Paying Your Team Just Got Easier

Get payroll done in minutes with unlimited pay runs, automated tax calculations, and filings, all seamlessly integrated within FreshBooks.

1 Month of Payroll Free. Details

How FreshBooks Payroll Software Works

With FreshBooks Payroll, you can pay your employees (W-2s) and contractors (1099s) right from your FreshBooks account, saving you time and ensuring accuracy. Plus, instantly see how much you’re spending on payroll, so you’re never in the dark.

Simplify Payroll Taxes and Compliance

Stay current with IRS changes and updates to reduce manual errors and tax penalties. Improve compliance with state and federal payroll tax laws while streamlining, automating, and calculating payroll tax deductions.

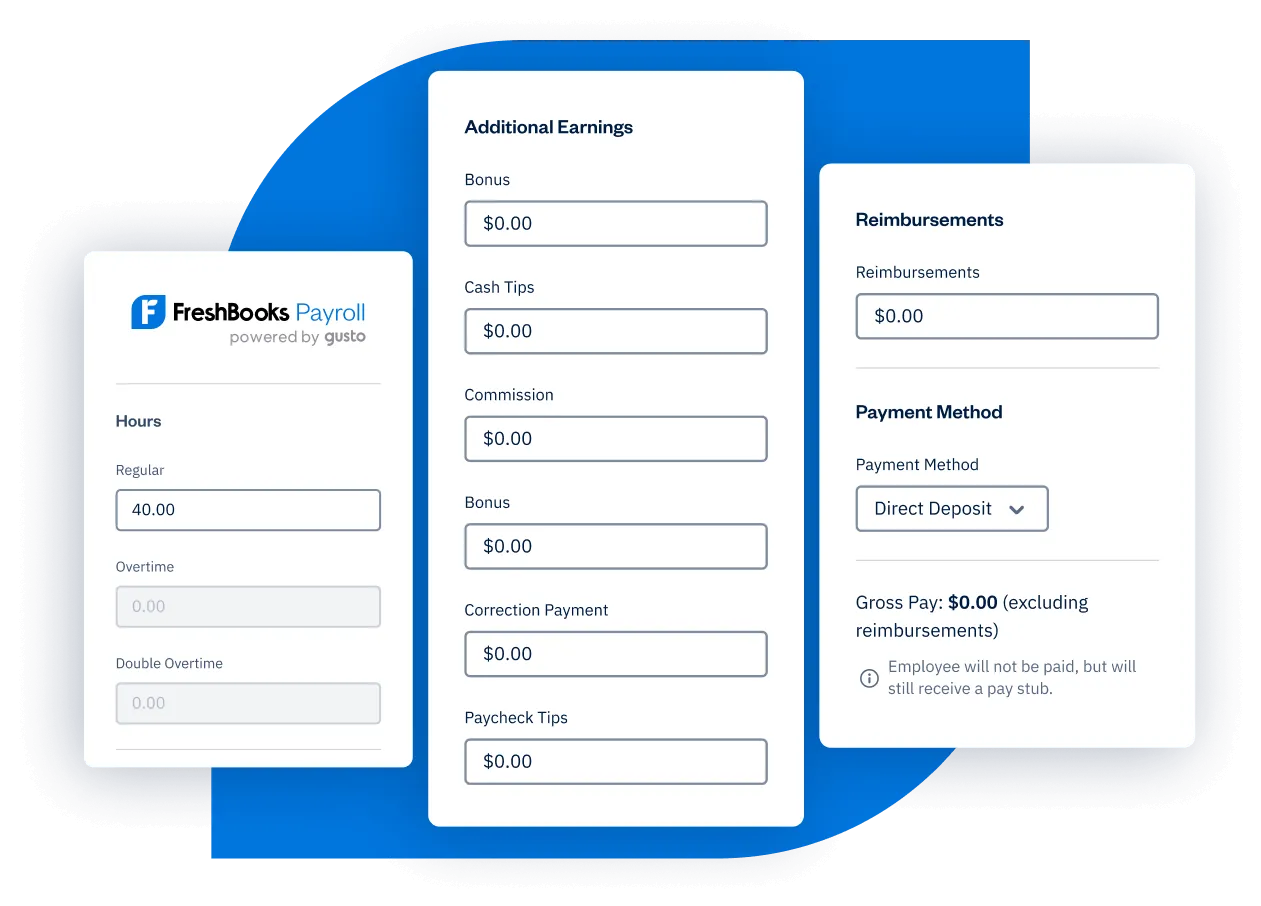

Pay Your Team In 5 Clicks

With FreshBooks Payroll, you can confidently pay your W-2 employees and 1099 contractors in minutes. Access unlimited payroll runs, automatic payroll tax filing and payments, direct deposit, and tax forms like W-2s and 1099s. Plus, transactions for every pay period will be automatically tracked so your reports and books stay accurate and organized.

A Complete View of Your Financial Health

Consolidate accounting, billing, and payroll with your FreshBooks account for a 360° view of your financial health.

All-In-One Payroll Service For Small Business

With the FreshBooks suite of offerings, you can simplify your business needs and bring everything together under one roof. You’ll save time when your billing, accounting, and payroll software is seamlessly interconnected.

Payroll Day, The Easy Way

Simple Set Up

Sign up for payroll right from your FreshBooks account, and our set-up process will have you paying your team in no time.

Keep Your Books

in Sync

Transactions for every pay run will be automatically created so your reports and books stay accurate and organized.

Pay Run Information

Get an at-a-glance summary of your previous payroll runs with hours and earnings for your team.

File Payroll Taxes Automatically

With FreshBooks Payroll, you get automated tax payments.

World-Class Payroll Support

Questions about FreshBooks Payroll? Our award-winning support team is here to help you get started and solve any issues you encounter.

Too Many Clients? We Have a Plan For That.

Our FreshBooks Select Plan could be the solution for you, saving you time and money.

The Select Plan includes:

- Exclusive access to our Select Support and Onboarding Teams to train your team and migrate your books from other platforms

- Dedicated onboarding service for your accounting & payroll needs

- Access to lower credit card fees and transaction rates.

- Two free team member accounts.

Frequently Asked Questions

FreshBooks Payroll software is a full-service payroll software system that allows you to pay your employees (W-2s) and contractors (1099s). Process payroll, view payroll reports, and download forms for state and federal taxes. Plus, transactions for every pay run will be automatically created so your FreshBooks accounting software reports and books stay accurate and organized.

FreshBooks Payroll software has automatic tax filing and assistance with tax compliance, so maintaining accurate books and simplifying one of the most confusing parts of your business has never been easier. You’ll save yourself time, money, and likely, a few headaches too. All for a low monthly cost with no hidden fees.

In general, an employee:

- Works at a specific time and place set by you, the employer

- Generally works for just one company

- May receive training

- Uses your tools or other work-related resource

- Does work that is an integral part of your business

- Is subject to a large degree of control by you

- Is generally paid a salary or hourly wage

In general, a contractor:

- Can work whenever and sometimes wherever they’d like

- Can work for multiple companies

- Usually trains on their own

- Uses their own tools and resources

- Controls their own method of work

- Is often (but not always) paid by the project or on a flat-fee basis

As a result, each type of worker has different tax implications, so it is important to categorize them properly.

FreshBooks is designed for both small business owners just starting out and small and medium-sized businesses that are continuing to grow. You can keep your team on track with easy-to-use timesheets, expense tracking, and payroll. Add employee information with free Team Member Profiles or invite your Team Members with varying permissions as one of 5 user roles: Admin, Employee, Contractor, or Accountant. You can customize these roles further with Client Access and Project Manager settings.

Paying yourself is an important part and consideration of running a small business. FreshBooks Payroll helps you pay yourself easily. To get started:

1. Determine Your Business Type

Deciding on your business entity will help set the foundation for the entire payroll process, and will help point you to the payment style that’s right for you.

2. Figure Out the Best Payment Method

Now, think about how you’d actually like to pay yourself:

A. Owner’s Draw

This allows you, as the owner of the business, to withdraw money from your business for personal use. Currently FreshBooks Payroll does NOT support Owner’s Draw.

B. Salary

Salaries are set, recurring payments that are taxed by the state and federal governments.

3. Select an Amount

Once you’ve determined the right method, you need to calculate how much to give yourself. Here’s a handy guide to help: how much to pay yourself.

4.Pick a Payroll Schedule

If your business has at least one employee (including yourself!), you need to think about how often you want to pay yourself (e.g. bi-weekly, monthly, etc.)

5. Get Your Paycheck

Getting paid can be as easy as writing a check and depositing it into your personal bank account or using direct deposit.

FreshBooks Payroll software enables you to run payroll with ease, generating payroll tax filings & payments, W-2s, 1099s, and direct deposits on your behalf. Your transactions for every pay run will be automatically created so your reports and books stay accurate and organized.

FreshBooks Payroll calculates your taxes with the correct government agencies every time you run payroll. FreshBooks Payroll software also makes filing payroll taxes easier because it’s done automatically for you.

FreshBooks Payroll software is an add-on for current FreshBooks subscribers. In addition to the cost of your FreshBooks subscription, you will pay for FreshBooks Payroll per person. The subscription costs $40/month plus $6/month for each person and includes unlimited payrolls, free direct deposit, and automatic tax filing of federal and state payroll taxes. FreshBooks Payroll software is deeply integrated with FreshBooks accounting software for seamless data entry and accurate records.

With FreshBook’s full-service payroll software, processing payroll takes 4 days, at which time your employees will get their paycheck deposited by direct deposit.

Managing your team is easier than ever with FreshBooks Payroll. Users can pay their employees and contractors (in minutes!) right from within FreshBooks while their payroll income taxes are automatically withheld and remitted. Plus, transactions for every pay run will be automatically created so your reports and books stay accurate and organized.