Present Value Interest Factor (PVIF): Definition, Formula & Example

If an individual or a business is given a choice between a large sum of money or an annuity, it can be difficult to choose. Do you go with the large sum now? Or do you get paid in increments over time?

The reason that it is tricky is that the future value of the annuity is different from the same amount of money today. One of the things that you will need to consider is the present value of the sum of money. That’s where the present value interest factor comes into play.

But what exactly is the present value interest factor? And how can it help?

We’ll take a closer look at everything to do with PVIF in our handy guide.

Table of Contents

KEY TAKEAWAYS

- The present value interest factors (PVIFs) are commonly used to make the calculation of a time-value of a sum of money simpler.

- Present value interest factors are most regularly used when analyzing annuities.

- In terms of reference, present value interest factors are normally made available in table form.

What Is the Present Value Interest Factor?

The present value interest factor (PVIF) is a factor used to calculate the present value of a sum of money that is to be received at some point in the future. The factor is basically used to help determine whether the cash received now is worth more or less than what will be received later.

The PVIF is an important part of the calculation of the present value of money under the Discounted Cash Flow model. This is for figuring out the present value of the future cash flows of an investment.

For easier reference, the PVIF is commonly shown in the form of a table. The table will usually provide the present value factors for a number of different combinations of time periods and discount rates.

What Is the Formula for the Present Value Interest Factor?

The formula for the present value interest factor can be used to estimate the current worth of a sum of money. This is a sum that is to be received at a future date. As we mentioned earlier, PVIFs are commonly presented in the form of a table. This is with values for different combinations for time periods and interest rates.

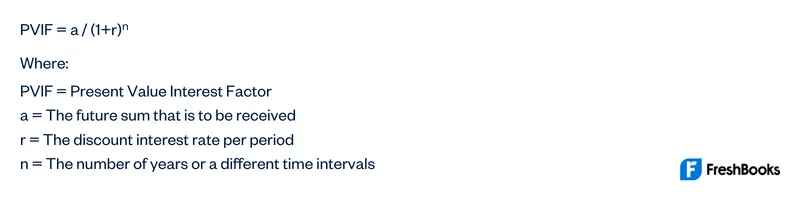

The present value interest factor formula is as follows:

The time period is basically the amount of time after which the money is to be received. It can be expressed in terms of days, months, or years.

The discount interest rate refers to the interest rate or the internal rate of return that an investment can earn within that particular time period. It represents the rate at which the future value of the sum of money is discounted in order to get to its present value.

It’s important to note that this discount rate shouldn’t be confused with another discount rate. The other rate refers to the interest rate that is charged by federal banks on their loans and advances. This is to commercial banks and other such financial institutions.

There are also a number of online calculators that can be used to do this calculation for you. The online calculators allow you to input your values and it will process the calculation.

What Is an Example of the Present Value Interest Factor?

Here is an example of how you can use the PVIF and the formula to calculate the present value of a future sum of money.

Let’s say that Company X is set to receive $100,000 in five years’ time. The current discount rate is 5%. With this information, and using the formula laid out above, we can make the calculation.

PVIF = 100,000 / (1+0.05)5

PVIF = $78,352.6

The present value of the future sum can then be calculated by subtracting the PVIF figure from the original future sum that is to be received. Therefore, the present value of the $100,000 to be received in five years’ time would be:

$100,000 – $78,352.60 = $21,647.40

Why Is the Present Value Interest Factor Important?

The PVIF is based around the concept of time value. This states that a dollar that you have today is worth more than a dollar you’d have tomorrow.

The reason for this is that the value of money appreciates over time. Provided that the interest rates remain above zero and the growth rate is stable. So the dollar you receive today can be invested and be worth more tomorrow. This potentially earned money helps to increase the value of the cash if you have it today, compared with having the same base value tomorrow.

Another point is that the money received today has a less inherent risk of uncertainty. Meaning that there may be a scenario where you end up not receiving the money in the future.

So essentially, the present value of a sum of money is inversely proportional to the time period.

PVIFs are often used when analyzing annuities. The present value interest factor (PVIF) is a useful tool, especially when it comes to calculating annuities. This is when deciding whether to receive a lump-sum payment now, or accept annuity payments in the future.

Using the estimated rates of return, you can compare the value of an annuity payment with the value of a lump sum payment.

However, the present value interest factor can be calculated only if the annuity payments are for a pre-decided amount. Also if this spans a predetermined range and period of time.

Summary

The PVIF is a useful tool when considering the time value of money. By using the relatively simple formula, you can quickly and accurately calculate the present value of a lump sum of money that is due to be received.

This can be helpful in business for a wide variety of reasons. Most importantly, it can be used to figure out if a payment schedule is worth the same amount of money if it is taken in a different manner.

FAQs on the Present Value Interest Factor

The present value interest factor for an annuity (PVIFA) is used to help calculate the present value of a number of future annuities. The idea is based on the time value of money definition. Meaning a dollar reviewed today is worth more than a dollar received tomorrow.

The present value interest factor (PVIF) is the reciprocal of the future value interest factor (FVIF). FVIF considers the effect of compounding and is always more than one. This is because the value of money grows with time.

FVIF helps to determine the effective future value of cash flows. This is based on the compounding concept of interest calculation.

PVIFA is the present value interest factor for an annuity. This is used to determine the present value of a number of future annuities. PVIF is the present value interest factor for a lump sum.

Share: