A Guide to Using Cashless Payment for Your Business

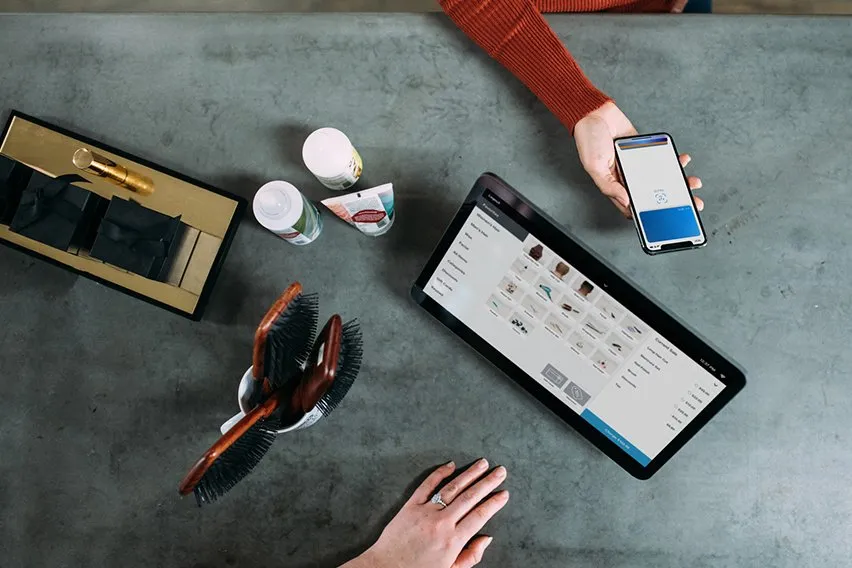

The world is going cashless, and it’s time for you to get on board.

The idea of a cashless society can be scary at first, but it doesn’t have to be! In fact, there are so many benefits to using digital payments in your business. You can save money by reducing fees associated with handling physical currency. This also reduces the risk of theft or loss.

Digital transactions also allow businesses more flexibility in how they operate their business. Businesses can accept payments online through ecommerce websites like Shopify. They can also take payment directly from customers via mobile apps such as Venmo or PayPal. There are endless possibilities when it comes to making your business more efficient by going cashless! This article will discuss cashless payments, how to set them up, the best software to use and more.

Here’s What We’ll Cover:

What Does Cashless Payment Mean?

The Pros and Cons of Cashless Payments for Businesses

What’s the Best Software for Cashless Payments?

Are Cashless Payments a Good Thing?

What Does Cashless Payment Mean?

Before we go into the pros and cons of using cashless payments, let’s first define what it is. Cashless payment refers to any exchange of value that does not involve actual physical currency. Instead, customers use cards or accounts linked directly to their bank or digital accounts. Some common examples are credit cards like Barclaycard, debit cards, PayPal, and Venmo.

The Pros and Cons of Cashless Payments for Businesses

Cashless payments have countless benefits in the business world. They also come with some downsides. Read on to learn more about the pros and cons of using cashless payments in your business.

Pros:

Cashless transactions are highly secure and reduce the risk of theft or loss. You’ll also eliminate fees associated with handling physical currency. Digital transactions allow businesses to be more flexible when it comes to accepting payments.

For example, many companies now offer electronic transactions that can be completed by swiping a card or scanning a QR code. Other options include onboarding new customers through mobile apps and websites.

Cons:

Other than the cost of implementing cashless systems, there is essentially no downside to using them for your business. However, you should keep in mind that not all customers are able to use cashless transactions. If you operate a business that serves this specific customer base, it could be worth considering accepting cash.

What’s the Best Software for Cashless Payments?

Here are some important criteria to consider when deciding what software or system to use:

- Process speed

- Security

- Ability to interface with popular platforms like Stripe, Barclaycard, PayPal and Square.

There are several options available for cashless payment software. These include First Data’s Clover Station, Harbortouch POS, Revel Systems and Square Register. Read on for a brief summary of these systems and their features.

Clover Station

Clover Station is a point-of-sale system that claims to be the most powerful and flexible solution for small business owners. It includes an easy to use user interface, inventory management capabilities, sales analytics reports and seamless integration with payment processors like First Data’s Clover. This is a card reader and POS software.

Harbortouch POS

Harbortouch’s point-of-sale system is designed specifically for small business owners. They typically need a cashless payment solution that does not break the bank. It offers a variety of features, including an easy to use interface, customer loyalty programs and advanced reporting tools. Additionally, it is one of the only cashless systems to offer PayPal integration.

Revel Systems

Revel Systems provides a full spectrum point-of-sale solution. It allows you to process credit card transactions and manage employees, inventory and other tasks. It can be used to accept payments from Apple Pay, Google Wallet and Square Wallet. You can choose which payment method works best for your customers.

Square Register

Most small business owners use Square to process credit cards and mobile wallets. In 2014, Square unveiled a new point-of-sale system called Square Register. Square Register lets you accept debit/credit card transactions using a sleek tablet or smartphone POS interface. You can also use it to sell goods online with its exclusive ecommerce functionality.

Are Cashless Payments a Good Thing?

The benefits of cashless transactions are obvious. Is this a trend that every business should jump on right away? The answer will depend on several factors. These include the size and budget of your business as well as the preferences of your customers.

If you have any concerns about how to get started with cashless payment systems, consult an expert in the field. They will be able to help you determine if cashless transactions are right for your business. They can also show you how they work and provide guidance on the software that best suits your needs.

Cashless payments are becoming more popular. Merchants all over the world look for ways to increase security while saving money. Choosing the best software for cashless payments is crucial. With the right service provider by your side, you’ll know your transactions are in safe hands.

Be sure to check out our resource hub for more articles like this one.

RELATED ARTICLES

Stripe vs PayPal UK: Which Payment Gateway Is Better?

Stripe vs PayPal UK: Which Payment Gateway Is Better? How to Take Payments Over the Phone: A Virtual Terminal Guide

How to Take Payments Over the Phone: A Virtual Terminal Guide What Is a Lump Sum Payment?

What Is a Lump Sum Payment? What Is TT Transfer (Telegraphic Transfer)?

What Is TT Transfer (Telegraphic Transfer)? What Is a Credit Default Swap (CDS)? Definition, Pros & Cons

What Is a Credit Default Swap (CDS)? Definition, Pros & Cons What Are Faster Payments & How Long Does a Faster Payment Take?

What Are Faster Payments & How Long Does a Faster Payment Take?