Bonus Tax Rate 2025: How Bonuses Are Taxed

When your hard work gets rewarded, it’s hard to see it diminished by a supplemental bonus tax rate. Did you know you have options? You can take steps to minimize how much tax is taken out of a bonus. Read on to learn how your bonus is taxed and how you reduce your taxable income.

Key Takeaways

- A bonus is categorized as supplemental wages and is taxable income.

- A bonus is taxed using a percentage method or an aggregate method.

- The flat tax rate for a bonus is 22%.

- You can minimize your tax burden by having your employer withhold taxes from each paycheck above your tax bracket, utilizing all available deductions, and taking advantage of qualified investments.

Table of Contents

- What Is a Bonus?

- What Is Bonus Tax Rate?

- How Are Bonuses Taxed?

- Bonus Tax Minimization

- Maximize Tax Savings with FreshBooks

- Frequently Asked Questions

What Is a Bonus?

A bonus is any payment received above your regular salary or wages. The IRS categorizes bonuses and other additional bonus pay as supplemental income.

Severance pay, back pay, reported tips, accumulated sick leave, commissions, retroactive pay increases, and payments for nondeductible moving expenses are other examples of supplemental pay. Taxable fringe benefits and expense allowances paid under a nonaccountable plan are also subject to supplemental wage rules.

What Is Bonus Tax Rate?

Your supplemental wages are subject to federal income and employment taxes. Generally, the 2024 federal bonus tax rate is a 22% flat rate if employers withhold taxes using the percentage method. If you receive your bonus and regular wages in one pay without itemized amounts for each, your marginal income tax rate applies.

Under the percentage method, when the total accumulated supplemental income is over $1 million in a tax year, the excess is subject to a 37% tax rate. You must include all businesses under common control when calculating the total value of supplemental wages issued.

How Are Bonuses Taxed?

Supplemental wages like bonuses are subject to tax withholding by your employer. If the total bonus or bonuses amounts to less than $1 million in a calendar year, your employer can withhold taxes one of two ways. They can either use the percentage method or the aggregate method. But how to calculate bonus tax isn’t always straightforward. Depending on your tax bracket and total taxable income, one may be more beneficial to you than the other.

Supplemental income is subject to social security, Medicare, and FUTA taxes, regardless of the withholding tax method. It may also be subject to state income tax.

The Percentage Method

Your employer can use the flat rate or percentage method if:

- They withheld income tax from your regular wages in the current or immediately preceding calendar year

- They pay your bonus separately or combine them with your regular pay but specify each amount

If both criteria apply, they can withhold a bonus check tax rate of 22%. The percentage method often results in less tax and more money for you initially. However, when you file your income taxes the following year, you may discover this method withheld too little or too much tax. Too much may result in a tax refund, but not enough could result in tax owed to the IRS.

The Aggregate Method

An alternative to the percentage method is the aggregate method or wage bracket method. Your employer pays you a bonus with your regular wages and withholds federal income tax in alignment with your tax bracket as if the combined amount were your regular wages for a payroll period. As an example, your regular monthly salary is $7,500. Over 12 months, that wage puts you in the 22% tax rate ($90,000). If you receive a $3,000 bonus, with the aggregate method, you add that to your regular wage, $3,000 + $7,500 = $10,500, then multiply it by 12. You are now in a higher tax bracket, and your rate is 24% ($126,000). For that pay period, your tax rate is 24% rather than regular 22%.

When the payout falls outside the regular pay schedule, and there aren’t any concurrent wages, it can be trickier to calculate the federal taxes for your supplemental wages. Your employer can still combine your bonus with your wages, but they use the current or preceding payroll wages to calculate the income tax withholding. They subtract the tax withheld from the regular pay, and the remaining tax comes from the bonus.

If there are other supplemental wages during the payroll period, all the payments plus the salary determine the amount of income tax to withhold. Subtract the withheld tax from the previous bonus and then withhold the remaining amount from the supplemental payout.

Think of it this way. It’s the end of the year, and you get a Christmas bonus and your end-of-year unused sick leave. Your monthly salary falls on the first of every month, but the Christmas bonus is on the 20th of December, and the unused sick pay is on the 27th of December. Your employer aggregates the Christmas bonus with your current salary to determine how much tax to withhold. They subtract the amount of tax due on your salary, and the remaining amount comes off your Christmas bonus. The salary, Christmas bonus, and unused sick pay combine to calculate the total tax. The amount of already withheld tax gets subtracted, and the remainder comes off your sick leave. In this example, if your wage is $3,600, your bonus is $3,600, and your unpaid sick leave is $3,000, you move up two tax rates from 12% to 24%. ($3,600 + $3,600 + $3,000) x 12 = $122,400.

An employer must use the aggregate method if they didn’t withhold income tax from your regular wages in the current or immediately preceding calendar year.

Navigating the rules and regulations surrounding the withholding of tax on bonuses can be easy when you have support. Learn how FreshBooks can take the pain out of tax preparation with this short video.

Bonus Tax Minimization

A bonus should be a welcome one-time pay increase, not a potential tax headache. Supplemental wage tax withholding does have exceptions and ways to minimize the negative financial impacts.

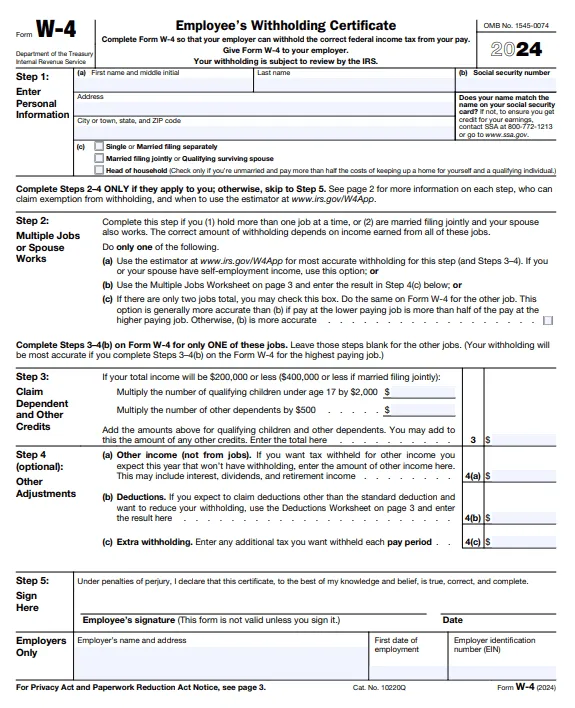

Take a Look At Your W-4

The IRS recently redesigned the W-4 form to reflect the changes to personal or dependency exemptions. Since you can no longer claim these exemptions, they are no longer on the form.

With the new form, you select to increase or decrease your withholding allowance by an amount, a rate table, or enter a specific amount. You can also request your employer withhold additional federal taxes each pay period.

Review your current W-4 withholdings. It may be beneficial to complete a new W-4 if your filing status or household income has changed. There may be an opportunity to change your year-end tax liabilities.

Verify Whether Your Bonus Is Taxable

Generally, your bonus is subject to income tax. The award may be excluded from your income if it is tangible personal property and an achievement award for length of service or safety achievement.

To qualify, the award must:

- Have cost your employer less than $1,600 ($400 for awards that aren’t qualified plan awards)

- The award was part of a meaningful presentation

Your employer should tell you if it is a qualified plan award. You can receive an achievement award with a higher value, but you must report the excess on your income tax return.

The IRS limits the taxable exclusion for your achievement bonus if:

- You received a length-of-service award for less than 5 years of service

- You received another length-of-service award during the year or the previous 4 years

- You’re a manager, administrator, clerical employee, or other professional employee receiving a safety achievement award, or if more than 10% of eligible employees previously received safety achievement awards during the year

Tax Deductions

You can minimize the impact your bonus has on your overall year-end tax liability by utilizing all tax deductions you qualify for. Depending on your job, you may be able to claim itemized deductions like health and dental expenses, mortgage and student loan interest, charitable contributions, and depreciation. You may want to consider changing your filing status if you are married and filing separately. The IRS offers more claims and deductions to taxpayers who file jointly rather than separately.

Invest In A Tax-Advantaged Account

You can minimize your tax burden by maximizing your allowable investing in a qualified retirement savings account like a 401(k) or a health savings account. Investing into your qualified plan can help to decrease your overall taxes owed and help you plan for the future. Depending on your plan, your employer may match your contribution.

Move quickly if you think this option is best for you. There may be a delay in processing between the date you alert your employer or payroll department to your updated preference and the date it takes effect.

Defer Your Bonus

Another way to minimize your bonus tax is to defer the compensation to a future year. Unlike a qualified plan, an NQDC is not protected under the Employee Retirement Income Security Act and carries more risk.

Check with your employer if they offer a nonqualified deferred compensation (NQDC) with a flexible distribution schedule and a diversified investment profile. Research the plan documents carefully before making a decision. You should seek advice from a tax professional before choosing to defer to an NQDC.

Maximize Tax Savings with FreshBooks

Now that you have some guidance about your employee bonus tax withholding, how it’s calculated, and your tax options, you can make an informed decision about your tax situation. Your bonus should benefit you, not harm your household income. By minimizing your overall tax liability, you can maximize your bonus and spend it on the things that matter, like your retirement!

FreshBooks accounting software can track and categorize expenses to help you capture every eligible deduction. Try FreshBooks free by signing up today to see how easy tax filing can be!

FAQs About Bonus Tax Rate

FreshBooks has summarized some of the frequently asked questions about bonuses and supplemental tax withholding for quick reference. Have a look!

Are bonuses always taxed at 40%?

No, bonuses are generally taxed using a percentage method of 22% up to $1,000,000, then 37% on the excess. Your employer can also use a wage bracket or aggregate method and apply your marginal tax rate to the combined wage and bonus amount.

How do bonuses show up on W2?

Your bonus will be in box 1 of your W-2. The IRS categorizes a bonus as supplemental income. Since it is subject to income tax, it is lumped in with your regular salary or wages. You do not need to fill out a 1099-Misc to report your bonus on your income tax return.

Can I change my tax withholding for a bonus?

You can change your withholding amount on your Form W-4 in anticipation of a bonus. Make any changes early in the tax year. Delays in processing changes to your payroll can have a negative impact on your tax situation at the end of the year.

Is commission taxed differently than a bonus?

Commissions are taxed differently than bonuses. If you’re an employee, your employer withholds taxes from your commissions as outlined on your W-4.

If you are considered an independent contractor, you are responsible for declaring your income and paying the taxes.

Can I give your employee a tax-free bonus?

No, you cannot give your employee a tax-free bonus. Any cash, a gift certificate, or fringe benefits like season tickets and vacations may be subject to tax. You can give tangible personal property as a reward without tax as long as it falls within the qualifications.

Can I put all of my bonuses in a 401(k) to avoid taxes?

You may be able to allocate some or all of your bonus to your 401(k). The total amount cannot exceed your yearly contribution limit. Check with your employer to learn more about your 401(k) plan and contribution limits.

More Useful Resources

- Tax Settlement

- Tax-Saving Strategies for High-Income Earners

- Married Filing Jointly vs Separately

- How Do Savings Bonds Work

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Tax Settlement: How to Settle Your IRS Tax Debt

Tax Settlement: How to Settle Your IRS Tax Debt EV Tax Credit 2025: How It Works

EV Tax Credit 2025: How It Works 10 Airbnb Tax Deductions

10 Airbnb Tax Deductions Married Filing Jointly vs Separately: Which is Better

Married Filing Jointly vs Separately: Which is Better How to File Taxes in 2025: 7 Steps

How to File Taxes in 2025: 7 Steps Estimated Tax Payments 2025: Overview and When To Pay

Estimated Tax Payments 2025: Overview and When To Pay