Daycare Invoice Templates

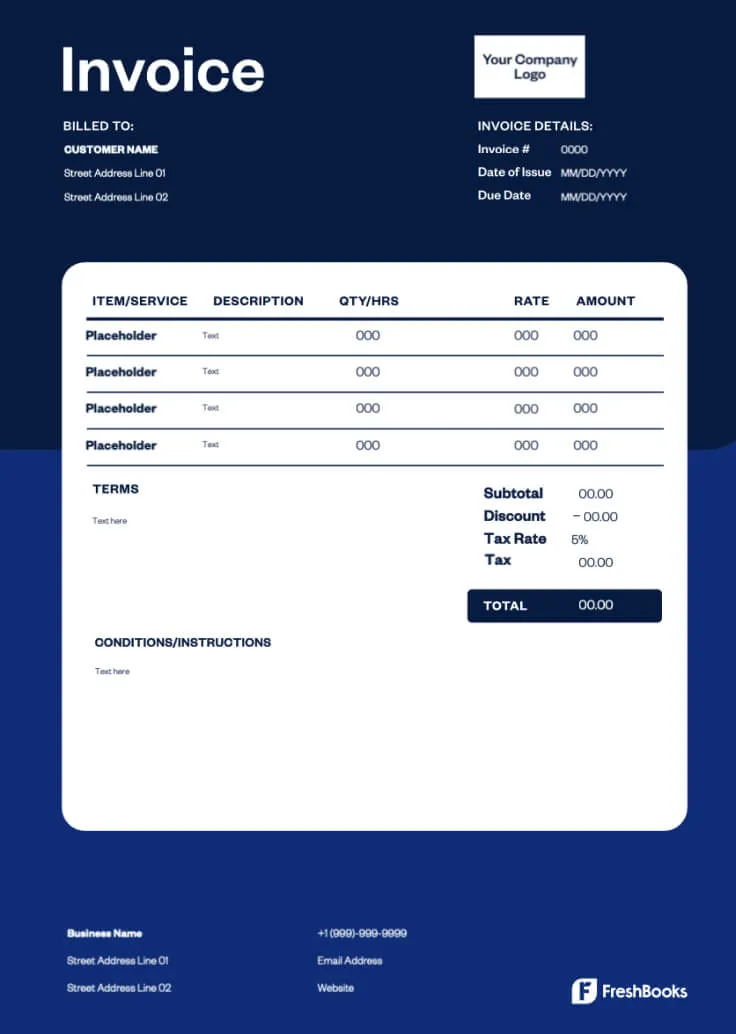

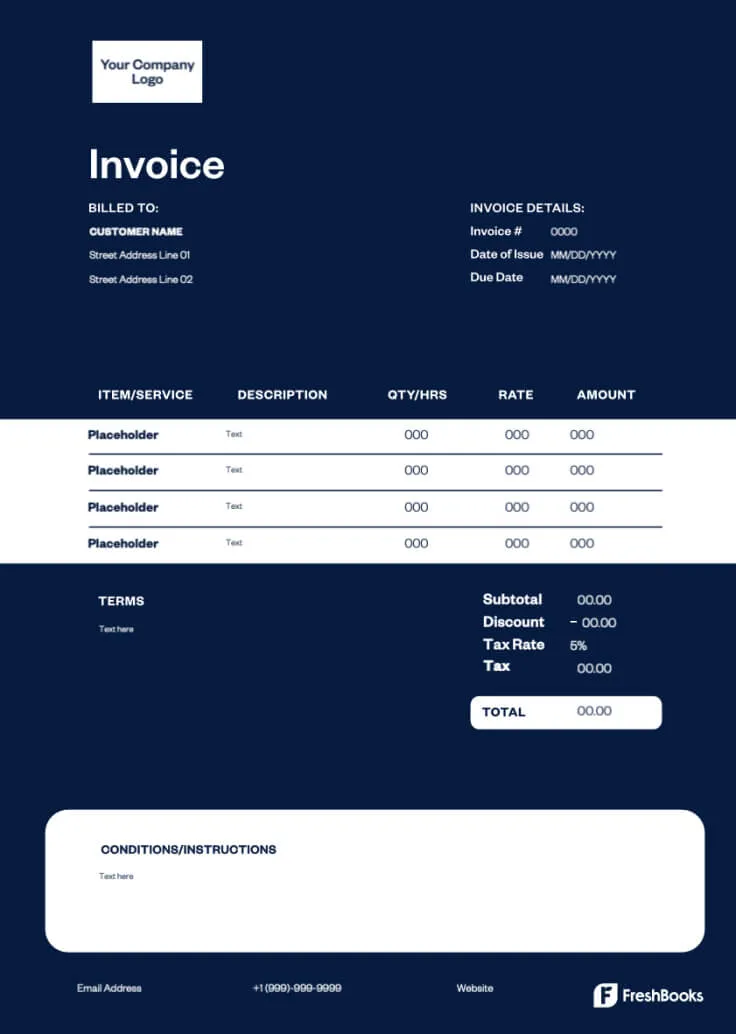

Success in the daycare industry depends on care and consistency—show off yours with the professional-looking daycare invoice template from FreshBooks.

Download the Daycare Invoice Template

Daycare professionals are busy enough looking after children and providing an enriching, educational environment. Rather than spending time creating invoices from scratch each week, try a free daycare invoice template that’s easy to edit and customize to your needs.

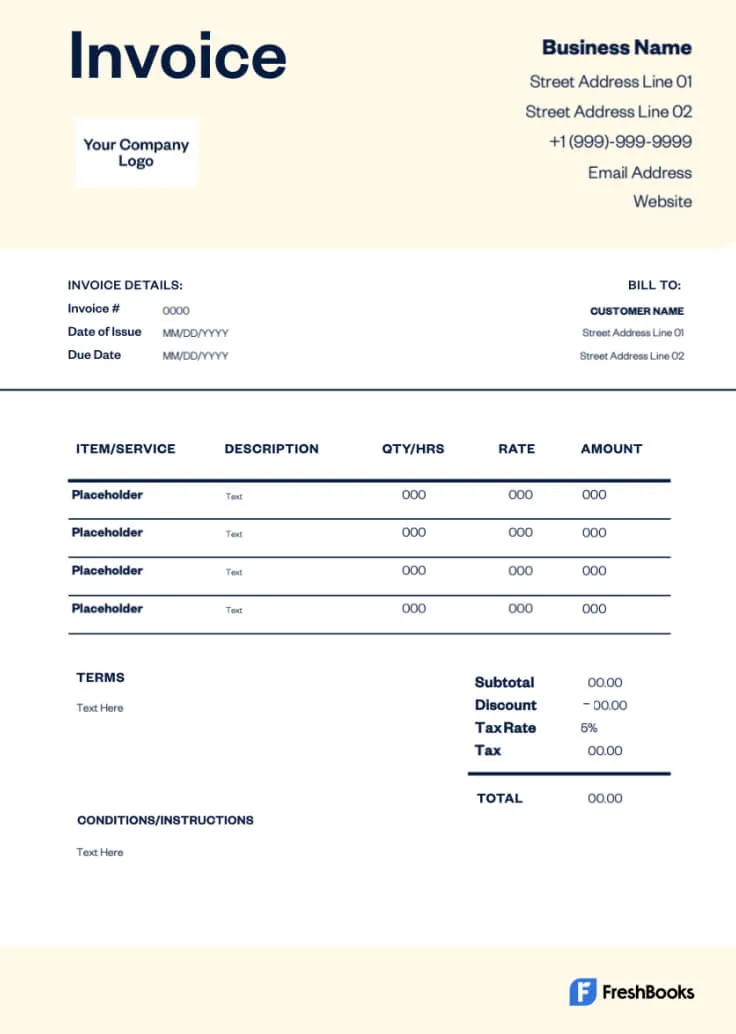

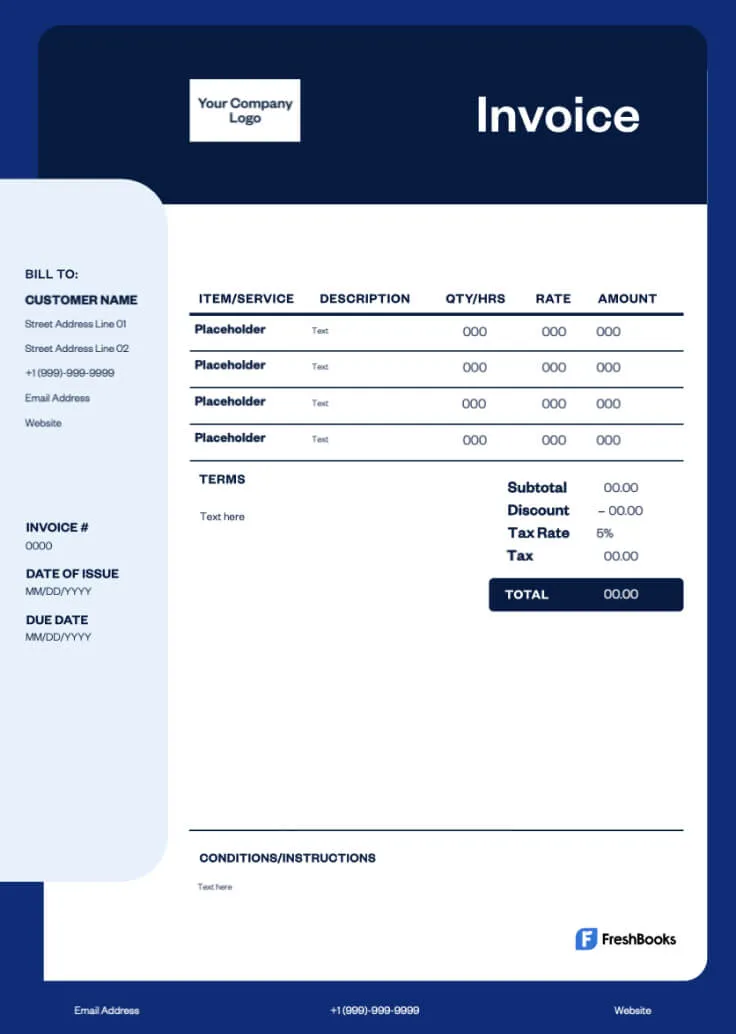

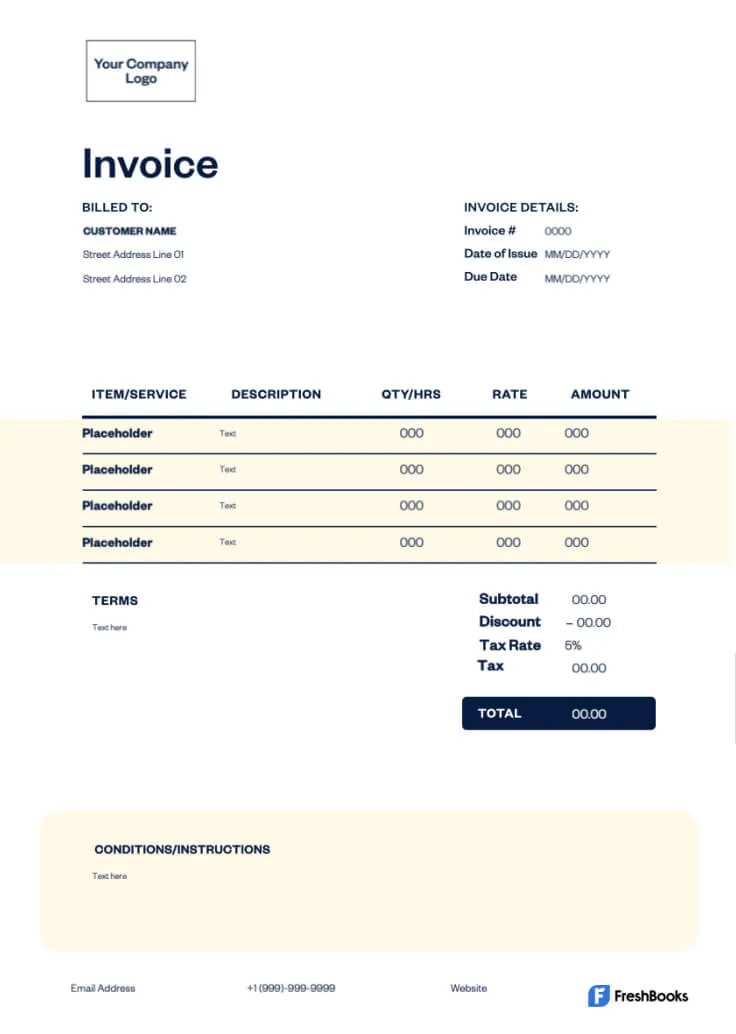

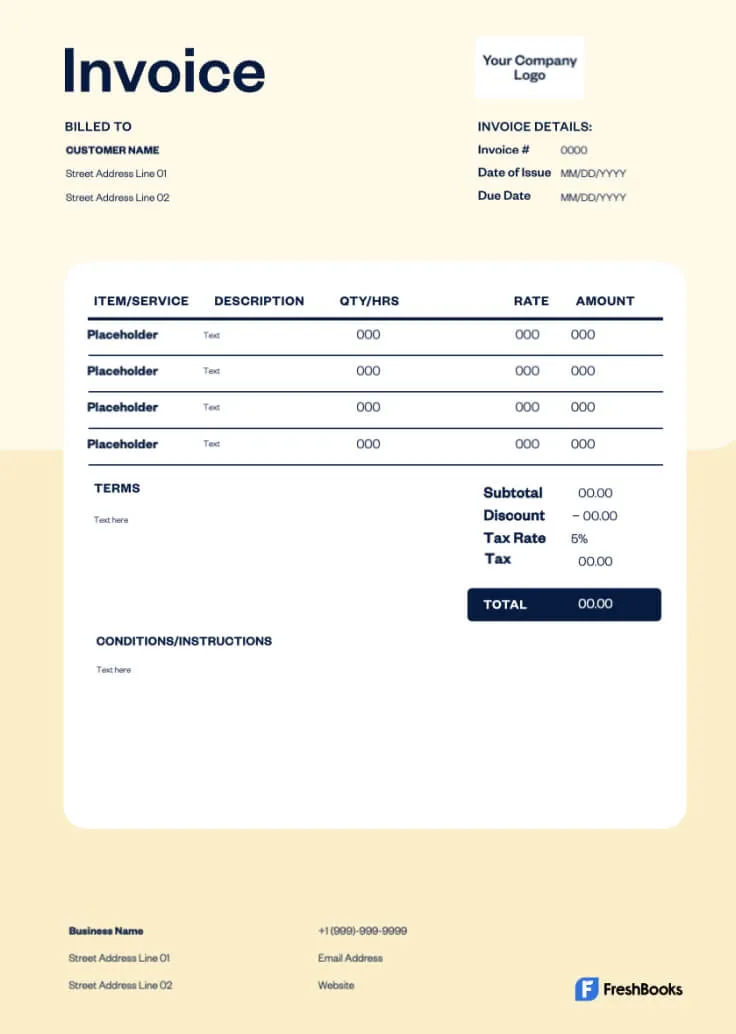

Choose a template

Free Invoice Generator

If you’re looking for a quick way to create a one-off invoice without downloading and editing a template, look at the free invoice generator by FreshBooks. Just enter the relevant information about you, your client, and the work you did, hit ‘generate,’ and send it off to your client—simple as that.

More Invoice Templates by Industry

If you work in a related industry to daycare and childcare, FreshBooks is here to help with our list of professional, industry-specific invoicing templates. These are free and completely customizable, meaning they can work for nearly any business scenario.

Still searching for the perfect template? Check out our invoice template main page for a collection of industry-specific templates that suit your needs.

Contractor Invoice Template

Contractors, whether in childcare or any other industry, can invoice for their time, travel, and any incurred expenses using contractor invoice templates.

Freelance Invoice Template

Freelancers of all types must have the ability to invoice effortlessly. This freelance invoice template is easy to customize, export, and send to your clients, ensuring faster payment.

Medical Invoice Template

You can tailor this medical invoice template to bill for healthcare equipment, supplies, and medications.

Itemized Invoice Template

If your invoices need detailed information on products and services rendered, try this free itemized invoice template.

Non-Profit Invoice Template

Find customizable non-profit templates for event fees or marketing expenses with non-profit invoice templates that you can tailor to any type of charitable cause.

Consulting Invoice Template

Are you a consultant in the childcare business or another industry? Create individual invoices and add a personal touch with consulting invoice templates to simplify billing.

Tutor Invoice Template

Handle your next private tutoring lesson or after-school homework help session with tutor invoice templates to streamline your billing process.

Hourly Invoice Template

From work like childcare and copyediting to house cleaning and web design, free downloadable hourly invoice templates make billing simple.

Services Rendered Invoice Template

If you charge for services provided in childcare, such as early learning programs or supplying nutritious meals and snacks, this invoice template will help you bill more efficiently.

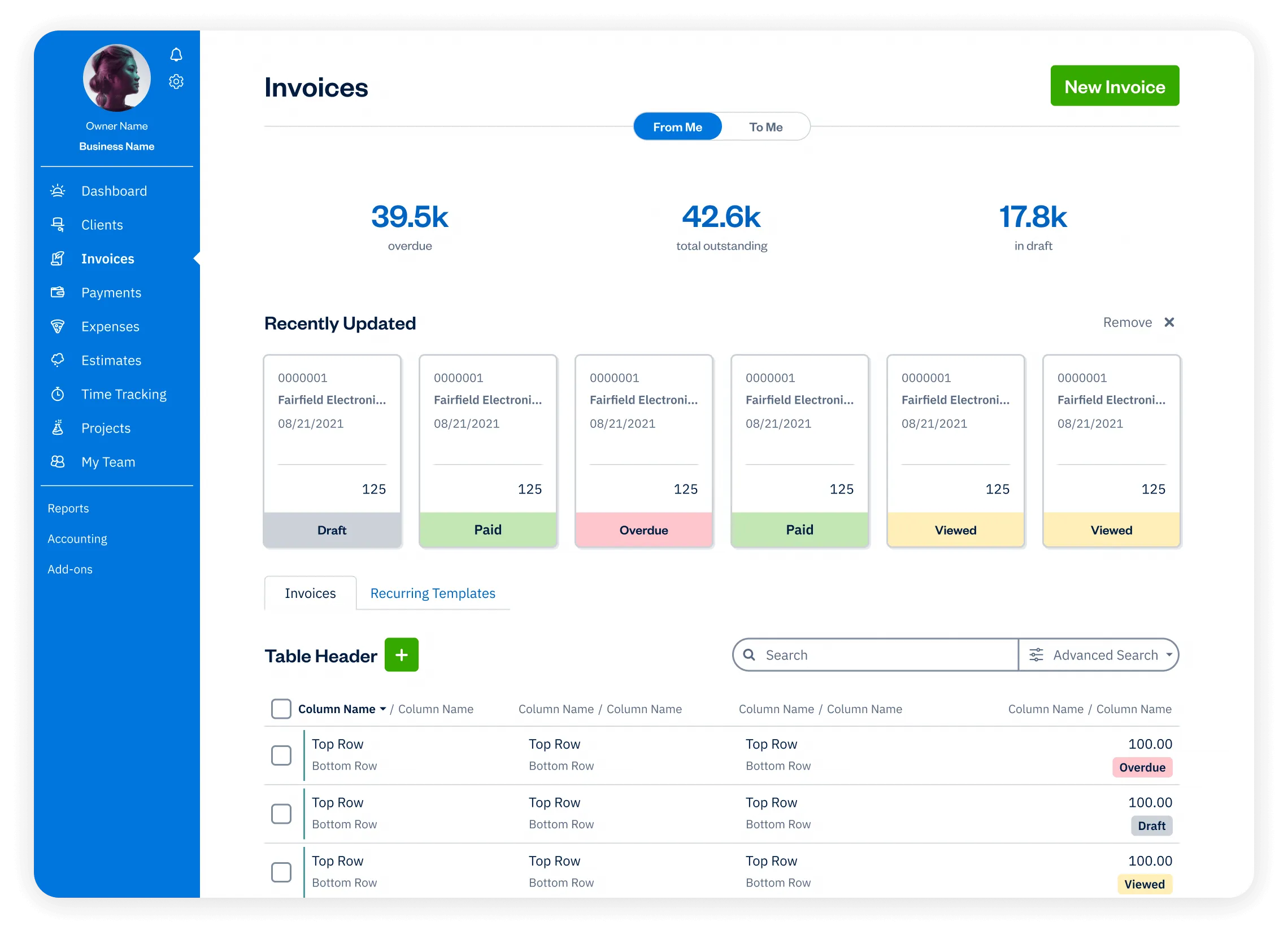

Daycare Invoice Template vs. FreshBooks

Saving time on invoices is great, but what if there was an even more complete solution that helped simplify the entire daycare invoicing process—not just a part of it? While there’s a lot to love about a free invoice template that you can easily customize to your needs, FreshBooks invoicing software is also a great option for those looking for more automation, features, and support. Here are the main differences between these offerings at a glance:

Daycare Invoice Template

VS

FreshBooks

Features

Daycare Invoice Templates

Flexible invoice templates

Printable formats

Email invoices at no cost

Accept payments on invoices

Schedule invoices

Automate payment reminders and late fees

Manage paid and outstanding invoices

Set up deposits for projects

Add discounts and credits to invoices

Automate recurring subscription invoices

Create and send invoices via mobile devices

Access your invoices FOREVER on the cloud 🔥

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Daycare 101: Helpful Resource for Your Daycare Business

Though important, invoicing is certainly not the only part of running a successful daycare business. With this in mind, FreshBooks has worked to create and compile a number of helpful, free resources to help your daycare service get off the ground and flourish the way it deserves.

How to Start a Daycare Business

How to Do Accounting for Your Daycare Business

Tax Deductions for Daycare Business

Frequently Asked Questions

There are no federal laws dictating the specifics of your daycare invoice form for services, but many states have regulations you’ll need to follow. You’ll also need to ensure you’re registered with the state to collect sales tax to remain compliant with tax laws for your childcare centers.

As with all invoices, daycare billing needs some key information. These include the invoice date, the invoice number, the name and address of your daycare center and your client, a description of services rendered, payment terms, payment due date, and any relevant tax information. With Freshbooks, you can send professional invoices in a snap that includes all this information.

Typically, daycares and other childcare professionals will bill their clients every month. However, some will bill quarterly or annually instead. When in doubt, it’s best to invoice daycare clients on the same day each month. Freshbooks’ invoicing software helps you bill monthly, quarterly, or annually on a recurring basis for your daycare businesses.

These days, it’s most common and convenient to accept digital payment solutions (e.g., Square, PayPal, or FreshBooks invoicing software) for daycare invoices. However, you can also accept credit card payments or even checks if you prefer. It’s best to keep available accepted payment methods to a minimum for simplicity’s sake.

Daycare and other childcare are sometimes tax deductible on the part of your client, so it’s vital that your invoices are filled out accurately and free from errors. If you’re concerned about the chance of a mistake, consider using a free invoice template or another solution like FreshBooks’ invoicing software.

Deciding on the rates you’ll charge for daycare services can be quite a process at first. You’ll need to consider your expenses, future ambitions for the business, and the market and demand for your services. See FreshBooks’ above resources with all the details to help you decide.

As a childcare provider, you’re expected to maintain records of all kinds, though it can sometimes be unclear how long you have to keep them. Always check with your state licensor first, as they’ll likely have the most in-depth rules regarding records. Generally, keeping your records as detailed and far-reaching as possible is best. With Freshbooks’ invoicing software, all of your invoicing and billing processes will be saved to the cloud for your daycare centers.