Net Revenue: What Is It & How Does It Differ From Gross Revenue?

There is a lot to understand about business profitability. You need to consider net earnings, gross income, and sales revenue. But what about when you want to calculate net profit or net income? Are there any differences when you want to find a company’s total profit?

You must also consider employee payroll when compiling your company’s financial statements. As a business owner, there are going to be many moving parts to worry about.

But don’t worry, that’s why we put together this guide. We are going to break down net revenue and how it’s different from gross revenue. Keep reading to learn everything you need to know. We’ll also dive into some formulas and calculations, some ratios, and more!

Table of Contents

Net Revenue Formula & Calculation

When Should You Use Net Revenue vs Gross Revenue?

What Is Net Revenue?

Net revenue is often referred to as net sales. It’s the total amount of revenue a business generates from daily operations. To calculate net revenue, you must subtract any necessary adjustments. These may include discounts, refunds, or returns.

There may be a range of other expenses to consider when determining net revenue.

These can include:

- Various marketing costs

- Office supplies

- Rent and utilities

- The total cost of goods sold

- Taxes

- Employee compensation

- Legal and administrative costs

It’s also worth mentioning the difference between interest payments and dividend payments. You can deduct interest payments from your gross revenue to help calculate net revenue. Yet you rarely deduct dividend payments. Instead, these deductions occur in other business accounting processes.

Net Revenue Formula & Calculation

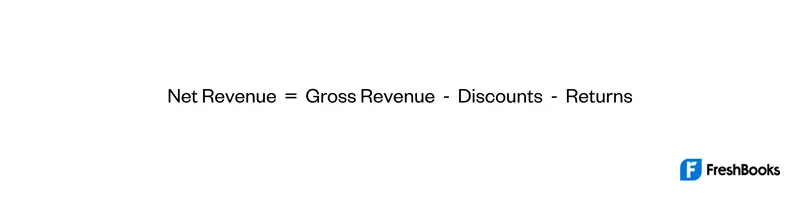

Calculating net revenue is simple to do as long as you have the right information. This is the formula for calculating net revenue:

Expenses can include overhead costs, the cost of goods sold, and other types of variable expenses. Calculating net revenue allows you to gain insights into the total profit of your business over a certain period.

For example, let’s say that you offer a subscription service to your customers. They are paying £10 per month. A total of 15 customers decide to cancel their subscription for a full refund. But, you still have 100 other customers who continue to pay the monthly fee.

Here, you still earn £1,000 in revenue but will need to subtract the refund amount. This would be £150. Your net revenue for the month would thus be £850.

Net vs Gross Revenue

Net revenue is an adjusted amount that comes from gross revenue. You determine net revenue by subtracting different refunds and discounts, for example. Gross revenue is the total amount of revenue your business earns in a period without subtracting anything.

Net revenue provides a more accurate picture of business performance, but gross revenue can be an effective growth metric.

Gross Revenue Reporting

Your income statement will include the entire gross revenue of your business. It will get reported as top-line revenue. Gross revenue is going to be the same as your gross sales. This is the total amount of revenue generated by the business in a period of time.

It’s a simple process to calculate and report gross revenue. And making use of small business accounting software can make it even easier. FreshBooks is an easy-to-use accounting software that comes with all the features you could need.

It’s important to recognise that even though gross reporting considers total money coming in, the money is only in the form of sales. This means that the likes of loans or capital contributions are not included.

Net Revenue Reporting

Net revenue reporting works like gross revenue reporting, but there can be a few more calculations to consider. Net revenue is equal to gross revenue minus any expenses in the same period.

For example, you will deduct expenses like overhead, the cost of goods sold, and other variable expenses. Reporting net revenue is going to reflect the total profit of your business over a period.

When Should You Use Net Revenue vs Gross Revenue?

Even though they’re similar, gross revenue and net revenue serve two different purposes. Gross revenue can be most helpful if you want to track your total sales volume.

This can paint a clearer picture for things like market share. Or it can be helpful when you want to gain insights into whether your salespeople are achieving business goals.

Net revenue comes into play when you want to determine overall profitability. You can get more insights compared to tracking gross revenue. This information may allow you to make more informed business decisions.

Although net and gross revenue provide different insights into how your company is performing, they’re both important. Find as much information as possible to help guide your business forward. Ensure you have enough cash flow to continue operating and grow your bottom line.

Net vs Gross Revenue Ratios

Both net and gross revenue reflect the financial strength and standing of your business. They’re both handy to use when you want to determine business performance.

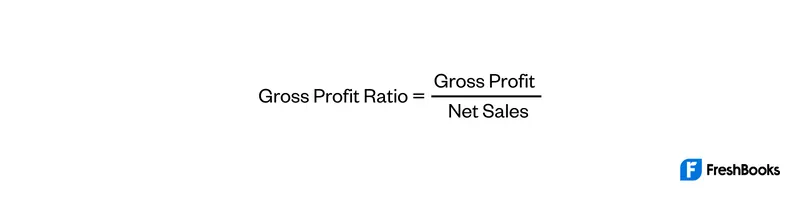

The gross profit ratio is an effective financial metric that can provide insights into profitability. You can also refer to it as your gross profit margin. It’s the percentage of your gross sales compared to the cost of producing the product or service.

The formula for calculating the gross profit ratio looks like this:

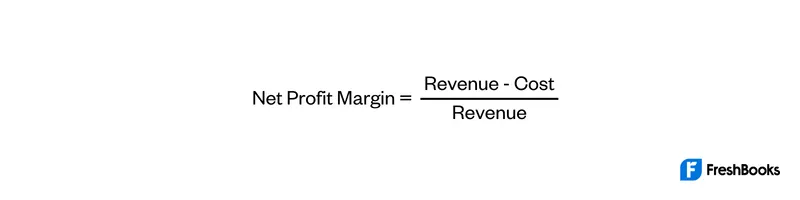

For net revenue, you would use the net profit margin. This is also your return on revenue. Base this metric on the revenue of your company.

The formula to calculate your net profit margin would look like this:

The net profit margin of your business has to do with the total profitability after subtracting expenses and adjustments.

Key Takeaways

Net revenue is also known as net sales, and it’s the amount of revenue your business generates, minus any necessary adjustments. These can include the likes of refunds, discounts, and certain variable expenses.

It differs from gross revenue in a few ways. Gross revenue accounts for the total amount of revenue your business earns in a certain period without removing any expenses. Net revenue can be effective when you want to gain insights into the overall profitability of your business. A company’s gross revenue can be more effective as a growth metric.

FAQs on Net Revenue

Is Net Revenue the Same As Profit?

They are similar. Net revenue is the revenue your business earns after subtracting expenses. Profit relates to the income that’s left after deducting any remaining expenses from net revenue.

What Is Net Revenue vs Net Sales?

Net revenue refers to the total revenue earned by a business from every source. Net sales refers to the revenue or income received in return from selling a good or service.

Is Net Revenue the Same As EBITDA?

They are similar, but EBITDA doesn’t include the capital structure or tax situation of a company.

Is Net Revenue the Same As Gross Margin?

Net revenue refers to the total amount of revenue generated by a company minus total expenses. The gross margin gives insights into the percentage of revenue a company earns that exceeds the total cost of goods sold.

Is Net Revenue the Same As EBIT?

EBIT relates to the income that a business generates before it pays any interest or taxes.

RELATED ARTICLES

Inventory Accounting: A Complete Guide

Inventory Accounting: A Complete Guide What Is the Margin of Safety? Here’s the Formula to Calculate It

What Is the Margin of Safety? Here’s the Formula to Calculate It How to Calculate the Inventory Turnover Ratio for Your Business

How to Calculate the Inventory Turnover Ratio for Your Business What Are Micro Entity Accounts?

What Are Micro Entity Accounts? What Is a Merchant Account? How Do I Get One?

What Is a Merchant Account? How Do I Get One?