MTD Software That Makes VAT Return Filing a Breeze

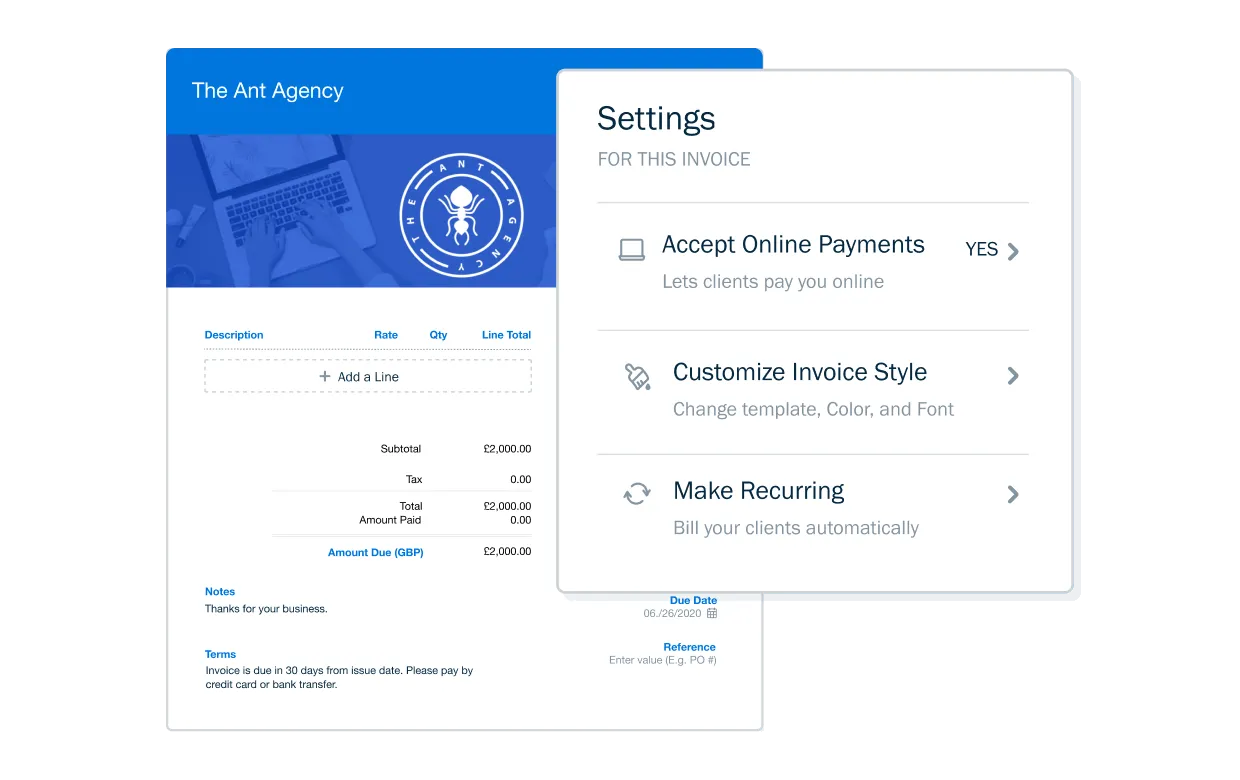

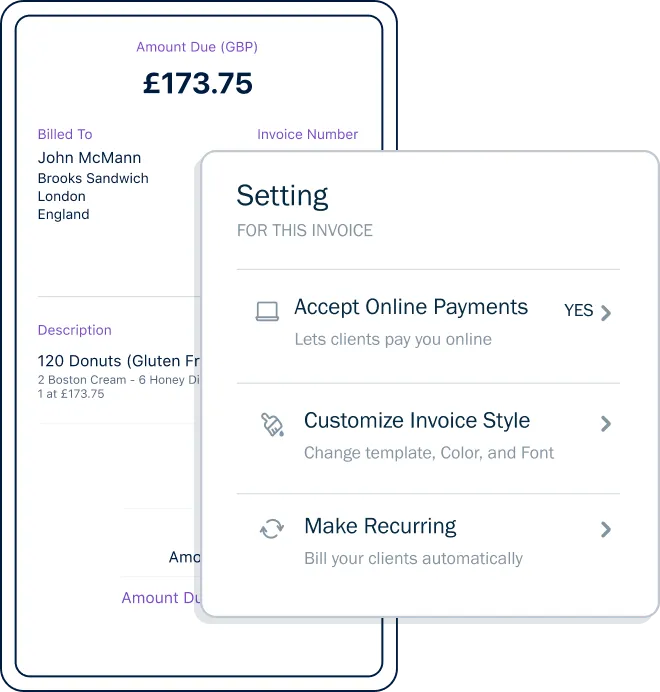

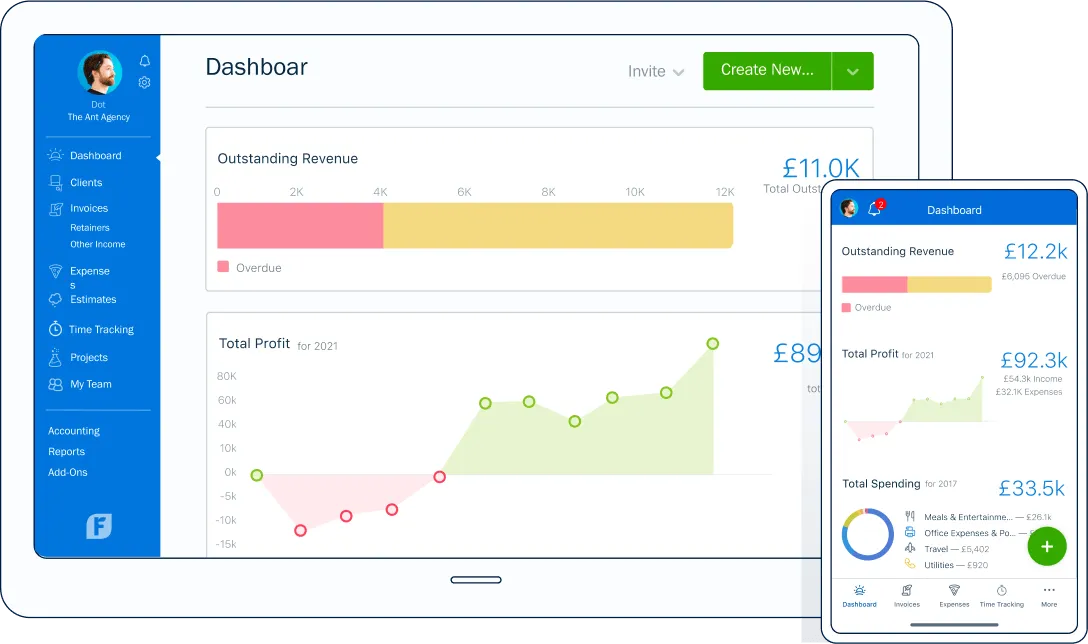

Need an easy way to file your VAT returns? FreshBooks is Making Tax Digital (MTD) software that makes it incredibly simple. Plus, with invoicing, payments, and expense tracking – you can keep your records accurate all year ‘round.

Stress-Free VAT Returns Start With FreshBooks

HMRC Recognised MTD Software

FreshBooks is MTD-compliant, HMRC Recognised accounting software that keeps accurate digital records of all your invoices, payments, and expenses.

Have Confidence in Your Compliance

FreshBooks automatically generates VAT Return Reports, connects to the HMRC for filing, and allows you to export files for your accountant.

File With the VAT Scheme You Prefer

FreshBooks supports Cash Accounting, Accrual Accounting, and Flat Rate accounting schemes commonly used to file VAT Returns.

How Easy Is Making Tax Digital on FreshBooks?

Connect and configure your MTD profile in FreshBooks.

Automatically track VAT transactions in your account.

Run a VAT Return Report, and adjust if needed.

Submit it directly to HMRC with one simple click.

Free for 30 days. No credit card required.

Cancel anytime.

Easy-to-Use Accounting & Bookkeeping Features

Why 30+ Million People Have Used FreshBooks

4.4 Excellent

“This software fits well with small businesses as they can easily do invoices with tax and VAT things, expenses and even payroll. Thumbs up!”

4.4 Excellent

“It’s great on the customer side of things… creating invoices and for doing other tasks such as estimates, petty cash, and simple VAT returns.”

4.4 Excellent

“FreshBooks is one of the best accounting softwares for accurate invoicing, expense tracking and reporting. The ease of use is exceptional.”

Find Out More About MTD on FreshBooks

Frequently Asked Questions

Making Tax Digital is an HM Revenue & Customs (HMRC) initiative designed to ensure the UK tax system is effective, efficient and more straightforward for VAT-registered businesses. FreshBooks is an MTD software (with an MTD Software Portal) that lets you submit your MTD VAT Returns to the HMRC and review past submissions, VAT liabilities, and VAT payment history. Making tax digital for VAT-registered businesses is simple with FreshBooks MTD software (Making Tax Digital software).

For VAT-registered businesses, once a VAT Profile is configured and signed in with the Government Gateway, it’s easy to submit returns directly to the HMRC using FreshBooks.

Making Tax Digital software programs are HMRC-recognised software programs that ensure your business’ digital records are compliant with the HMRC. This means when you submit VAT returns through your MTD-compatible software (FreshBooks), your VAT submission and tax returns meet the standards and expectations of HMRC.

At the same time, FreshBooks also ensures you have the information you need for your income tax self-assessment. It’s easy when all business finances are in one place.

Learn more about how FreshBooks makes tax time easy in this article: How to Enjoy a Stress-Free UK Tax Season With FreshBooks

Get all the details about how MTD works in FreshBooks in this helpful step-by-step guide.

The amount of VAT a business pays or claims back from HM Revenue and Customs (HMRC) is usually the difference between the VAT charged by the business to customers and the VAT the business pays on its own purchases.

With the Flat Rate Scheme:

- You pay a fixed rate of VAT to HMRC

- You keep the difference between what you charge your customers and pay to HMRC

- You cannot reclaim the VAT on your purchases – except for certain capital assets over £2,000

To join the scheme, your VAT turnover must be £150,000 or less (excluding VAT), and you must apply to HMRC.

The Flat Rate Scheme is supported in FreshBooks MTD submissions. We also have a VAT Calculator to help you calculate VAT

Simply put, bridging software is a light and more complex solution than FreshBooks for your Making Tax Digital needs. It extracts and collects information from the spreadsheets you’ve been maintaining all year and consolidates it. Then, it links it to HMRC’s portal and submits it electronically. It’s a solution for Making Tax Digital that allows you to keep using spreadsheets to keep digital records. But a bridging software, as the name suggests, will now act as a ‘bridge’ between you and HMRC’s tax return portal.

The HMRC wants businesses like yours to use bridging software for Making Tax Digital reflects as part of the HMRC’s Application Programme Interface (API) first strategy—making tax collection and VAT return filing digital, making it more efficient, less time-consuming, and overall easier to manage.

Alternatively, using Making Tax Digital software programs like FreshBooks ensures you can efficiently run your business in a way you can’t while using spreadsheets, and you get MTD-compliant digital record-keeping software that makes it easy to file your VAT return.

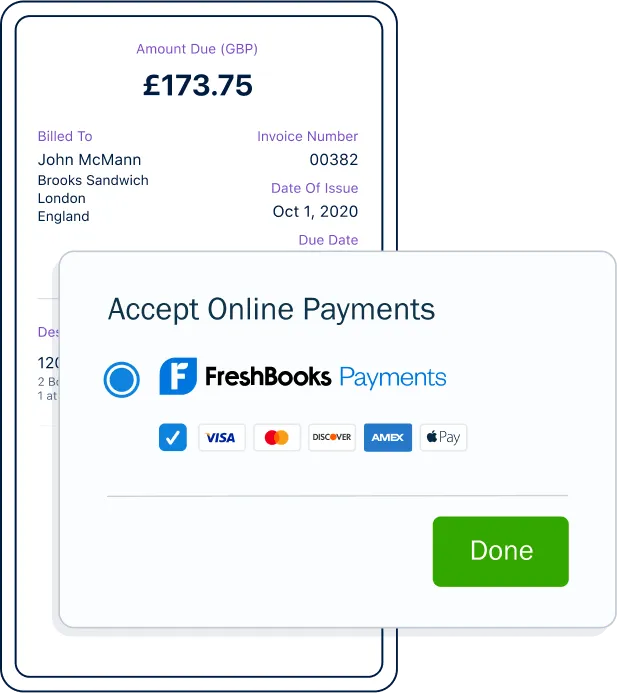

PSD2 stands for Payments Services Directive 2 and is a new EU regulation on authenticating online payments. FreshBooks is PSD2 compliant as of September 14, 2019, when PSD2 went into effect. This affects all European Business Owners who bill Clients based in Europe only. In addition to PSD2, the UK has implemented the Open Banking Standard for users in the UK who use third-party apps to connect to their bank accounts.

BACS Direct Debit (also known as Bankers’ Automated Clearing System (BACS)) is available through the FreshBooks integration with Stripe. It allows businesses to receive online payments from Clients through bank-to-bank transfers in GBP currency.

Barclaycard is one of our many online payment processors (also known as payment gateways) to allow you to receive online payments in GBP with credit and debit cards by Barclays via SmartPay Fuse.

When it comes to ensuring high-end business performance for self-employed individuals and small businesses, Barclaycard and FreshBooks provide fast payments and total peace of mind.

Learn more about Barclaycard and FreshBooks in this short video.

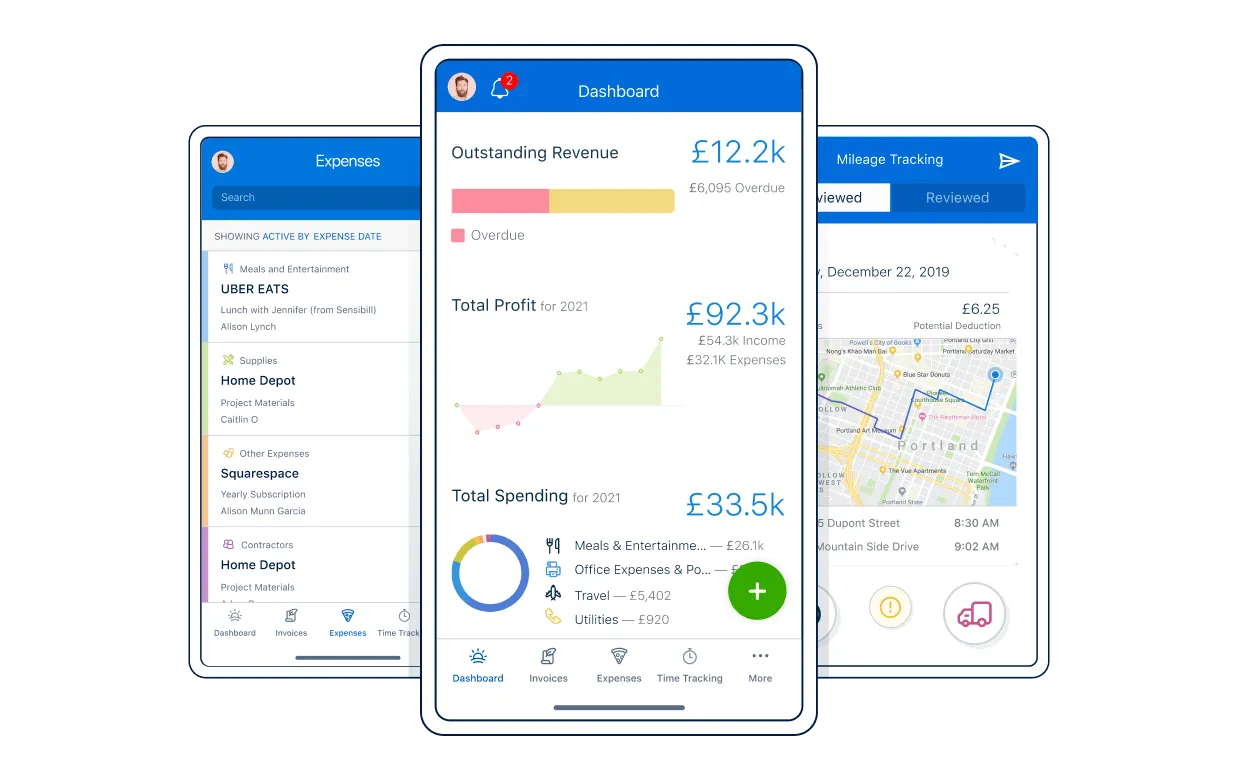

Looking for MTD software (Making Tax Digital software) that’s right for your business means trying out your options. So give FreshBooks a free try. It’s on us. As a small business owner, you get unlimited access to FreshBooks accounting software through our 30-day free trial, with no contracts and no credit card required. You even get free phone and email support if you have questions about setting up your account.

That’s right, the free trial period gives you access to all of our unlimited invoicing features, expense features, project management tools, the FreshBooks mobile app, business financial reports, accounting reports, everything you need for income tax, and as many billable clients as you need. Basically, all the features growing businesses need to keep growing are available to try out.

Need more answers? Check out this great article on the FreshBooks blog: How to Make the Most of Your Free 30-Day FreshBooks Trial

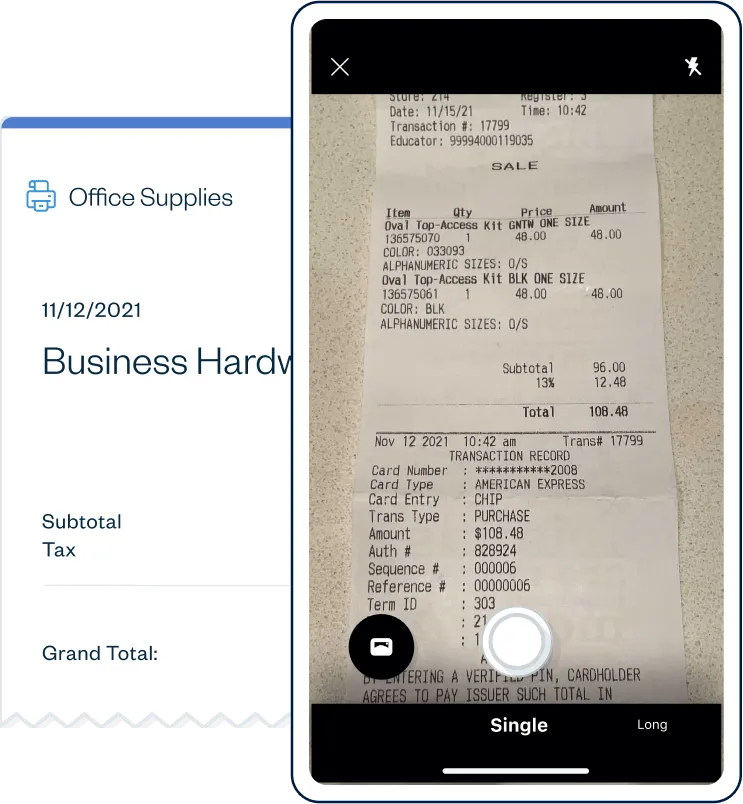

Sales Tax is imposed on the price of some items and services and is charged as a percentage of the selling price and is collected at the time of the sale. The amount of Sales Tax to charge depends on the State, City, and Country your business may operate in, and multiple or different taxes can be charged at the same time. MTD software (Making Tax Digital software), like FreshBooks, needs to have an accurate way to track sales tax.

The business charges Sales Tax on the government’s behalf, which means Sales Tax is not a part of your business’ income. Sales Tax must be paid back to the government (also known as tax remittance) at specific intervals depending on your government’s requirements.

MTD software (Making Tax Digital software), like FreshBooks, needs to be able to track other income so you can properly report your income tax. As a business owner, you may be receiving income or revenue through other means that don’t require an invoice (like non-invoice income). While tracking it might be different, this other income still needs to be reported on income tax self-assessment returns.

Other income can be from selling through online stores (like Shopify and Etsy), at fairs, selling ads, or renting space, for example. This can be tracked in FreshBooks by recording the details of the income, along with the payment (which is optional).

Recording Other Income allows you to provide accurate information for your accountant, so you can get a complete picture of the health of your business.

The short answer is YES, it will help you file your income tax, and VAT returns!

Here’s the long answer:

You probably already know that FreshBooks is MTD software that’s compliant with HMRC’s making tax digital initiative to help you file VAT returns for your VAT-registered business.

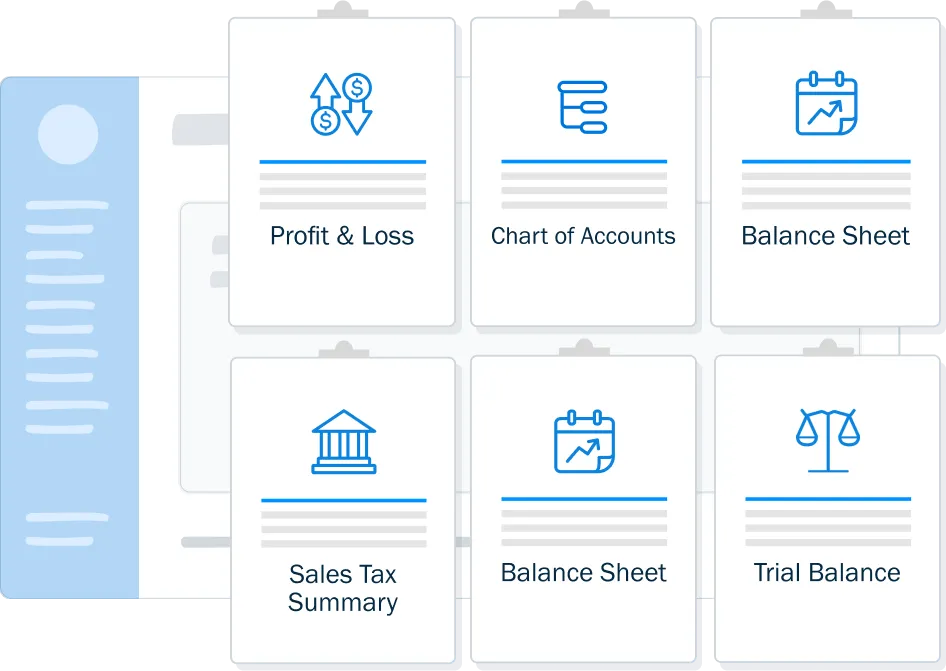

However, FreshBooks accounting software also has accounting reports for small businesses to do much more than submit VAT returns, like the Profit and Loss Report and Sales Tax Summary, which have the key numbers you need to fill out and file your taxes. We’ve even put together a list of handy resources to help you get ahead of tax time, which you can check out below. If you need double-entry accounting or bookkeeping help with filling out your return, check out our Accounting Partner Program to get matched with one of our vetted accounting or tax professionals.

Learn about the Profit & Loss Report here.

Learn about the Sales Tax Summary Report here.

Get a quick overview of reports in this short video.

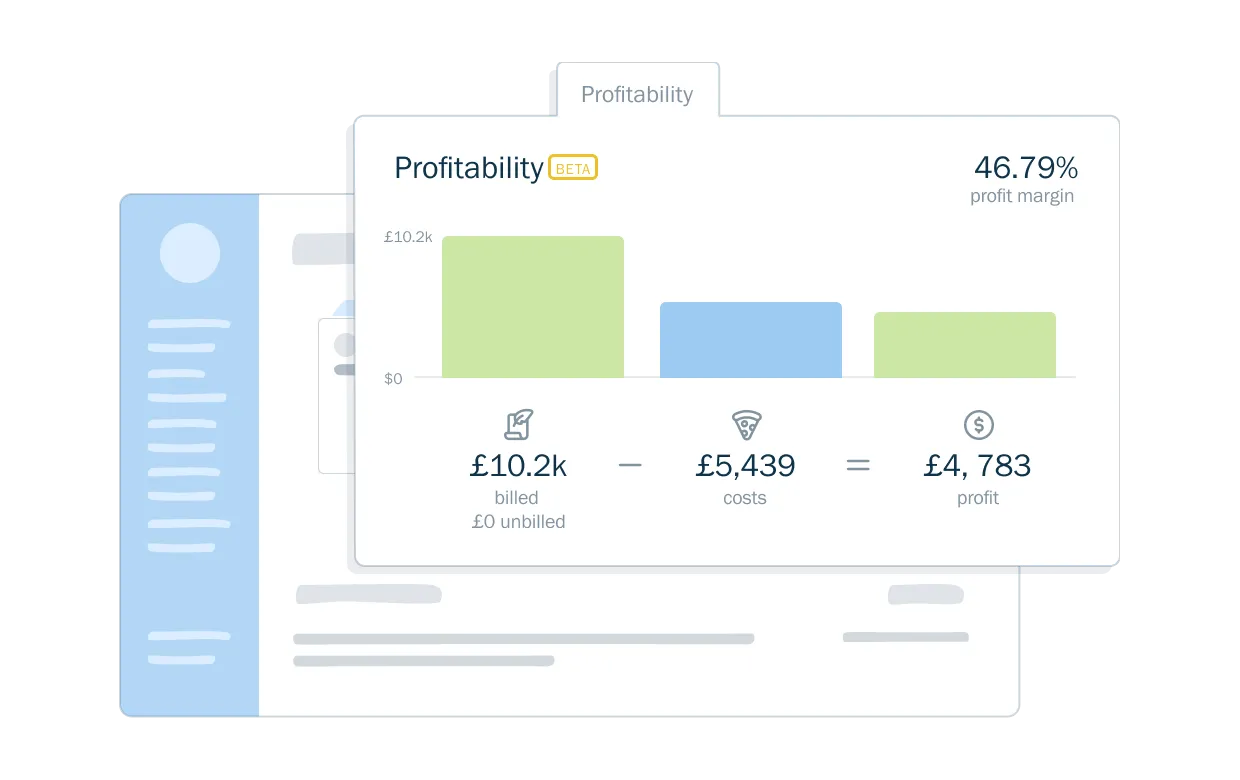

Project Profitability – Powerful Ways to Track Each Project’s Profitability

View a more detailed breakdown of each of your projects with the Project Profitability Widget, Profitability Summary Report, and Profitability Details Report. These tools give you an in-depth analysis of how each project is performing. It makes it easy to always know where your money is going. Check out all the details here.

Want to hear about Project Profitability in action? Check out this case study: How Zachary Uses Project Profitability to Save $2k per Month

Simple Workflows Like Converting Estimates & Proposals to Projects

This is just one example of a time-saving workflow in FreshBooks, but you can easily convert an estimate or proposal into a project with a single click. The same customer that got your estimate or proposal now has a project assigned to them, and any and all services added to the estimate or proposal are now added to the project.

Check this out to learn more about how useful Estimates can be: Landscapers Marc & Darryl Broke Even in 3 Months Using FreshBooks Estimates

FreshBooks Accounting Partner Program

Are you an accountant seeking deeper connections with your clients through collaborative accounting? The Accounting Partner Program was launched to help you with exactly that, and you can join any time.

We could write an eBook detailing why FreshBooks is the best accounting software for your business, and a better solution than Quickbooks Online, Xero, MYOB, Zoho, Wave, or any other accounting software. However, the best way to decide is to start a 30-day free trial. You get to use all the user-friendly features and don’t need a credit card to sign up.

FreshBooks is the perfect solution for everyone, from very small businesses all the way up to established tech companies with big teams. Kind of like this one: Erik’s Health-Tech Startup Relies on FreshBooks to Keep Cash Flow Strong

Want more information about which of the FreshBooks plans is right for you? Check out this blog article: Wondering Which FreshBooks Plan Is Right For You?

Before starting a trial, if you want a thorough breakdown of the main reasons FreshBooks is a better accounting software, then check out the links below.