Inventory Accounting: A Complete Guide

Inventory is the biggest cost to stock holding businesses. But it is also the biggest earner.

The movement and management of your inventory affect your business in many different ways. It impacts cash flow, cost of goods sold and it even affects profit. This is exactly why accounting for your inventory properly is such a vital aspect of running a business.

Accounting for inventory can be a tricky task. That’s why we’ve put together a complete guide on what exactly inventory accounting is, and how you can streamline your own processes.

With this handy guide, you’ll be able to boost your profits and ensure a smooth and easy inventory accounting process.

Here’s What We’ll Cover:

How Does Inventory Accounting Work?

The Key Terms of Inventory Accounting

What Are the Benefits of Inventory Management?

What Is Inventory Accounting?

Inventory accounting is the section of accounting that deals with the valuation of products in your inventory. It also accounts for changes in your inventoried assets.

A company’s inventory can typically be split into three stages of production:

- Raw Goods

- In-progress Goods

- Finished Goods

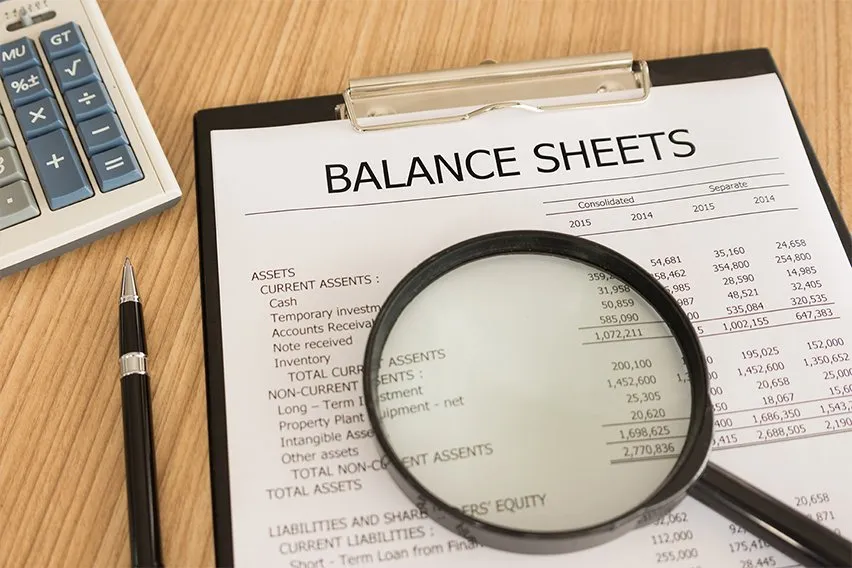

Inventory accounting will then allow you to assign values to the items in each of these three stages of the process. You can then record them as company assets. These assets are likely to be of future value to the company, so they need to be accurately accounted for and valued. This means that the company will have a precise valuation.

It’s important to note that inventory is considered a current asset. This means that it is not depreciable.

A business’s management of both their inventory purchases and inventory turnover has to follow the Generally Accepted Accounting Principles, or GAAP, rules. This requires that all inventory must be properly accounted for using either the cost method or the market value method.

How Does Inventory Accounting Work?

When a business buys an inventory item, it is recorded as a cost. It is also recorded as an asset, because it can be used to sell on to generate revenue. When you do sell that item, the capital gained will be recorded as income. The item would then be removed from your list of assets.

This is the most basic and commonly used way of inventory accounting.

The GAAP requires that inventory must be properly accounted for. This is according to a very particular and stringent set of standards. These standards go some way towards limiting the potential overstating of profit by understating inventory value.

Profit can be defined as a business’ revenue minus its costs. Revenue is generated by selling inventory. So if the inventory value is understated, then the profit that’s associated with the selling of inventory may in turn be overstated. This can potentially lead to the company’s valuation being inflated.

The GAAP rules also guard against company’s potentially overstating their value. This would be by overstating the value of their inventory. Since inventory is an asset, it actually affects the overall valuation of the business.

So if a company is manufacturing or selling an outdated item, it may see a decrease in the value of its inventory. If this isn’t accurately captured in the company’s financial statements, then the value of the company’s assets and the company itself may be inflated.

The Key Terms of Inventory Accounting

There are two key terms that retailers need to consider when it comes to inventory accounting. These terms are:

1. Cost of Goods Sold

The cost of goods sold, or CoGS, is the direct cost associated with producing any goods that are then sold by a company. They are a core element of measuring a business’s profitability and value of its inventory.

CoGS refers to the amount it costs a business to produce the products it sells. This includes everything that went into producing the goods such as:

- Materials

- Tools

- Labour

However, CoGS doesn’t factor in costs that are not directly tied to the production process. So the price of shipping, advertising and a business’ sales force doesn’t apply.

Therefore, your CoGS helps you to figure out the amount of gross profit you’ve made in a sale. So for example if you sell an item that is valued at £100, and the CoGS is £70, then you’ve achieved a gross profit of £30.

To calculate your CoGS, you’ll need to follow this simple formula:

CoGS=(Beginning Inventory Cost+Purchases Cost)-Ending Inventory

Ending Inventory

When it comes to the end of a business’ accounting period, it is somewhat unlikely that the business has sold the entirety of its inventory.

So any unsold inventory becomes an asset that must first be valued, and then included in the financial statement for the financial period.

This unsold stock is known as the ending inventory or EI. It can be calculated as such:

- Take the beginning inventory or BI. The BI is the units carried over from the end of the previous financial period.

- Add any inventory that has been newly purchased throughout the accounting period.

- Subtract any units that have been sold to customers.

What you will be left with is the final inventory figure to be included as a company asset.

So the formula would simply be:

Ending Inventory=(Beginning Inventory+Purchases)-Sales

What Is Inventory?

The term inventory has been used a lot so far. And there can be some confusion around what is and isn’t considered inventory.

Inventory can be defined as the items that your business has bought with the further intention of reselling to their customers. These items could be resold without any changes. Or they could be combined with other different inventory items to create a new inventory product.

Things that wouldn’t be considered inventory are things that you have bought in and are considered assets, but wouldn’t be resold to customers. This could include things such as:

- Work Tools

- Vehicles

- Stationary

- Real Estate

Or for example, if you’re running a drop-shipping business where you sell goods online through a third party supplier. Drop shippers don’t have anything that would be considered inventory as the third party supplier is the owner of the goods. It must be owned by you to be considered your inventory.

When talking about inventory accounting, it’s also important to mention inventory management.

What Are the Benefits of Inventory Management?

There are a number of ways that inventory management can combine with inventory accounting. This can help businesses both save money and make money. Some of these benefits include:

- Maximising Sales: Good inventory management means that you’ll never run out of a popular product that is selling well.

- Lowering Bills: By streamlining your inventory, you can reduce storage costs. This is by ordering fewer of your slow-moving items.

- Avoiding Waste: You can keep tabs on any write-offs. This may be due to damage, product expiry or theft.

- Getting Better Deals: When you know what you should be ordering a lot of, you can look for bulk discount deals.

- Pinpointing the Profit: Properly tracking your inventory costs will help you to figure out where the true profit margins are. This is seen on each product line that you sell.

- Helping Your Marketing Team: By tracking your sales, you can identify seasonal sale habits and trends. This in turn will help you to plan promotions.

Key Takeaways

Inventory accounting is a useful and profitable tool for keeping a track of your inventory and maximising its earning potential.

Through the use of accounting software such as FreshBooks, you can further streamline your inventory accounting process. This can help ease the pressure on your finance department.

Are you looking for more business advice on everything from starting a new business to new business practices?

Then check out the FreshBooks Resource Hub.

RELATED ARTICLES

What Is the Margin of Safety? Here’s the Formula to Calculate It

What Is the Margin of Safety? Here’s the Formula to Calculate It How to Calculate the Inventory Turnover Ratio for Your Business

How to Calculate the Inventory Turnover Ratio for Your Business What Are Micro Entity Accounts?

What Are Micro Entity Accounts? What Is a Merchant Account? How Do I Get One?

What Is a Merchant Account? How Do I Get One? What Is a Cash Flow Forecast and How to Make It?

What Is a Cash Flow Forecast and How to Make It?