More Payment Options Means Getting Paid Instantly

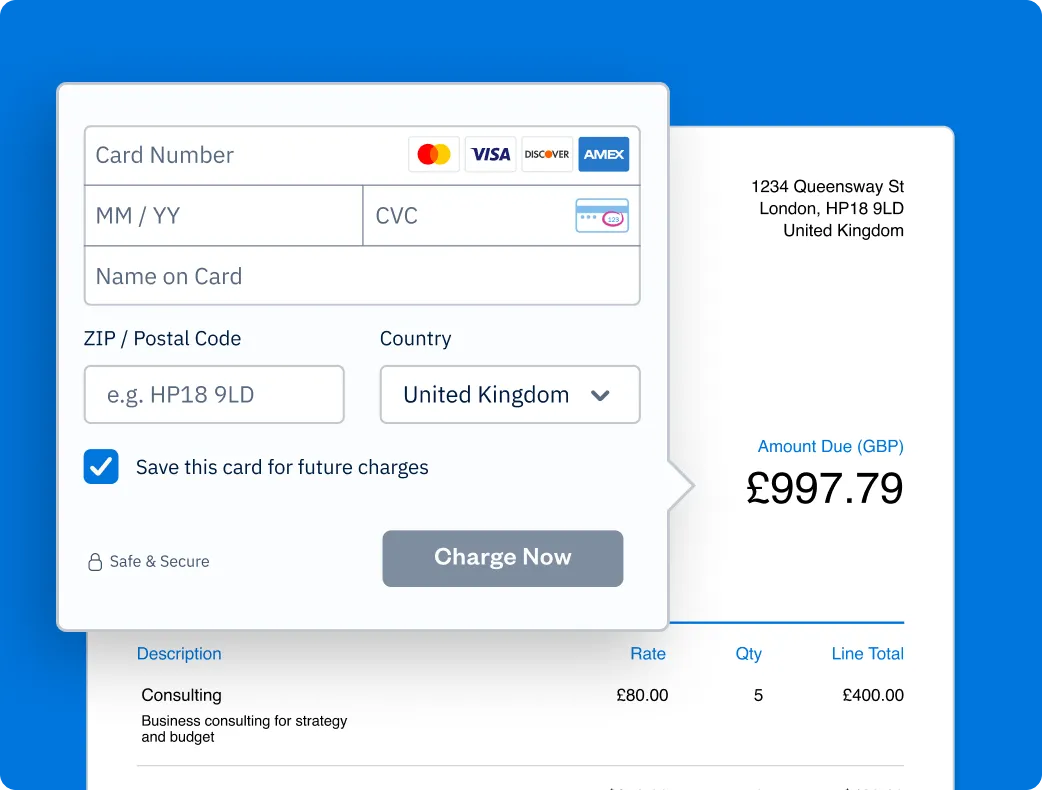

Enter and save client credit card information directly in FreshBooks, so you can skip the invoice follow-up calls and put an end to waiting on payments.

Hands-Off Payment Features

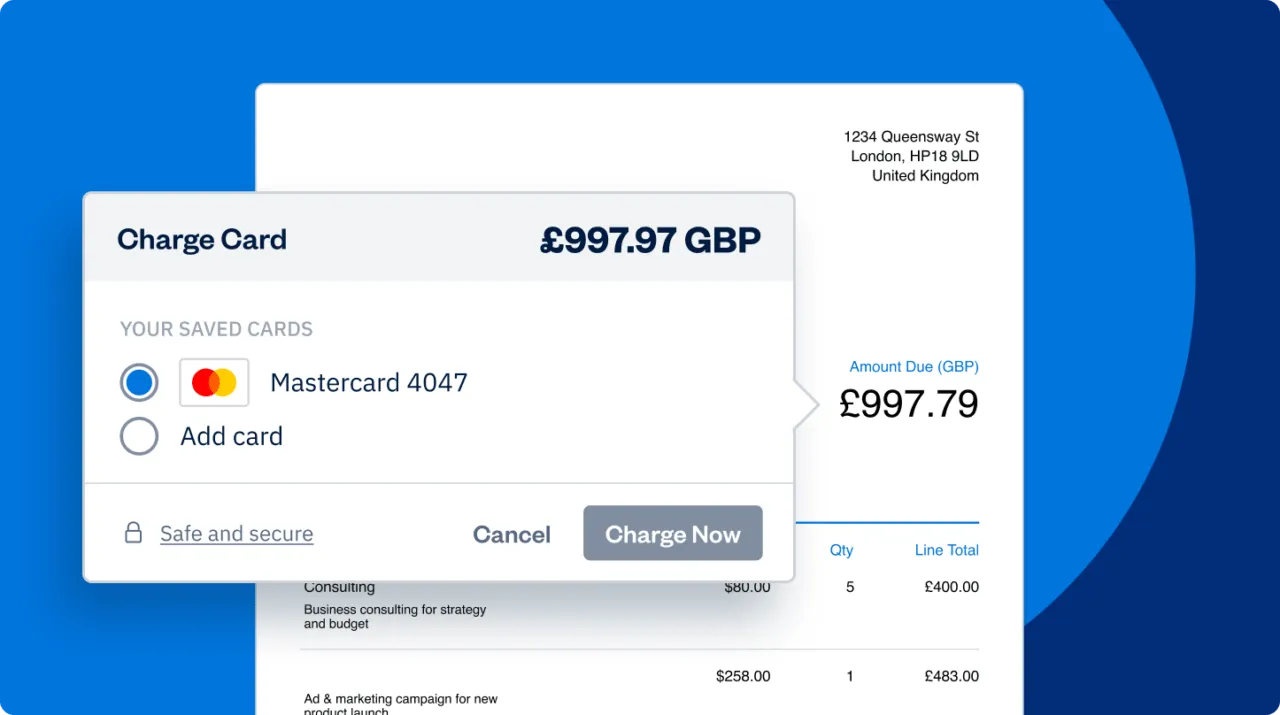

Take the “work” out of your billing workflow. Accept credit card payments, store card information, set up recurring payments, create automated subscription-based billing and manage relationships with repeat clients for both one-off transactions and subscriptions. Yes, getting paid instantly is really that easy.

In Person and Over the Phone

It’s simple. Enter and process credit cards at the moment of purchase, in person or over the phone, and you’re done. Processing payments on the spot is a win-win.

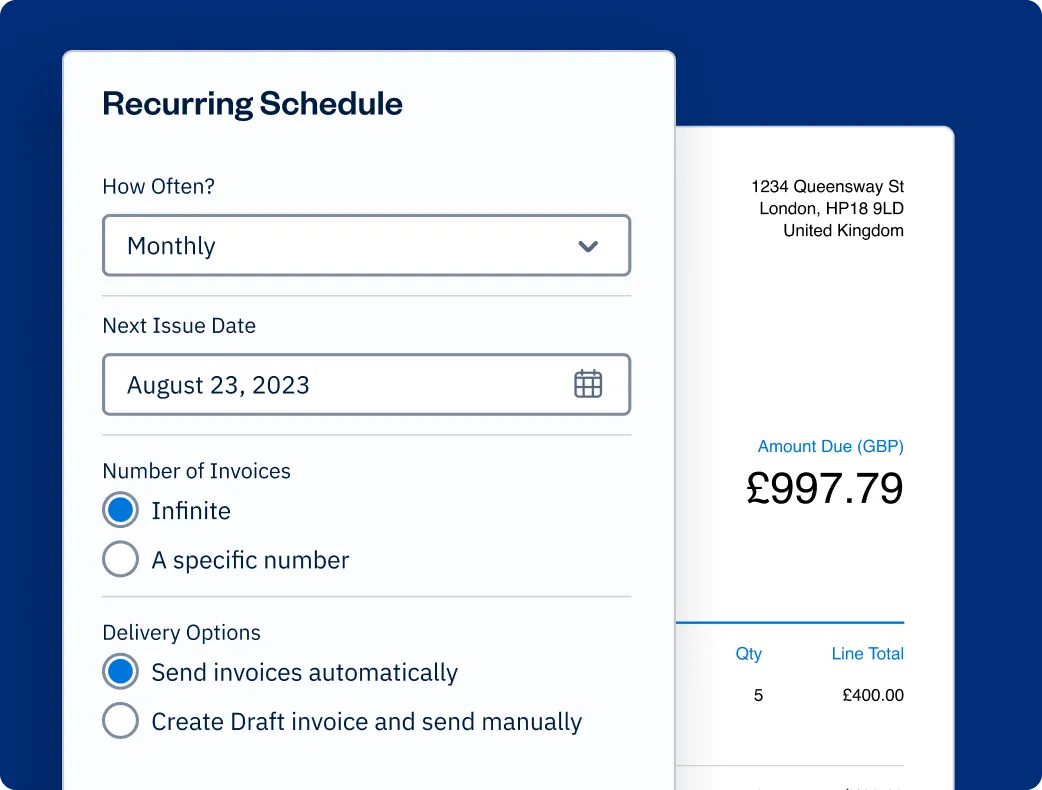

Wow! Subscription-Based Billing

You love recurring invoicing because it saves a lot of time. Now, add automated billing to create client subscriptions. Invoices are automatically created and paid with your client’s saved credit card information.

Virtual Terminal, Only Better

Advanced Payments is just like a Virtual Terminal, but with great added features. FreshBooks allows you to enter credit card info and save it for future use. This functionality is useful for actions like repeat billing and subscription-based billing, so you can set it and forget it.

Competitive Pricing

Unlock the convenience, security and speed all in one feature and all at one great price.

£15/month

add-on charge

+

2.1% + 20p

per transaction

- Accepts all major credit cards

Frequently Asked Questions

An add-on is a feature you can selectively add or remove from your account that provides functionality that’s not available with regular FreshBooks’ plans. The Advanced Payments add-on can be selected through the Billing & Upgrade page in your account or directly at this link. All add-ons are charged to your account monthly.

You do not need to have used online payments before! However, you will need to set-up a new or existing Stripe account in FreshBooks before you see the option to add Advanced Payments to your account. Review the instructions for connecting your Stripe account here.

Nope! Recurring invoices are still available for free in all FreshBooks plans and you can even add the option for clients to pay you with a credit card for free as well. The additional functionality offered with Advanced Payments is the ability to require a credit card on the recurring invoice, so your client must choose this method of payment instead of other available options. Once they add their card, they will also be automatically charged every month, similar to a subscription-service.

This is not a safe way to store client data, let alone credit card data. There are regulations in the credit card industry that most companies choose to follow because it is the safe way to store client card data (this is called PCI Compliance). Advanced Payments (and all of New FreshBooks) is PCI Compliant, so you know your client data is completely safe and secure. If you choose not to safely store credit card data, you risk being charged if the information is compromised.

Advanced Payments charges 2.1% + 20p/transaction (rates will vary depending on region) for all credit cards processed through it, which is higher than the rate for most cards regularly processed with FreshBooks Payments.

If you haven’t completed connecting your Stripe account to FreshBooks, you won’t be able to see the option to purchase Advanced Payments. You will need to answer a few questions and connect your bank in order to be fully set-up. Review the instructions for completing your Stripe account set-up here.

The Support You Need, When You Need It

- Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support:We’ve got over 100 Support staff working across North America and Europe