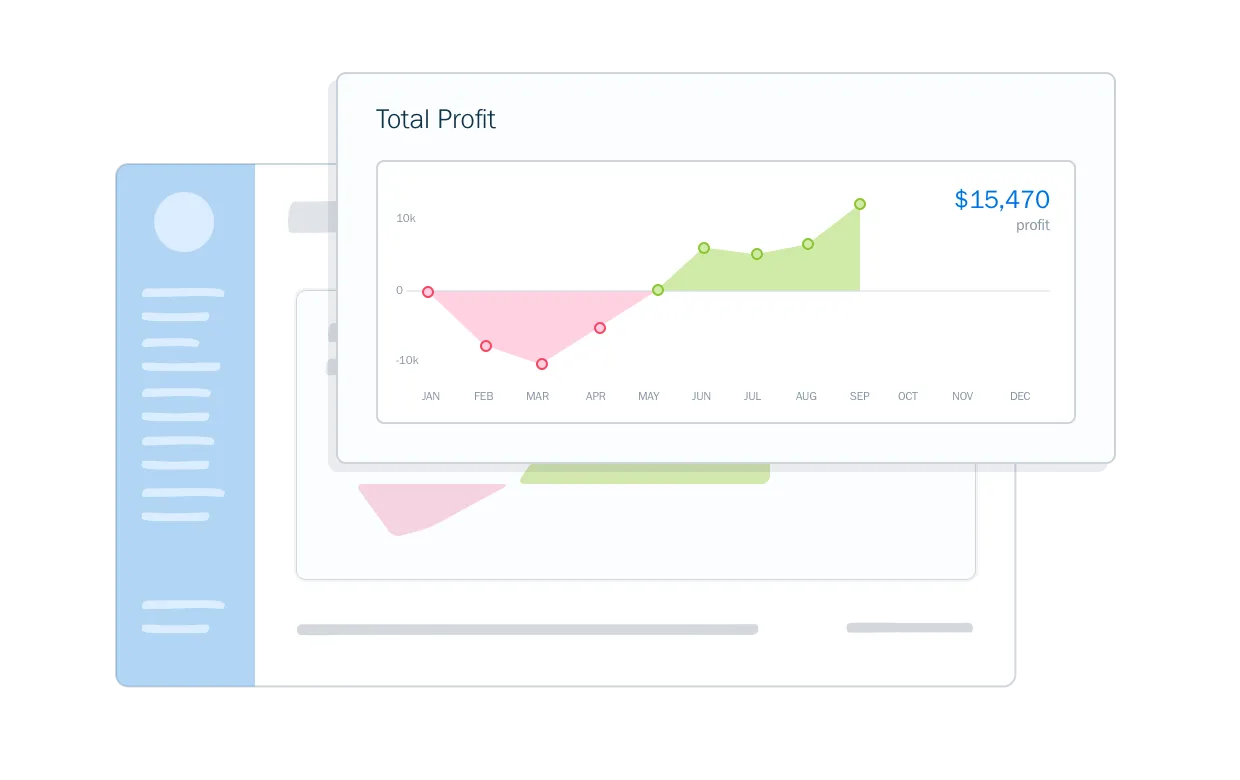

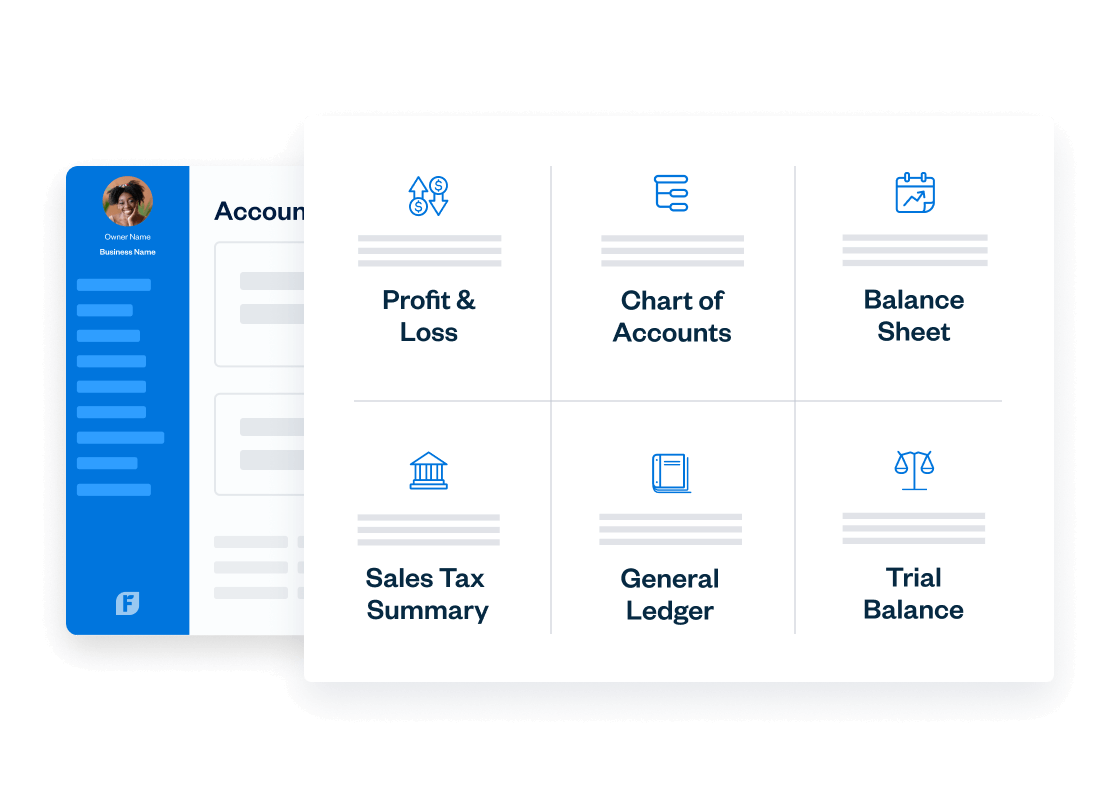

FreshBooks accounting software has accounting reports for small businesses, like the Profit and Loss Report and Sales Tax Summary, which have the key numbers you need to fill out and file your tax return. We’ve even put together a list of handy resources to help you get ahead of tax time, which you can check out below. If you need double-entry accounting or bookkeeping help with filling out your return, check out our Accounting Partner Program to get matched with one of our vetted accounting or tax professionals.

Learn about the Profit & Loss Report here.

We are committed to ensuring your data’s security and protection by implementing SSL policies and ensuring we’re PCI compliant. We also work with partners who have security measures in place to ensure your business finances are safe.

That means that any of your data entered into FreshBooks is totally safe, and when you enter new customers into your account their information is just as safe.

There is no difference between a double-entry bookkeeping and a double-entry accounting software. Some refer to it as double-entry bookkeeping, while others refer to it as double-entry accounting or double-entry journal accounting. All have the same fundamental difference from a single entry accounting or bookkeeping system.

A single entry system involves creating a single entry for all business transactions to the accounting records. In contrast, a double-entry accounting system means every business transaction amount is recorded in two accounts. Additionally, a double-entry bookkeeping system reduces the risk of accounting errors and offers a level of financial transparency that single-entry can’t provide.

In FreshBooks, you and your accountant have access to all of the double-entry accounting reports you need to properly operate and grow your small business.

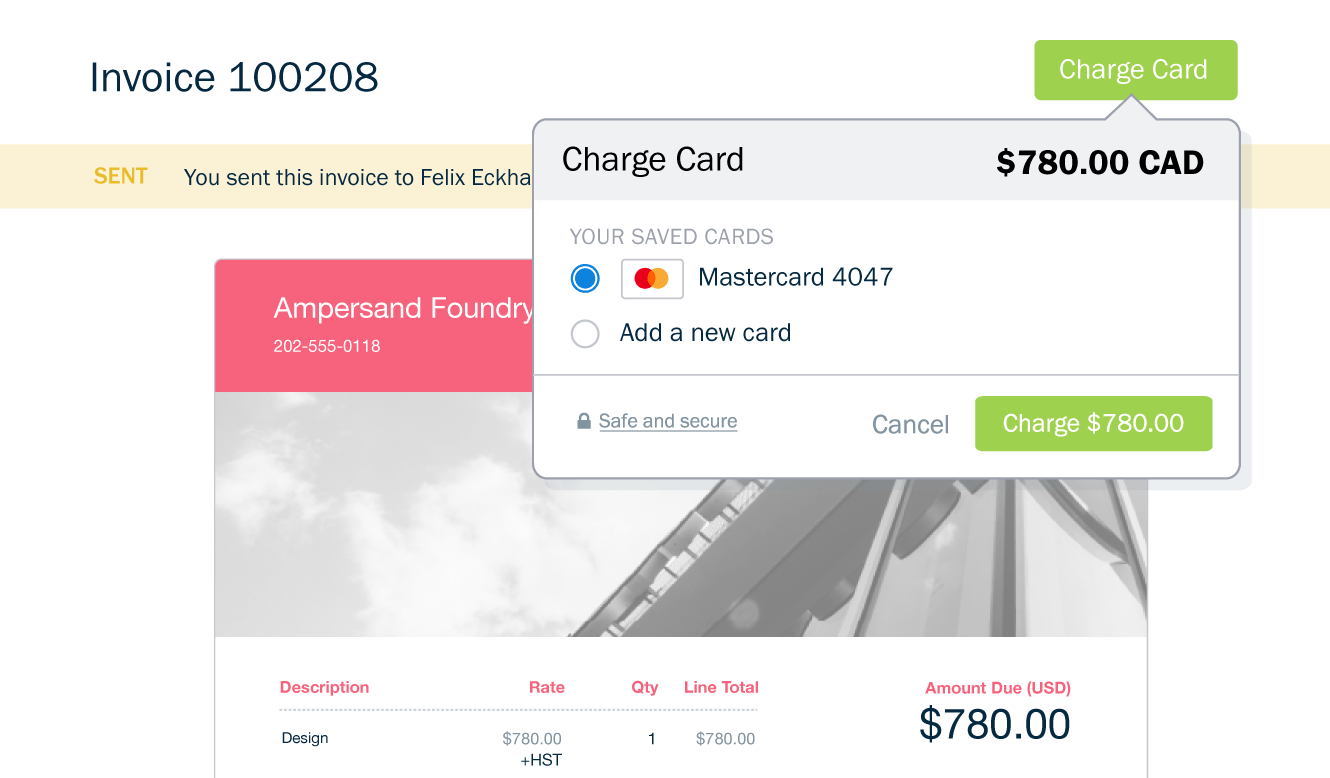

Depending on the type of payment processor you use, there are different costs associated with processing payments in FreshBooks. We know pricing is important to your bottom line, so you can count on no hidden fees and transparent FreshBooks pricing. Compare all the payment options FreshBooks offers and call us if you need more information.

FreshBooks Payments

– Credit: 2.9% + $0.30 per transaction

– Bank Transfers (ACH): 1% bank transfer fees*

– Secure for you and your clients

– Accept all major credit cards

– Bank Transfers (ACH) connects to most major banks in the U.S.

Stripe

– 2.9% + $0.30 per transaction on most cards

– Mastercard, Visa, AMEX, and Apple Pay

– Bank Transfers (ACH): 1% bank transfer fees*

– Secure for you and your clients

– Accept all major credit cards

– Bank Transfers (ACH) connects to most major banks in the U.S.

PayPal

– 2.9% + $0.30 per transaction

– Trusted by millions of users around the world

– Accept Visa, Mastercard, and American Express

– Accept Venmo and PayPal Credit

– Take payments in 25 currencies from 202 countries

*Bank Transfers (ACH) is only available for US customers

If you want even lower transaction rates then check out FreshBooks Select Plan.

With FreshBooks Select, you get preferred Bank Transfers (ACH) and credit card transaction rates,

a dedicated Account Manager, customized training for you and your team, and much more.

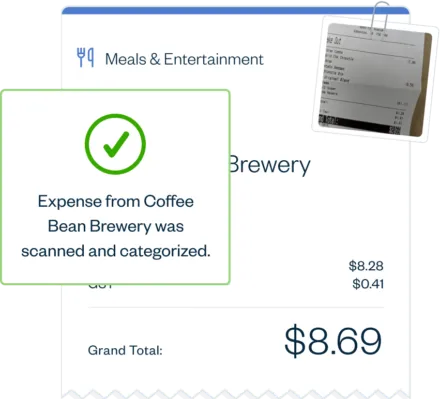

FreshBooks has a number of specialized features you won’t find in any other accounting software. Here are 3 that we know our customers absolutely love.

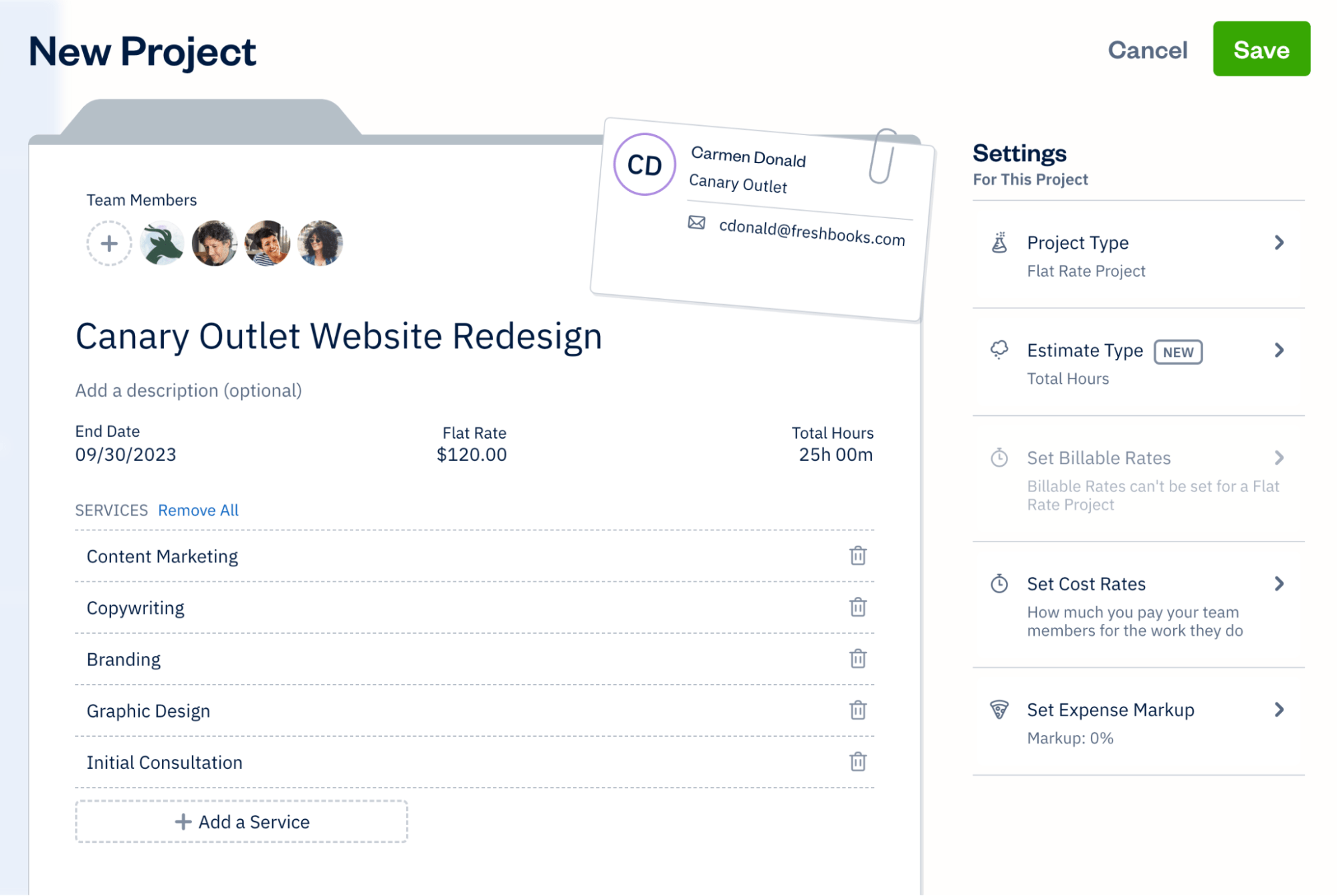

Project Profitability – Powerful Ways to Track Each Project’s Profitability

View a more detailed breakdown of each of your projects with the Project Profitability Widget, Profitability Summary Report, and Profitability Details Report. These tools give you an in-depth analysis of how each project is performing. It makes it easy to always know where your money is going. Check out all the details here.

Want to hear about Project Profitability in action? Check out this case study: How Zachary Uses Project Profitability to Save $2k per Month

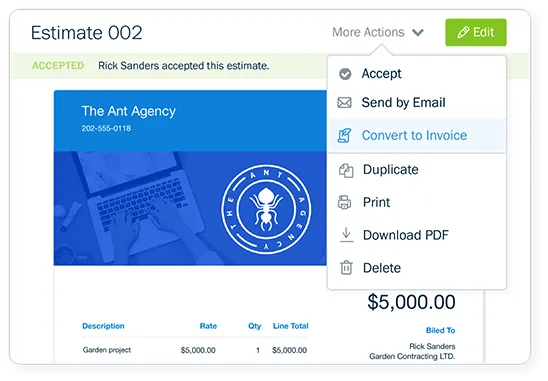

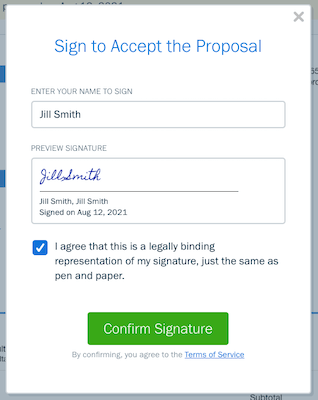

Simple Workflows Like Converting Estimates & Proposals to Projects

This is just one example of a time-saving workflow in FreshBooks, but you can easily convert an estimate or proposal into a project with a single click. The same customer that got your estimate or proposal now has a project assigned to them, and any and all services that were added in the estimate or proposal are now added to the project.

Check this out to learn more about how useful Estimates can be: Landscapers Marc & Darryl Broke Even in 3 Months Using FreshBooks Estimates

FreshBooks Accounting Partner Program

Are you an accountant seeking deeper connections with your clients through collaborative accounting? The Accounting Partner Program was launched to help you with exactly that, and you can join any time.

We could write an eBook detailing why FreshBooks is the best accounting software for your business, and a better solution than Quickbooks Online, Xero, Zoho, Wave, or any other accounting software. However, the best way for you to decide is to start a 30-day free trial. You get to use all the user-friendly features and you don’t need a credit card to sign up.

FreshBooks is the perfect solution for everyone, from very small businesses all the way up to established tech companies with big teams. Kind of like this one: Erik’s Health-Tech Startup Relies on FreshBooks to Keep Cash Flow Strong

Want more information about which of the FreshBooks plans is right for you? Check out this blog article: Wondering Which FreshBooks Plan Is Right For You?

If you want a thorough breakdown, before you start a trial, of the main reasons FreshBooks is a better accounting software then check out the links below.