How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates

The average small business owner pays 19.8% to 20% of their business’s gross income per tax year, sole proprietorships and partnerships pay 20% to 30%, and S corporations usually pay 15% to 25%. However, this figure can vary widely depending on the type of company in question. Some factors that affect a small business’s tax rate include where it’s located, and how it’s structured.

In this article, we’ll explore common tax deductions and financial challenges small business owners face, and you’ll learn how to estimate the amount your company will pay in taxes this year.

Key Takeaways

- A small business’s tax rates vary depending on whether it’s defined as a sole proprietorship, a partnership, an LLC, an S corporation, or a C corporation.

- Along with state and federal income tax, small businesses may also pay self-employment tax, payroll taxes, capital gains tax, property tax, sales tax, dividend tax, and/or excise tax.

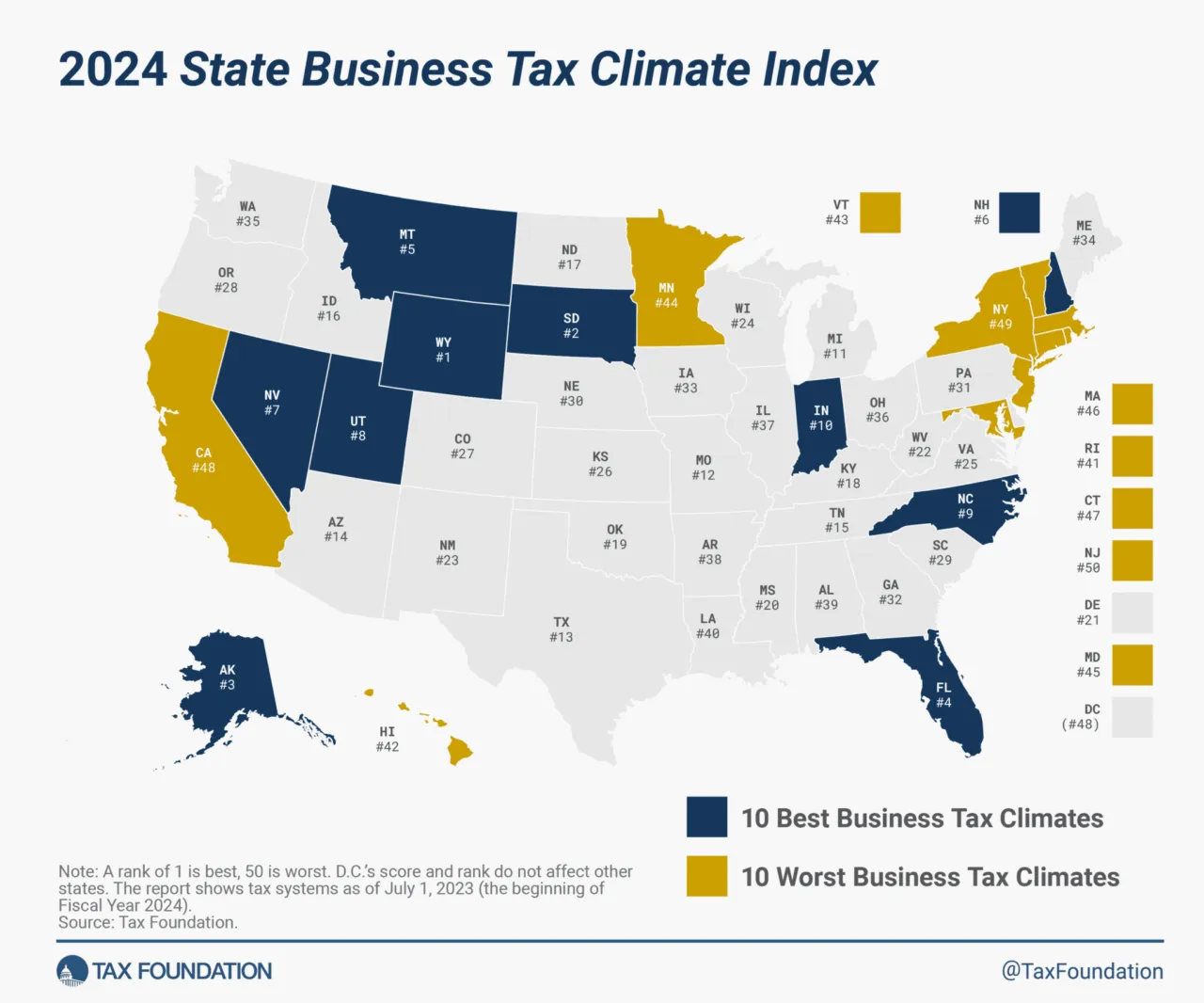

- Each state has different taxation rules, with some states being more favorable to small business owners than others.

- Some common deductions for businesses include startup costs, travel, business meals, home office, and insurance expenses.

- The key to effective tax preparation for small businesses is organized, efficient accounting, made easier with accounting software.

Table of Contents

- Small Business Tax Rate by Business Structure

- Other Types of Small Business Taxes

- What Is the Small Business Tax Rate by State?

- How Much Should a Small Business Set Aside for Taxes?

- How Tax Deductions Reduce Net Income for Small Businesses

- Simplify Small Business Tax Calculations with FreshBooks

- Frequently Asked Questions

Small Business Tax Rate by Business Structure

The structure of a business largely determines its tax rate. Many small businesses, for example, are considered “unincorporated pass-through entities,” meaning they pay the owner’s personal income tax rate rather than a corporate rate.

The following are the rates for federal income taxes of some specific business structures.

1. Sole Proprietorships

Most small businesses (over 70% in the U.S.) are classified as sole proprietorships. Sole proprietorships have one owner, are not officially set up as a business with the state, and are considered “pass-through” entities. This means small business owners running a sole proprietorship will report their business income on their personal taxes using IRS Form 1040 and Schedule C 1.

Once they’ve combined their self-employment tax liabilities, the business’s state and federal business tax rate, and sales tax, if applicable, their total tax rate will usually fall between 20% to 30%.

2. Partnerships

Partnerships are businesses with multiple business owners, and the owners would each individually report their income on their personal taxes. Partnerships are similar to sole proprietorships, as they’re considered pass-through entities as well.

To calculate the tax rate for a partnership, you’d take the total net profit, and divide this number between all partners. Each partner will receive a K-1 to report their income on their 1040. Using Form 1065 2 , each partner will then pay self-employment taxes, income tax, federal and state taxes, and sales taxes if applicable on that amount. The total rate for federal income taxes will usually fall between 20% and 30%.

3. Limited Liability Companies (LLCs)

A Limited Liability Company, or LLC, is a type of business structure with a definition that varies from state to state. In some cases, it’s treated as a corporation, while in others, it could be seen as a partnership, or as a part of the LLC’s owner’s tax return. 3

If an LLC does not want to be classified in this way for tax purposes, the owners may use Form 8832 to choose a new classification (sole proprietor, partnership, S corporation, or C corporation) and be taxed accordingly. 4 In most cases, an LLC’s tax rate is between 20% to 30%.

4. S Corporation

S corporations use Form 1120-S 6 to report income, gains, losses, deductions, and credits, along with Form 941 to report income and payroll taxes and pay the employer’s portion of Social Security and Medicare taxes.

5. C Corporation

Like S Corporations and LLCs, a C Corporation protects the owner(s) of the company from incurring personal debt due to business losses or liabilities. This is the only type of business that pays a corporate tax rate, which is 21% of the net profit for federal taxes, along with additional state corporate taxes, with a rate ranging anywhere from 0% to 11.5%. Combined, this could result in a tax rate with a potential maximum of 25.8%. Domestic corporations use Form 1120 to report their income, gains, losses, deductions, and credits, and to figure out their income tax liability. 7

Owners of a C corporation may pay themselves with dividends with a 20% maximum tax rate, or by giving themselves a salary, with as high as a 37% tax rate.

Income tax rates for individuals are progressive, meaning that the higher your individual taxable income is, the higher your tax rate will be. In 2024, there are 7 tax brackets that vary depending on how much you earn, as well as how you are filing. These are:

| Tax Rate | Single | Married, Filing Jointly | Married, Filing Separately | Head of Household |

| 10% | $0 to $11,600 | $0 to $23,200 | $0 to $11,600 | $0 to $16,550 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 | $100,501 to $191,950 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,725 | $191,951 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 | $243,701 to $609,350 |

| 37% | $609,351 or more | $731,201 or more | $365,601 or more | $609,350 or more |

Use the current Federal Income Brackets to see what percent tax you’ll owe based on your income, then use this state tax calculator to estimate what you’ll be taxed at a state level.

- For example, in New York, the state income tax of $64,474 would be $3,262.18.

Don’t worry if this number seems high! There are plenty of deductions you can claim.

Other Types of Small Business Taxes

Small business owners can expect to pay several different taxes based on their business income—even if they file those earnings at their personal income tax rate. These taxes for small business owners include:

Income Tax

First and foremost, you’ll need to pay state and federal income tax, as applicable in your region. Depending on where you live, personal income tax can range from 10% to 37%.

Self-Employment Tax

This covers Social Security and Medicare. Most small businesses not receiving a W-2 will need to pay this, which is currently at a tax rate of 15.3%.

Payroll Tax

Small businesses must pay 7.65% of an employee’s gross payroll earnings. Unemployment and workers’ compensation taxes may also apply.

Capital Gains Tax

This is taxation on investments or the sale of your assets. Assets held for more than a year are taxed at a capital gains tax rate of 0%, 15%, or 20%, depending on total income, with higher rates applying to higher business income. Assets held for less than a year are considered part of the business’s income and are taxed as ordinary income according to personal income brackets.

Property Tax

Any buildings or land owned by the small business will be subject to property tax. Property tax can vary widely, depending on the state in which the small business is located.

Dividend Tax

Dividends resulting from investments made by a small business are considered income and are taxed according to the owner’s tax bracket or the corporate tax rate, depending on the company’s business structure.

Excise Tax

Excise taxes are taxes included in certain international sales of goods, services, and activities within the US, at the time they’re purchased, and can be paid by percentage or charged per unit 8 Some examples include the taxes collected from airline tickets, tobacco, tire, or gasoline sales.

Use Tax

Use tax is a type of sales tax that’s conditional, as it is only charged on certain goods that were purchased without paying sales tax. For example, if goods are purchased in a state and the seller did not charge sales tax, then the purchaser stores or sells these goods where sales taxes are imposed, the municipality or state will require them to pay a use tax.

What Is the Small Business Tax Rate by State?

State income tax and other state taxes have changed thanks to the Tax Cuts and Job Act. Not all states have an income tax—in fact, some states have business taxes that are more favorable for small businesses than others.

For example, Florida is one of the best states for small business owners because it has no individual income tax. Nevada has no corporate or individual income tax, and New Hampshire has no sales tax. The most favorable states usually lack a major tax for small businesses.

On the flip side, the least favorable states for business tax purposes include New York, California, and New Jersey, with their common factor being high tax rates. For example, New Jersey not only has high property taxes but also has the second-highest corporate income tax in the country, an inheritance tax, and poorly-structured individual income taxes.

How Much Should a Small Business Set Aside for Taxes?

As a small business owner, you should allocate 30 to 40% of your net income per year to cover your quarterly federal and state tax installments. Setting aside funds for tax time in a separate business bank account with automatic transfers (either monthly or quarterly) makes paying taxes easier.

The best time to set aside money for taxes depends on your business’s establishment.

1. New to the small business game? Try setting aside at least 30% of your business income every time you’re paid.

2. Recently turned a profit? Sock away your 30% on a monthly basis.

3. Is your profit fairly stable year by year? Take last year’s net income, divide it by four, then take 30% of that number. Plan on saving that amount quarterly.

Setting aside funds for tax time in a separate business bank account is a good idea. Even better, set up automatic transfers (either monthly or quarterly) to this separate account.

Don’t worry too much if you underestimate the amount owed. The IRS says that as long as you pay as much taxes quarterly as you did the previous year, you fall under what’s referred to as the safe harbor rule. That means you won’t be penalized for underpaying.

How Tax Deductions Reduce Net Income for Small Businesses

Deductions, also known as tax “write-offs,” are expenses you can deduct from your total taxable income, to reduce the amount you must pay to the government. The following are some qualified deductible business expenses you may be able to use to reduce your tax bill.

Startup Expenses

You can deduct several qualifying costs of starting a business from your taxes. These include the cost of market analyses, business travel, advertising costs, consultant fees, and wages paid to trainees and their instructors. These costs should be treated as capital expenditures, as they’re directly involved in creating, launching, and organizing the business. Up to $5,000 in start-up costs, with another $5,000 for organizational costs can be deducted in the business’s first year.

Work-Related Travel Expenses

Suppose you must travel for work outside of the area where you usually conduct business, for longer than a normal day’s work. In that case, you can deduct expenses like fuel, airfare, parking, toll fees, meals, lodging, tips, laundry services, business calls, taxis, and other necessary, ordinary expenses that relate to business travel. It’s important to keep records of all expenses, a mileage log if you use your own vehicle, and details about the business reason for the trip. The IRS standard mileage reimbursement rate in 2024 is 67 cents per mile, making it well worth the extra work to document your trip.

Business Meals

Business meals can be deducted if they’re an ordinary, necessary part of running your business, an employee (or owner) is present at the meal, and it’s not an extravagant expense. Generally, businesses can deduct 50% of each business meal, while a meal made available to the whole staff can be deducted 100%. Make sure to not only save your receipts, but make a note of how the meal related to doing business, and who was present, in case of an audit.

Business Insurance

The IRS views many insurance premiums as a cost of doing business. If you have business insurance like liability coverage, workers’ compensation coverage, business interruption insurance, property coverage, or malpractice insurance, you can deduct the premiums you’ve paid from your taxes, which will reduce your taxable income.

Home Office Expenses

If you run a business out of your home office, you might be able to deduct a percentage of your mortgage, rent, utilities, landscaping services, repairs, and more from your self-employment taxes. To qualify for this deduction, the home office must be your principal place of business, and it must be used exclusively for work, with clearly identifiable boundaries. Additionally, there is a simplified method for home office deduction where you can deduct $5 per square foot for business use of the home, up to a maximum of 300 square feet.

Health Insurance Premiums

If you pay premiums for group health, vision, or dental insurance for employees, you can deduct them. Fill out Form 8941 to calculate the tax credit amount and the company-paid portion can be considered an expense that can be included as part of the general business credit on your income tax return.

Retirement Contributions

If you establish and maintain a retirement plan like a SEP (Simplified Employee Pension) or a Simple IRA (Individual Retirement Account), are self-employed, or are a partner in an LLC or partnership, you can reduce your net earnings from self-employment by the amount of your retirement plan contributions. In 2024, the SEP IRA limit is whichever is lower: 25% of gross income, or $69,000.

Simplify Small Business Tax Calculations with FreshBooks

As a small business owner, it’s important to understand your business type, tax liability, and the available deductions you can take advantage of for long-term financial success. Different types of business entities file taxes using different IRS tax forms, so having a clear understanding of what’s expected of your business at tax time is essential.

Searching for intuitive accounting software to help make tax prep simpler for your small business? FreshBooks accounting software can help. Our cloud-based accounting platform streamlines tax processes for small businesses by tracking income, expenses, and deductions automatically. With tax-ready financials, FreshBooks simplifies tax preparation, ensuring businesses pay accurate amounts and avoid penalties. It is also helpful to engage with a tax professional who can review your accounting records and help determine the best tax structure for your business.

FAQs on How Much Do Small Businesses Pay in Taxes

Do you have more questions on business taxes, average income taxes for different types of businesses, or anything else to do with ensuring a smooth tax year? Here are some of the most frequently asked income tax questions—answered.

Do small businesses pay taxes every 3 months?

Most likely, yes, small businesses pay taxes every 3 months. Small businesses are expected to pay estimated taxes at the end of each quarter. Unlike individual income taxes, which are paid annually in April, it’s up to businesses to calculate their estimated taxes and pay them every three months. If you miss these quarterly payments, your business could face a hefty fee later on.

How do I calculate taxes for my small business?

First, you’ll need to determine the applicable income tax rate for your business. This is based on your location, business structure, and annual net income. Then, you can do the math manually or use one of the many business income tax calculators available online. Alternatively, you could use an all-inclusive accounting and tax prep software, such as FreshBooks, to simplify tax calculation.

What are the tax benefits of owning a small business?

While small businesses can be subject to higher taxes, tax deductions also have a much higher potential. Available deductions for small businesses include advertising, communications (internet service, cell phones), utilities, business insurance, and more. The IRS website has more information on these available deductions.

Are there any tax breaks for small businesses?

Yes—small businesses can take advantage of several tax breaks, depending on the type of expenses they incur throughout the year. From deductions for rent and utilities to travel and communication, there are numerous tax breaks and deductions you should be aware of.

How much does a small business need to make to pay taxes?

It depends on the company’s structure. If you’re a sole proprietor and your small business earns a net income of more than $400 in a year, you must pay taxes. Businesses with employees must pay additional taxes, as do businesses subject to excise taxation.

Article Sources

- Sole Proprietorships, Accessed June 24, 2024.

- About Form 1065, US Return of Partnership Income, Accessed June 24, 2024.

- Limited Liability Company (LLC), Accessed June 24, 2024.

- About Form 8832, Entity Classification Election, Accessed June 24, 2024.

- S Corporations, Accessed June 24, 2024.

- About Form 1120-S, U.S. Income Tax Return for an S Corporation, Accessed June 24, 2024.

- About Form 1120, U.S. Corporation Income Tax Return, Accessed June 24, 2024.

- Basic Things all Businesses Should Know About Excise Tax, Accessed June 24, 2024.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

What is the Retail Method?

What is the Retail Method? What is Interest Expense?

What is Interest Expense? What Is a Profit and Loss Statement?

What Is a Profit and Loss Statement? What is a T Account?

What is a T Account? What Are Provisions in Accounting?

What Are Provisions in Accounting? Is Inventory a Current Asset?

Is Inventory a Current Asset?