Fiscal Year (FY) Definition & Overview

There are several terms and processes to understand when it comes to business accounting. And as a small business owner it’s important to know how these processes work. You want to ensure your business accounting is accurate and done within the right timeframes.

One of the main financial performance terms you might have heard is fiscal year. But how exactly does it work and is there anything that you should know? In this guide, we’ll cover how the fiscal year works, a few examples, some different types, and some of the main IRS requirements.

Before you know it you’ll have a better understanding of this accounting term so you can get back to business.

Table of Contents

KEY TAKEAWAYS

- Fiscal year is a certain 12-month period in which a company chooses to report their financial information.

- Everything from federal tax filings, audits, and various financial reports get based on the fiscal year.

- The fiscal year can be different from a calendar year. For example, it might be based on the primary revenue cycle of the business.

What Is a Fiscal Year?

When it comes to business, a fiscal year (FY) is a 12-month time period in which accounting gets done. The time frame is put into place to make it easier for companies to do their budget processes, tax filing, and for other accounting purposes.

It doesn’t always line up perfectly with a calendar year, either. A business might align its fiscal year with the primary periods where revenue is generated. For example, certain agriculture companies might try and coincide with a harvest season. As well, a college or university will have its fiscal year start and finish to coincide with the school year.

To put it simply, a fiscal year is the time period that gets set to track financial performance. It’s set up to make comparing and tracking financials as easy as possible. And it doesn’t matter the type of industry your business is in.

What Are the Different Types of Fiscal Year?

A fiscal calendar doesn’t have to line up with the start and finish of the calendar months. It might depend on accounting procedures and there are a few ways to track it. Let’s take a closer look at some of the different types and why some individual companies might use them.

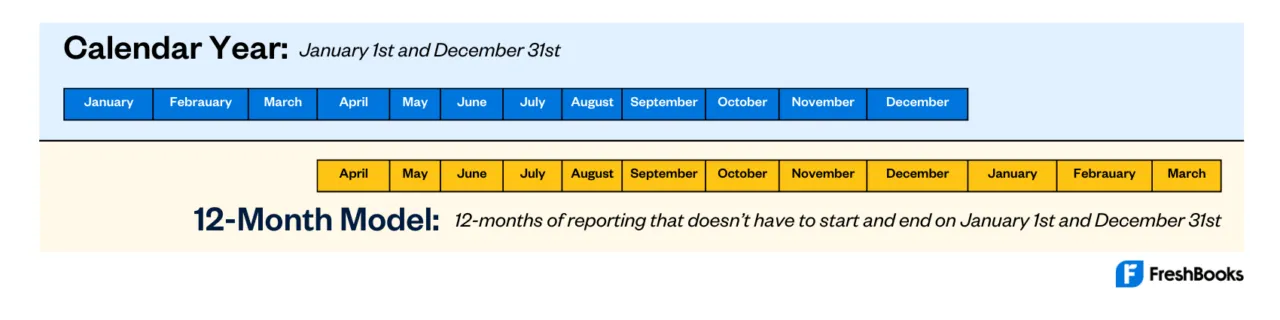

Calendar Year Model

This is one of the most common fiscal year tracking systems since it’s easy to match up with January 1st and December 31st. When a company decides to use this model, its fiscal year will be a total of 365 days. However, it will be a total of 366 days in the case of a leap year.

Using the calendar year approach works well if your business doesn’t have significant periods that line up with the end or beginning of the year. It’s a pretty straightforward process when it comes to reporting financials to the government.

Investors see benefits from this approach, as well, since it makes for a simple process. Many small businesses use the calendar year for financial reporting.

One of the biggest downsides of the calendar year approach is that key financial periods can get split up. For example, the quarters of the fiscal year might not align perfectly with key revenue-generating periods. This leads to making tracking your fiscal year a little more inconvenient.

12-Month Model

This approach works in a similar way to the calendar year approach. However, the 12-months of reporting don’t have to start and end on January 1st and December 31st. It’s another popular way to track financial performance.

With this model, you would choose a specific date to start your fiscal year, and then it would last for 12 months. Keeping a close eye on the end date of your fiscal year is important to do.

Many businesses aim to have their fourth quarter be their strongest of the year. In this case, it can be common to design their entire fiscal year around that fourth quarter. This can give the business a much better chance of showing a higher level of growth and profit.

One of the most common industries to use the 12-month approach is the construction industry. These businesses can have an increase in expenses and income at certain times of the year. Being able to choose when their fiscal year starts makes it easier to track losses and profit.

If they were to use the calendar approach, for example, their financial data might get split up. By being able to adjust their fiscal year, they can ensure financial reporting and planning are as easy as possible.

52 to 53-Week Model

This approach can be a better way to organize the fiscal year so financial data doesn’t get jumbled. Businesses will tend to use the 52 to 53-week model to have their fiscal year-end on the exact same day each year.

It can be a common way to track the fiscal year for retail businesses. This is since there can be different sales throughout the year that increase profits. By having the fiscal year include certain holiday sales, their sales figures in the fourth quarter will be stronger.

That said, it can be a more complex approach to the fiscal year compared to the 12-month or calendar year models. But if your business has a high revenue flow, the increase in complexity can be worth it financially.

IRS Fiscal Year Requirements

The calendar year is the default fiscal year IRS system. So any taxpayers will have to adjust certain deadlines when it comes to making payments and filing forms. Most people need to file taxes by April 15th of the following year.

Fiscal year taxpayers, on the other hand, have to file by the 15th day of the fourth month. And this is the fourth month that follows the end of the fiscal year.

For example, let’s say your business has a fiscal year that runs from July 1st to June 30th. In this case, you would need to file your taxes by October 15th.

To determine your fiscal year, all you need to do is submit your first income tax return. Then, you just need to observe the fiscal tax year from that date. You can choose to change to a calendar year approach at any time.

That said, if you want to change from a calendar year to a fiscal year, you must get permission from the IRS. Either that or you need to meet certain criteria that are outlined on Form 1128. This is the Application to Adopt, Change, or Retain a Tax Year.

Summary

Understanding the fiscal year of your business is important for financial reporting. Basically, a fiscal year is any 12-month period that you choose to report financial information. Everything from federal tax filings, external audits, and financial reports follow the fiscal year.

The calendar year approach is one of the most common and simplest models for the fiscal year. However, you can also choose to use the 12-month model or the 52 to 53-week model. It’s going to vary from company to company to align with the most convenient time period and business activity.

For example, some businesses see key periods in the 1st quarter, 2nd quarter, 3rd quarter, or 4th quarter. Wherever the key periods land, lining up your fiscal year with them will be good for business operations.

Basically, if your company chooses to use a fiscal year for budgeting and financial reporting, it’s a one-year period. It can be a common approach for different accounting purposes and to help prepare financial statements. It’s also an effective way to align your financial reporting with your most important quarters.

For example, all your revenue and expenses can align with the time periods where your business is most active. This can be common for seasonal businesses that see regular highs and lows throughout different months.

Regardless of the type of business that you operate, it’s important to find the right fiscal year. This way, you can ensure your business is maximizing certain accounting periods. You’ll be able to benefit in the long term and continue to grow your business.

FAQs on Fiscal Year

The easiest way to get your 1040 is to get it online. You can check with your e-filing provider that you used to find out exactly how to do this. When you do, you can also typically access your three most recent tax returns.

Most businesses that have their tax year-end on the last day of a month other than December use the fiscal year. These can include partnerships, sole proprietors, and limited liability companies. They can also include S corporations and personal service corporations.

In SAP, the fiscal year will contain a total of 16 different posting periods. Within this, 12 of the posting periods are considered to be normal posting periods. The other four are considered to be special posting periods.

Your fiscal year is always going to coincide with the end date of a specific 12-month period. Unless it is December, a fiscal year will always end on the last day of the month. For example, May 1 to April 30 would be a fiscal year.

It all depends on the type of business. Using a fiscal year instead of the calendar year can let seasonal businesses benefit from start and end dates. This helps align with their revenue and expenses. Essentially, it can present an accurate picture of overall financial performance.

Share: