Days Sales of Inventory (DSI): Definition, Formula & Calculation

To get a better understanding of your business, you can use a variety of financial ratios. Leveraging the information that these ratios provide allows you to make more informed decisions in the future.

One financial metric that lets you get insights into inventory is the days sales of inventory calculation. Read on to learn all about it, including the formula to calculate it, its importance, and an example of it in use.

Table of Contents

KEY TAKEAWAYS

- Days sales of inventory (DSI) relates to the average number of days that it takes for a company to sell the inventory it has. It also includes any goods that are still a work in progress.

- Analysts regularly use this financial metric to help gain insights into the efficiency of sales for a company.

- Having a higher DSI could potentially indicate that a company doesn’t manage its inventory effectively. Or, it could also indicate that the inventory a company does have is proving to be difficult to sell.

What Is Days Sales of Inventory (DSI)?

The days sales of inventory (DSI) is an important financial ratio and metric that helps indicate how much time in days that it takes a company to turn its inventory. The ratio also includes any goods that are still a work in progress. Essentially, it measures how efficiently a company can turn the average inventory it has into sales.

It can commonly get referred to in a few other terms. These include the average age of inventory, days sales in inventory, days inventory, days in inventory (DII), and days inventory outstanding (DIO). As well, the ratio can be interpreted in more than one way.

The figure that you end up with helps indicate the liquidity of inventory management and highlights how many days the current inventory a company has will last. Typically, having a lower DSI is going to be preferred since it means it will take a shorter amount of time to clear inventory. Yet, the average DSI is going to differ depending on the company and the industry it operates.

Days Sales of Inventory Formula and Calculation

In order to manufacture a product that’s sellable, companies need to acquire raw materials as well as other resources. Obtaining all of this helps to form and develop the inventory they have, but it comes at a cost. Plus, there are always going to be costs linked to manufacturing the product that uses the inventory.

For example, costs can include the likes of labor costs and utilities, such as electricity. All of these costs are represented by the cost of goods sold (COGS). Ultimately, they’re defined as the costs incurred to acquire or manufacture any products that are created to sell throughout a specific period.

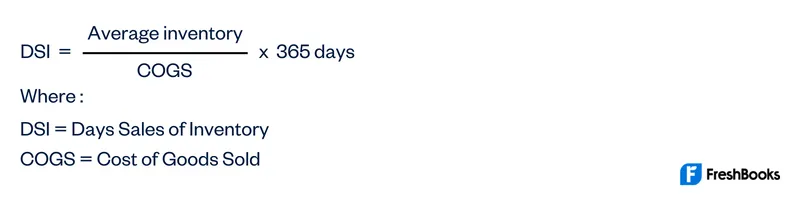

For the days sales in inventory calculation, you need to determine the average value of the inventory and the cost of goods sold during a given period. In mathematical terms, the corresponding period would be associated with 365 days in a year or 90 days in a quarter. It’s always worth noting that depending on the company and the industry, sometimes 360 days is used.

The numerator in the calculations is going to represent the inventory valuation. The denominator, on the other hand, will represent the average per day cost. This is how much the company would spend to manufacture the salable product.

Finally, the net factor will provide the average number of days that a company takes to clear or sell all of the inventory it holds.

There are two different versions of the DSI formula that can be used, and it depends on the accounting practices of the company. In the first version, the average amount of inventory is reported based on the end of the accounting period. For example, this could be the end of the fiscal year.

In the second version, the average value of end-date inventory as well as start-date inventory is considered. The resulting figure would then represent the DSI value that occurs during that specific time period. A retail company is an example of a business that would use days sales inventory.

The formula to calculate days of sales inventory would look like this:

Days Sales of Inventory Importance

Understanding the days sales of inventory is an important financial ratio for companies to use, regardless of business models. If a company sells more goods than it does services, days sales in inventory would be a primary indicator for investors and creditors to know and examine.

This is because the final figure that’s determined can show the overall liquidity of a business. Investors and creditors want to know more about the business sales performance. The more liquid a company is, it will likely translate into having higher cash flows and bigger returns.

As well, the management of a company will also be interested in the company’s days sales in inventory. Knowing these details will help gain insights into how efficiently inventory is moving. This can make a big difference in understanding storage and maintenance expenses when it comes to holding inventory.

There are also going to be carrying costs associated with inventory. These commonly include storage costs, insurance, rent, and other related expenses. All of these costs can end up impacting the profit margin of a company if they are not managed effectively.

On top of all of this, one of the biggest factors of importance is that the longer a company keeps inventory, the longer it won’t have access to its cash equivalent. Therefore, the company wouldn’t be able to use these funds for other operations and opportunities.

Example of DSI

Let’s say that a company has a total amount of inventory worth $10 million and its cost of goods sold for a fiscal year was $80 million. To find the days sales of inventory, you can input these figures into the formula outlined above. It would look like this:

DSI = (10/80) x 365 = 45.6 days

Typically you can find the inventory value on the company’s balance sheet. But the COGS value could also be obtained from the annual financial statement. Keep in mind that it’s important to include the total of all categories of inventory.

These can include progress payments, raw materials, work in progress, and finished goods. As well, this ratio can be important to plan for future demand, such as market demand and customer demand.

Summary

The days sales in inventory (DSI) is a specific financial metric that’s used to help track inventory and monitor company sales. Knowing how to calculate DIS and interpret the information can help provide insights into the sales and growth of a company. This is often important information that investors and creditors find valuable, and the company size doesn’t usually matter.

Essentially, sales in inventory can look into how long the entire inventory a company has will last. It’s critical information for management to understand, as well, so they can monitor the rate of inventory turnover and inventory levels. Plus, analyzing these details can help prevent theft of obsolescence, increase cash flow, and reduce costs. A retail corporation, such as an apparel company, is a good example of a company that uses the sales of inventory ratio to determine the cost of inventory.

FAQs About Days Sales of Inventory

To calculate days sales of inventory, you will need to know the total amount of inventory as well as the cost of goods sold for a time period. Then, you divide these numbers and multiply the figure by 365 days to find DSI.

To efficiently manage the inventory and balance idle stock, days in sales inventory over between 30 and 60 days can be a good ratio to strive for. Days of inventory can lead to a good inventory balance and stock of inventory.

Yes, if a company ends up selling more goods than the inventory it has, the turnover can become negative. This can be common in the manufacturing industry where a customer might pay for a product before parts or materials are delivered. The terms of inventory and types of inventory can vary, however.

Share: