Non-Profit Invoice Templates

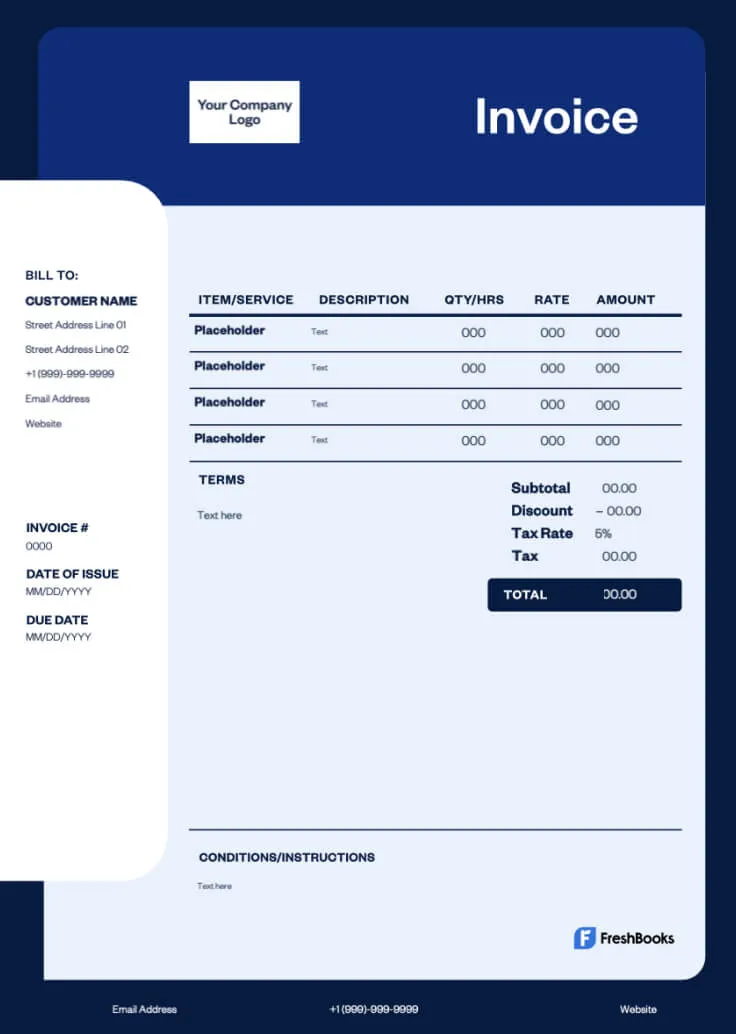

You work hard for the causes you care about; keep your focus on what matters with the free non-profit invoice template that streamlines your billing process.

Download Non-Profit Invoice Template

Don’t let timely administrative work keep you from saving the world. Download the non-profit organization invoice template to create customized donation invoices in minutes.

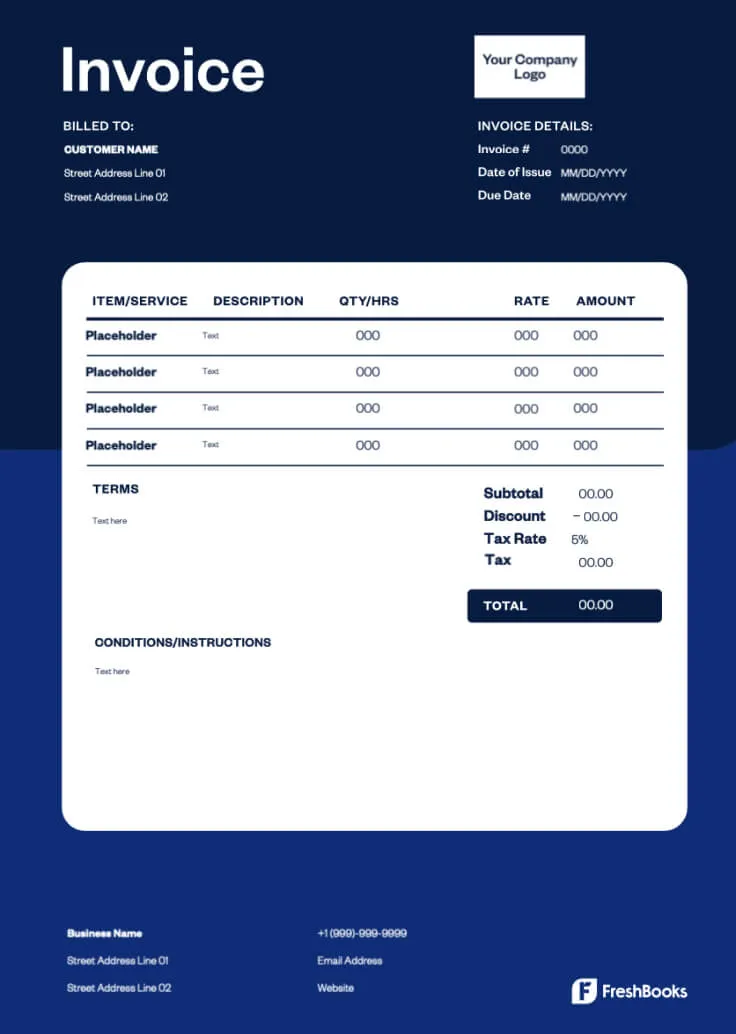

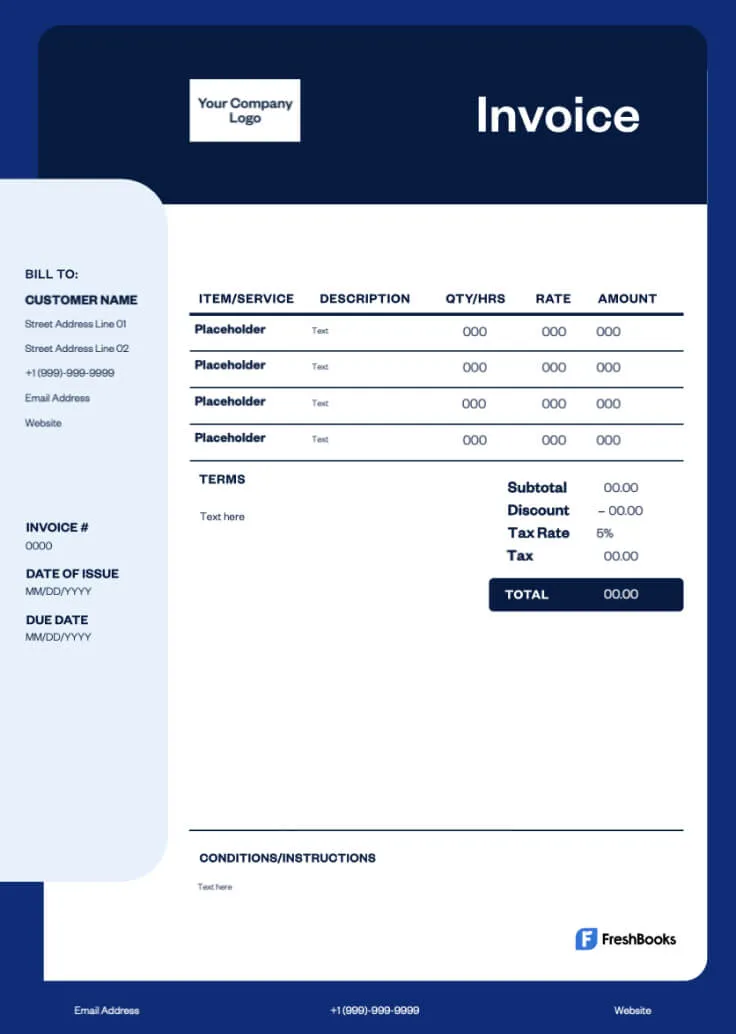

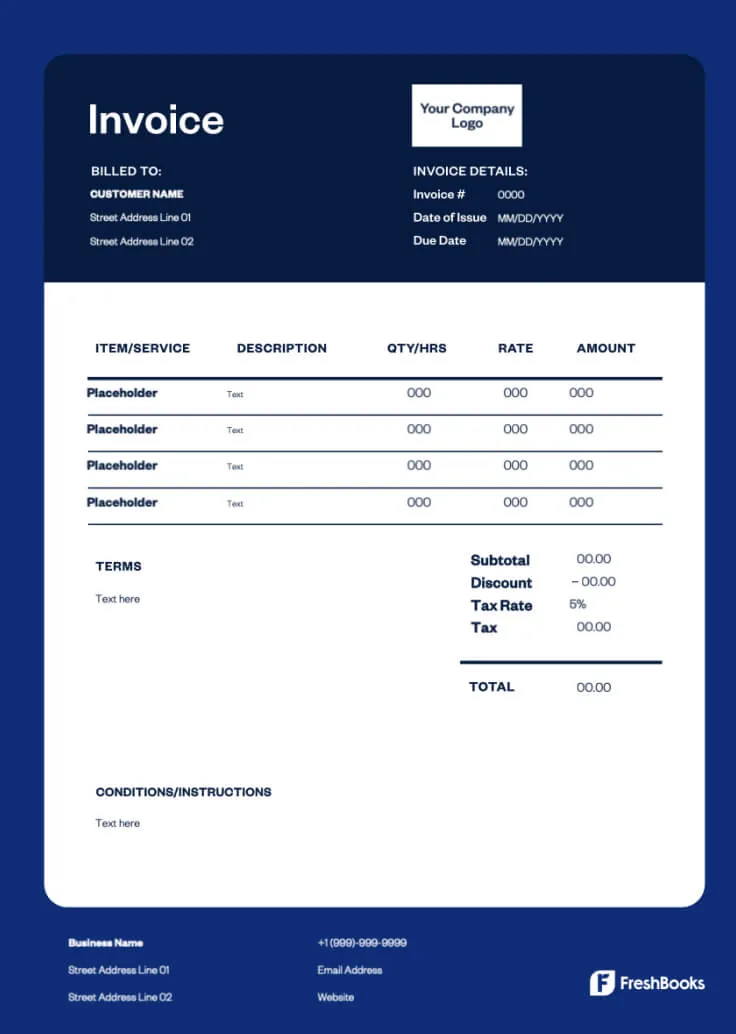

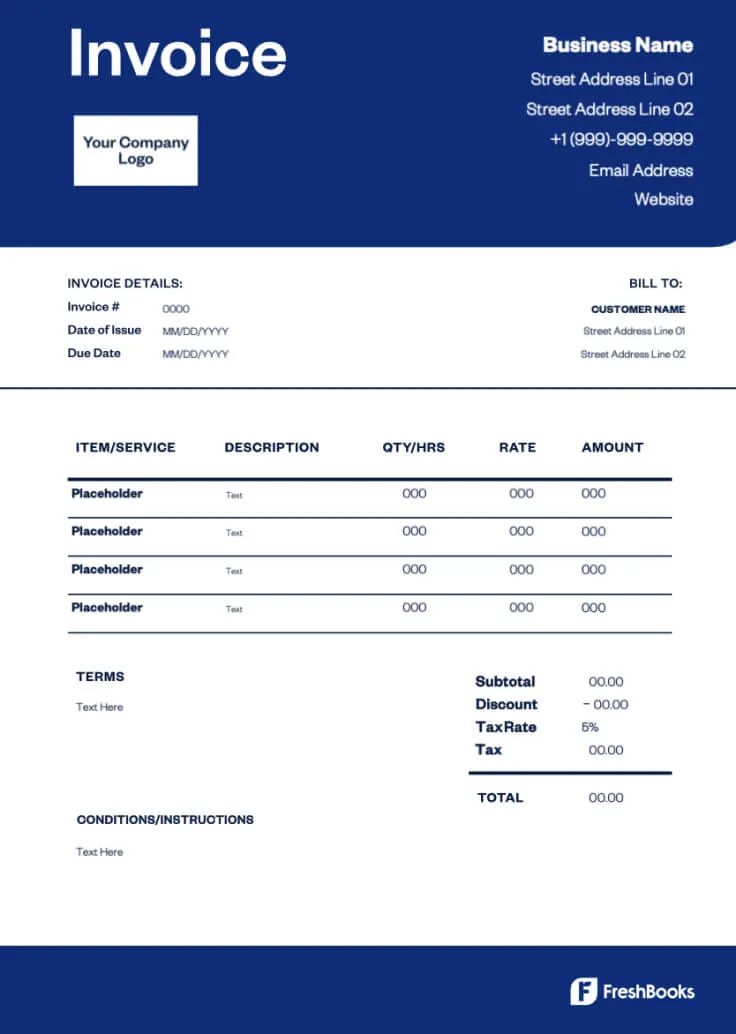

Choose a template

Free Invoice Generator

Skip the downloading process and create a custom invoice online with FreshBook’s free invoice generator. With a user-friendly design, you can have invoices customized and sent in no time—no downloading necessary.

FreshBooks Invoice Generator

Drag your logo here, or select a file

Bill From:

Bill To:

Invoice Number:

Date:

Amount Due (USD)

$0.00

| Description | Rate | Qty | Line Total |

|---|---|---|---|

| Subtotal | 0.00 |

|---|---|

Discount | |

| 0.00 | |

| Total | 0.00 |

| Amount Due (USD) | $0.00 |

More Invoice Templates by Industry

It takes a village to do the work you do. Discover industry-focused free invoice templates customized for those you work closest with.

Still can’t find the perfect template? Check out our invoice template main page for a collection of industry-specific templates that suit your needs.

Bakery Invoice Template

Make billing for cookies, cakes, and pastries easy with bakery invoice templates that include breakdowns of labor and ingredient costs.

Catering Invoice Template

Caterers can bill for ingredients, supplies, venue setup, and more with customizable catering invoice templates.

Small Business Invoice Template

From work like graphic design and retail to cleaning and tutoring, free downloadable small business invoice templates make billing simple.

Hotel Invoice Template

Good accommodation is hard to find. Make sure you’re paid correctly with a professional-looking hotel invoice template.

Freight Invoice Template

You can tailor a freight-specific invoice template to bill for delivery as well as pickup and time spent on a job.

Accounting Invoice Template

Outline the costs for your time, financial record preparation, and analysis with a downloadable accounting invoice template that’s made for accountants.

Consulting Invoice Template

Create individual invoices for clients and add a personal touch with consulting invoice templates to simplify billing.

Tutor Invoice Template

Find customizable tutor templates for math, science, and more with tutor invoice templates that you can tailor to any subject.

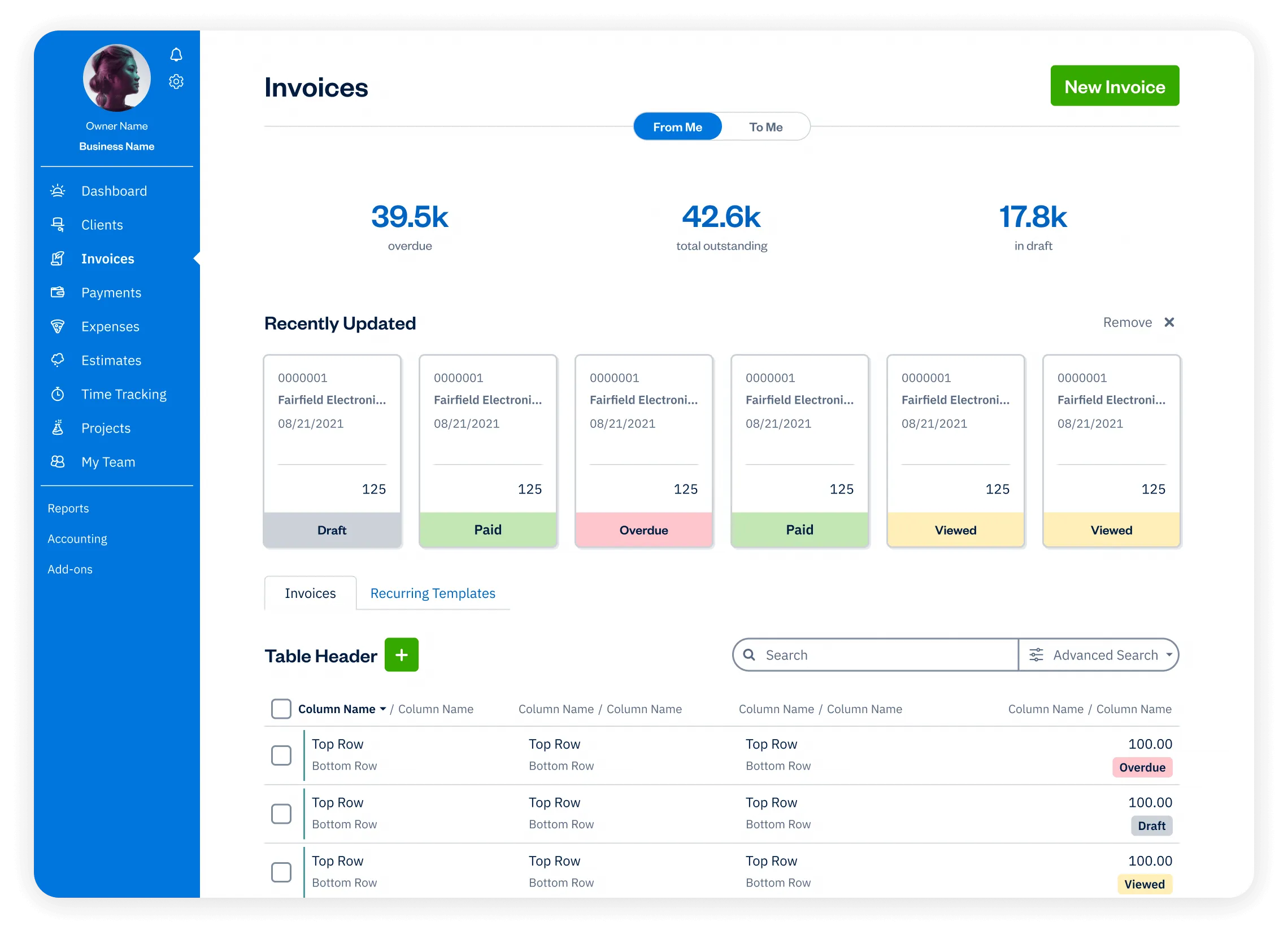

Non-Profit Invoice Template vs. FreshBooks

Take your business further with FreshBooks invoicing software. User-friendly features allow you to streamline your invoicing process and put your business on autopilot.

Non-Profit Invoice Template

VS

FreshBooks

Features

Non-Profit Invoice Template

Flexible invoice templates

Printable formats

Email invoices at no cost

Accept payments on invoices

Schedule invoices

Automate payment reminders and late fees

Manage paid and outstanding invoices

Set up deposits for projects

Add discounts and credits to invoices

Automate recurring subscription invoices

Create and send invoices via mobile devices

Access your invoices FOREVER on the cloud 🔥

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Non-Profit 101: Helpful Resource for Your Non-Profit Organization

Dive into our collection of resources tailored to growing your non-profit organization and helping you create professional invoices. Discover topics related to non-profit accounting that help organizations succeed.

How To Start A Nonprofit In 8 Steps

Nonprofit Accounting: Basics and Best Practices Guide

How to Calculate Overhead for Nonprofit Businesses

Payroll for Nonprofits: Working Process & Benefits

Bookkeeping for Nonprofits: A Basic Guide & Best Practices

Nonprofit Tax Deductions for 501(c)(3) Organizations

Frequently Asked Questions

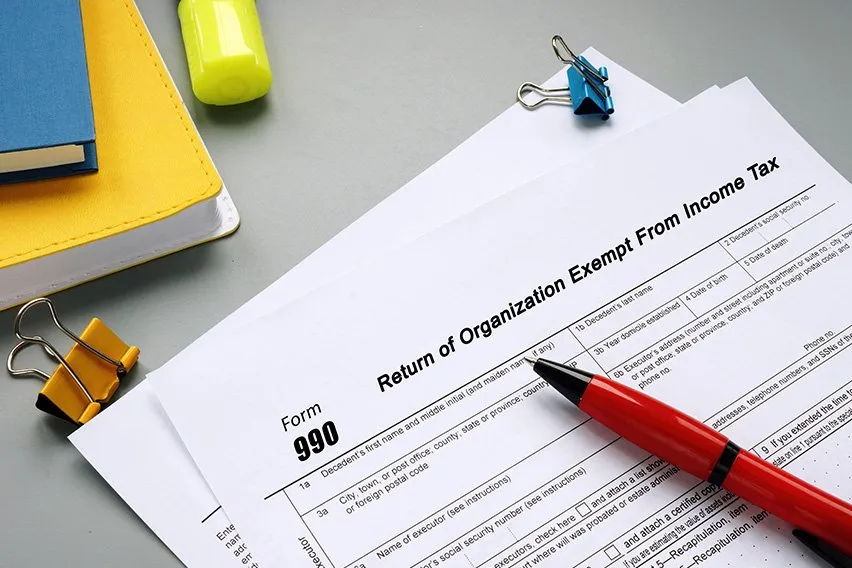

Regulations for non-profit organization invoicing can differ depending on your area. A non-profit organization must adhere to their area’s tax laws and regulations. They must also provide accurate and honest transaction details when invoicing and maintain transparency. This includes providing accurate contact details, donor information, goods or services provided in the transaction, costs, and payment details.

A non-profit organization can offer a diverse range of accepted payment methods on their invoices. This may include credit cards, debit cards, checks, bank transfers, and online payments. Offering a wide range of accepted payment methods can assist in receiving timely payments from clients. FreshBooks invoicing software allows you to get payment directly when sending an invoice for added convenience.

Non-profit organizations may need to include tax information on invoices dependent on the local laws and the nature of the transaction. There may be some instances where a non-profit organization is exempt as they do not pay taxes—however, it’s best to consult with your local tax authority to ensure accurate compliance.

Non-profit and charitable organizations can charge interest on overdue invoices as long as it is included in the payment terms. Outline the interest charges applied to past-due balances when filling out your invoice. This allows for transparency between parties and makes the customer aware of the potential charges.

Yes, non-profit organizations can issue invoices for in-kind donations that detail the donation amount of goods or services. These invoices serve as documentation for the value of the donations pledged to charity organizations, which is helpful to the non-profit organization in organizing billing and the donor to keep track of tax-deductible donations.