Real Estate Accounting: A Complete Guide for 2025

Handling the accounting for your real estate practice doesn’t have to be a major hassle. A strong foundation in accounting best practices paves a smooth path for your business to flourish and win new clients.

In this short article, you’ll learn the fundamentals for taking control of the accounting side of your real estate business. We hope this short guide gives you the tools to make an informed decision regarding your real estate business’s accounting practices. Take advantage of the information offered here and put your small business on the pathway to success.

Key Takeaways

- Proper accounting practices can give you an edge over the competition by allowing you to make informed decisions about future projects and purchases.

- Investing in accounting best practices will set you up to excel during tax season.

- Simplifying your processes gives you more time to spend on vital business activities.

- Accounting is not the same as bookkeeping as it involves a vastly wider net of activities.

- Conduct a monthly review to take firm control of your real estate business’s future.

Here’s What We’ll Cover:

What is Real Estate Accounting?

Real Estate Accounting Basics—What to Track

Why Do Real Estate Agents Need Accounting?

Accounting Vs. Bookkeeping for Real Estate Agents

Accounting Best Practices for Real Estate Agents

Common Real Estate Accounting Mistakes

How to Simplify Your Real Estate Accounting Needs

Streamline Your Real Estate Business Accounting

What is Real Estate Accounting?

Real estate accounting refers to the monthly and yearly financial tasks a business owner must perform to keep their operations running smoothly. More specifically, real estate accounting deals with the potential revenue generated by properties and matters of taxation, including crucial real estate agent tax deductions.

As with any accounting practice, real estate accounting requires tracking income and expenses to create a clear overview of each property’s cash flow. You can use this information to make tax payments and prepare the business owner for a potential audit.

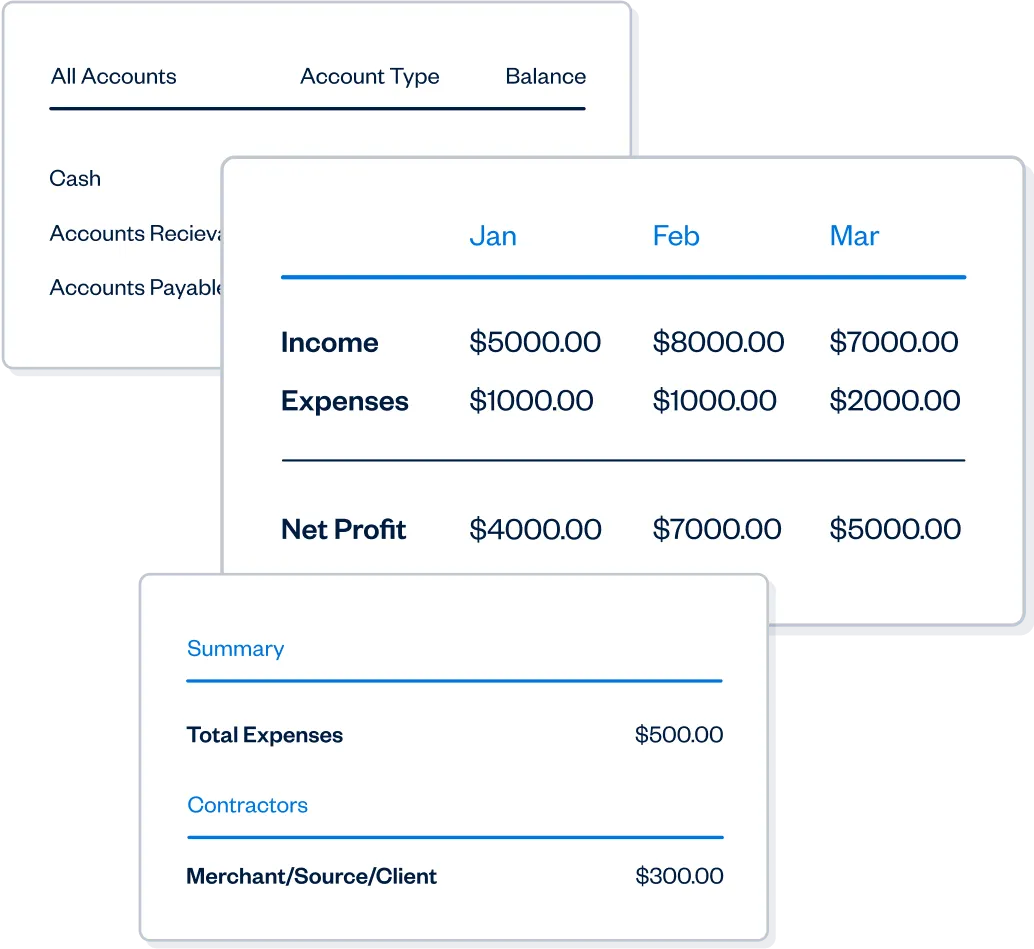

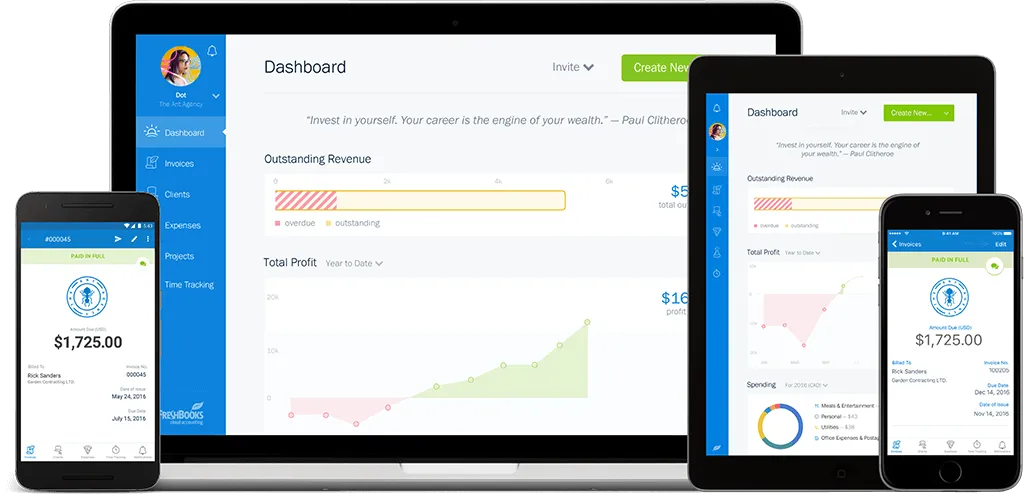

If you want to stay one step ahead of the game, consider investing time in learning about FreshBooks accounting software. Our online software allows small business owners to take control of their accounting challenges easily, thanks to receipt tracking, automated reconciliation, and easy-to-read metrics. Click here to learn start your free trial today.

Real Estate Accounting Basics – What to Track

Real estate accounting is incredibly important in several contexts.

A strong accounting foundation is relevant whether you sell small properties as a hobby or facilitate property management services and generate millions of dollars. Although the scale of each one is different, the underlying habits are similar.

The list below highlights some of the basic things you should track, regardless of whether your operations are just getting started or have built considerable traction.

Income From Commissions

Real estate agents generate income from property sales and commissions associated with each closed deal. As the primary source of income, it’s vital that real estate professionals accurately track, monitor, and report all incoming sources of cash from these sources.Keep track of these numbers in your accounting system of choice to keep things simple.

Association Fees and Expenses

Depending on employment status, real estate agents may be required to share some of their commission as a percentage with a brokerage or firm. This amount is considered an expense. Additionally, real estate professionals often pay membership fees to associations and other national organizations, which may count as deductions.

Continuing Education Costs

Maintaining a real estate license costs money in the form of renewals and continuing education classes. Consider these costs as necessary expenses, and make sure your accountant can include these amounts in your costs for the year.

Office-related Charges

Although fairly basic, your duties might require using standard office supplies, equipment, and other administrative tools. Larger expenses include office rentals, event space, and recurring services such as cleaning or maintenance. As more real estate professionals operate in a mobile format, these costs may be minimal.

Marketing Expenses

Marketing and advertising are how you inform the community about the services you offer. These expenses can include:

- Website design and development

- Social media management

- Print and newspaper advertisements

- Online and digital advertisements

- Business cards

- Event sponsorships

Travel, Mileage, and Transportation

Going from property to property to sell, speak with clients, or monitor a network of properties requires a lot of time and travel. Many real estate businesses must remember to include these numbers in their real estate accounting procedures.

Why Do Real Estate Agents Need Accounting?

Whether you work on smaller real estate deals or spend your time negotiating large-scale corporate contracts, maintaining proper accounting records is crucial for any real estate business to succeed.

If you’re a small business owner, you’ll want to invest time in learning the details of the accounting side of your business. Here is a short list of some of the most commons reason why you will want to get a good handle on your accounting needs:

- The ability to gain a high-level perspective of your personal financial situation

- Insight into your financial performance from year-to-year

- The opportunity to manage your cash flow and watch for potential red flags

- Having a streamlined process for generating yearly tax returns

- Looking at your outgoing expenses to make payments on time

- Taking advantage of any tax deductions that might be available to your real estate business

The True Goal of Real Estate Accounting

While there are many benefits to maintaining up-to-date accounts, an ongoing and transparent accounting process allows you to clearly and fully understand the health and future of your business. This is the true goal of real estate accounting: It’s a powerful tool to help you make financially sound decisions for a business’s growth and profitability.

While this doesn’t require complete knowledge of everything there is to know about financial management, it does require a willingness to learn, make changes, and stay on top of essential accounting tasks.

If you’re looking for an affordable solution to your accounting needs, you may want to consider looking at our accounting templates. These templates greatly simplify the accounting process for small business owners and real estate investors by offering easy-to-understand layouts and a streamlined design.

Accounting Vs. Bookkeeping for Real Estate Agents

The terms “bookkeeping” and “accounting” are often used interchangeably, but when it comes to maintaining your real estate business, they’re typically used to describe entirely different things.

In general, bookkeeping activities include things like:

- Keeping a close eye on debit and credit card charges

- Creating a system for invoicing clients and collecting payment

- Double-checking the accuracy of bank statements and records

- Maintaining good payroll procedures (if applicable)

On the other hand, accounting is broader and encompasses a wide range of financial tasks and responsibilities. As you consider accounting as a whole, factor in things like:

- Performing audits or financial analyses to gain insight into your financial health

- Maintaining compliance with business regulations and legal requirements

- Making necessary preparations for tax time

- Having an accurate understanding of profits, losses, and gains

- Generating quarterly and annual financial statements and reports

- Budgeting

Understanding the division between bookkeeping and accounting gives you more confidence and helps you know when to delegate tasks to other professionals in these crucial areas.

Did you know that FreshBooks offers time-saving bookkeeping software tailored to the needs of small business owners? If you want to simplify your business, peek at our bookkeeping solutions and learn how to generate net cash flow reports on the fly and prepare for tax season in a snap. Click here to start your free trial with FreshBooks today.

Accounting Best Practices for Real Estate Agents

Now that you know the importance of strong real estate accounting and what to expect regarding trackable financial information, it’s time to take a closer look at best practices.

Within the real estate industry, these five elements can separate fiscally responsible agents from those who rely on disorganized or outdated records in their accounts.

Conduct a Monthly Review

If you use an official accounting system, that system will automate much of the behind-the-scenes work. This is a massive benefit in terms of time and convenience, but you should continually monitor and perform monthly checks on your accounts.

The same is true if you work with a financial manager. Schedule a monthly meeting to review your incoming cash and outgoing expenses. If the numbers are off track, this regularity allows you to pivot and track down errors in your accounts without huge time lags.

Use Accurate Reporting Procedures

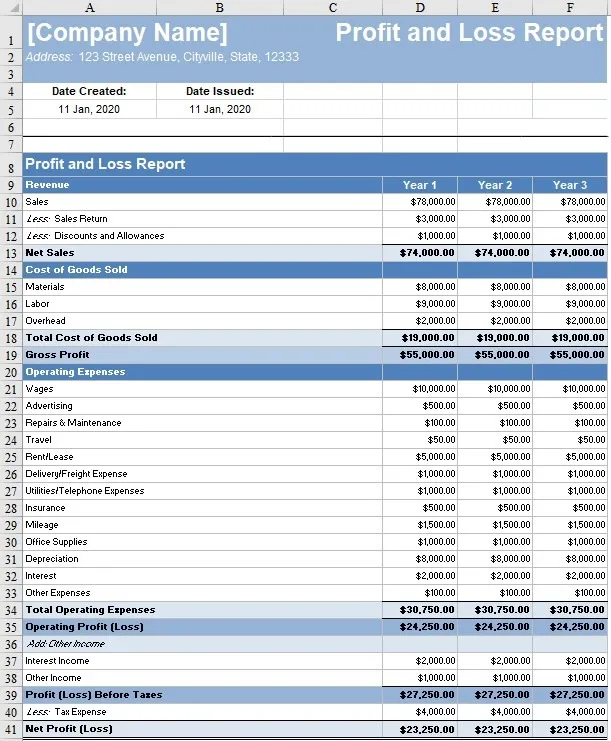

Accurate reporting relies on accurate numbers, which supports the idea of having a monthly review. Once you know that your financial data is correct, you can pull reports for your business accounts, such as:

- Profit and loss (P&L) statements

- Income statements, including rental income

- Outgoing cash flow

- Tax documents

Manual accounting procedures limit you on the type of reports that you can generate with the click of a button, but automated software enables you to pull, analyze, and sort data in a short amount of time.

Separate Personal and Business Funds

Although commissions and other income sources technically belong to you as a real estate agent, lumping them into your general bank account can become an organizational hassle.

It’s wise to create a separate business account so you can keep track of every transaction. You can then connect to your personal account or transfer funds between accounts on a pre-scheduled basis.

Having separate checking and savings accounts for your business makes connecting them seamlessly to your accounting software or platform easier. Doing so can relieve an extra step or manual work for you and your accountant.

Itemize All Incoming and Outgoing Transactions

Knowing how to itemize your financial accounts properly can save you time and effort at tax time and alleviate stress. Once you develop patterns and practice good itemization, you’ll be able to complete this step quickly.

The Internal Revenue Service (IRS) uses Schedule E to define important business itemizations. Familiarize yourself with these deductions and other relevant categories on this list in order to properly manage your expenses and income streams.

Learn Local Requirements

Managing real estate is a local and regional game, meaning that rules and requirements vary based on where you live and work. One of the best pieces of advice for better real estate accounting is to familiarize yourself with local regulations specific to your jurisdiction when you get started.

In short, managing your real estate accounting procedures is about more than personal preference. You must comply with how your county, city, or state regulates real estate income, such as state tax obligations or business license requirements.

These details could change how you choose to manage or outsource your bookkeeping needs, so it’s essential to understand the expectations and policies.

Common Real Estate Accounting Mistakes

Suppose you’re new to accounting in any industry. In that case, you should expect a few mistakes as you get used to managing financial records and developing a bookkeeping system that suits your personal style and needs

Here are the most common real estate accounting mistakes and how to avoid them:

- Always back up your files, data, and other records: If you maintain information in a cloud-based system, ensure the automatic backup function is on. If you’re maintaining files another way, such as on paper or via spreadsheets, develop a system for duplicating these files. There’s no greater accounting headache than having to locate critical information and not being able to.

- Don’t assume you can lump all expenses together: If you’re trying to itemize expenses for maximum tax benefits, don’t assume each category is the same. If you’re not a tax expert, hire one to help you navigate which expenses go together and which should be filed separately.

- Communicate with any invested party: Real estate income happens in a variety of ways, and you may rely on multiple people to close a deal or manage investments. With accounting, never assume that these individuals know what you need in terms of documentation. Verbalize what you need, and provide timely reminders about new documents, tax statements, or other proofs of purchase.

How to Simplify Your Real Estate Accounting Needs

If all of the information about real estate accounting processes overwhelms you, don’t despair! There are always options for streamlining your real estate accounting.

Depending on how much you want to invest, most real estate agents turn to one of the following options for their accounts.

- Implementing a solid accounting platform: Intuitive and user-friendly platforms make it easy to get up to speed with your accounting procedures. There are plenty of options to suit every budget. As a bonus, many real estate accounting software options are cloud-based, meaning you can take your financial records anywhere and have 24-7 access.

- Outsourcing the work to a consultant or accountant: As you climb to new heights in your real estate business, hiring a financial manager is worth the investment. A professional can save you substantial time and effort with your accounts while leveraging the power of accounting software and platforms that allow you to have visibility.

Streamline Your Real Estate Business Accounting

The right real estate accounting system always considers everything that makes your small business unique. It’s entirely possible to find an adaptable solution that accommodates your business practices, whether that includes property management, working with tenants, or tracking commissions.

Streamline your small business’s accounting work with FreshBooks real estate accounting software. Its features include modern invoicing, late payment reminders, interactive team collaboration, and more. Click here to get started.

Conclusion

In this short article, we explored the key aspects of real estate accounting. We looked at the fundamentals of real estate accounting and then moved to discussing the differences between accounting and bookkeeping. Finally, we examined some of the best practices to put in place for successful real estate accounting.

Whether you’re well on your way to starting a successful real estate business or just getting started, this article will put you well on your way to bringing more clarity to your accounting practices

FAQs on Real Estate Accounting

What type of Accounting is Used in Real Estate?

Real estate accounting is the typical term for accounting practices focusing on real estate transactions. This type of accounting practice looks at the revenue generated by various properties and the following tax requirements.

How is Accounting Used in Real Estate?

Like any other accounting practice, accounting in real estate is used for many reasons. One of the chief reasons is to provide an accurate and clear picture of the overall health of a business. Another reason is for tax purposes and to quickly assemble the required documents for an audit if one’s business is selected.

What is Bookkeeping in Real Estate?

Bookkeeping in real estate focuses primarily on ensuring that accurate records of invoices, expenses, and payroll are kept. While many use the terms bookkeeping and accounting interchangeably, bookkeeping refers to a narrower subset of financial activities within a given business.

Is Real Estate Accounting Difficult?

Ask the owners of many real estate companies, and they might answer with an empathetic ‘yes.’ But if you invest a small amount of time into learning the fundamentals of accounting practices and organization, you can easily reap major rewards.

What are the duties of a real estate accountant?

A real estate account takes responsibility for the financial aspects of the buying, selling, leasing, and renting of real estate properties. Also known as property accountants, this position also plays an important role for preparing documents for tax season.

Businesses Related to Real Estate

- How to Start a Painting Business

- How to Start a Moving Business

- How to Start a Handyman Business

- How to Start a General Contractor Business

- How to Start an HVAC Business

- How to Start a Pest Control business

- How to Start a Plumbing Business

- How to Start a Roofing Business

- Real Estate Tax Deductions

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Accounting and Bookkeeping for Your Cleaning Business (Easy 10 Steps)

Accounting and Bookkeeping for Your Cleaning Business (Easy 10 Steps) Construction Accounting: Ultimate Guide for Contractors

Construction Accounting: Ultimate Guide for Contractors Nonprofit Accounting: A Complete Guide with Best Practices

Nonprofit Accounting: A Complete Guide with Best Practices Why is Accounting Important?

Why is Accounting Important? How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates

How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates What is the Retail Method?

What is the Retail Method?