Free Invoice Generator

Table of Contents

- Invoice templates vs. Invoice generator: which is right for your business?

- How to create an invoice with the free invoice generator

- Key elements of a professional invoice

- Customising your invoice with a free invoice maker

- Benefits of using an online invoice generator

- Free invoice generator vs. FreshBooks

- View our Invoice Template Gallery

- Helpful Invoicing Resources

- Have Questions? We Have Answers!

Invoice templates vs. Invoice generator: which is right for your business?

For UK small businesses, there are typically two ways to create invoices: using an invoice template or using an online invoice generator. Both simplify invoicing but serve slightly different purposes.

| Feature | Invoice Templates | Invoice Generator |

| Format | Downloadable documents | An online tool within a web browser |

| Customisation Level | High degree of control over layout, fonts, and design | May offer less detailed customisation |

| Design | Customisable to match your brand | Generally provides a clean, professional look |

| Ease of Use | Requires manual input and formatting | Often includes features like automatic calculations |

| VAT Handling | User is responsible for accurate VAT calculation | Often includes fields for VAT calculation |

| Output | User creates the final output | Generates a polished final invoice |

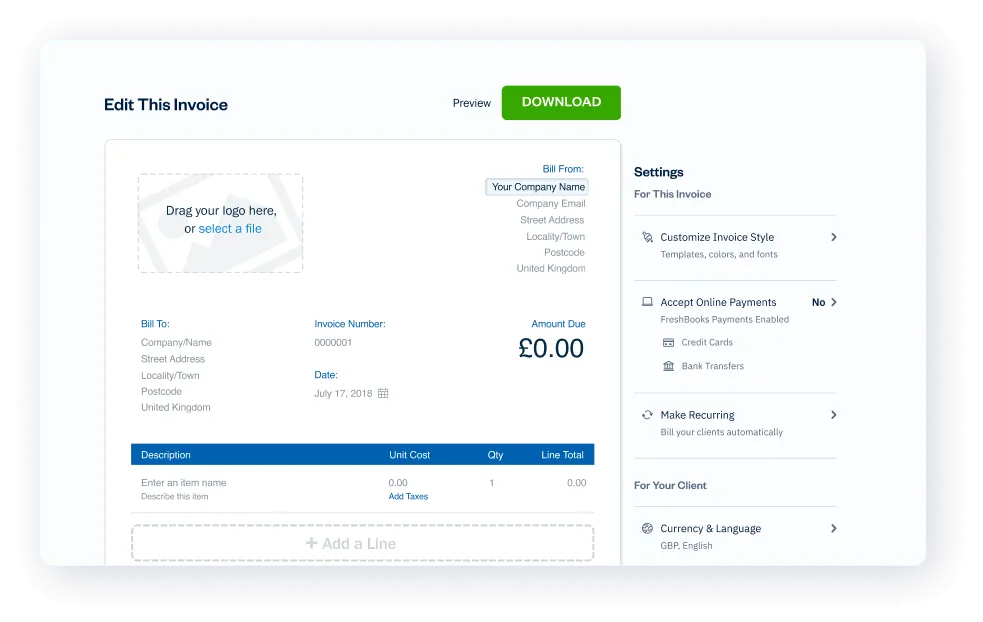

How to create an invoice with the free invoice generator

The free invoice creator is a simple, user-friendly tool—and it does all of the math for you.

It can automatically calculate subtotals, totals, and taxes, reducing manual entry errors and speeding up the invoice preparation process.

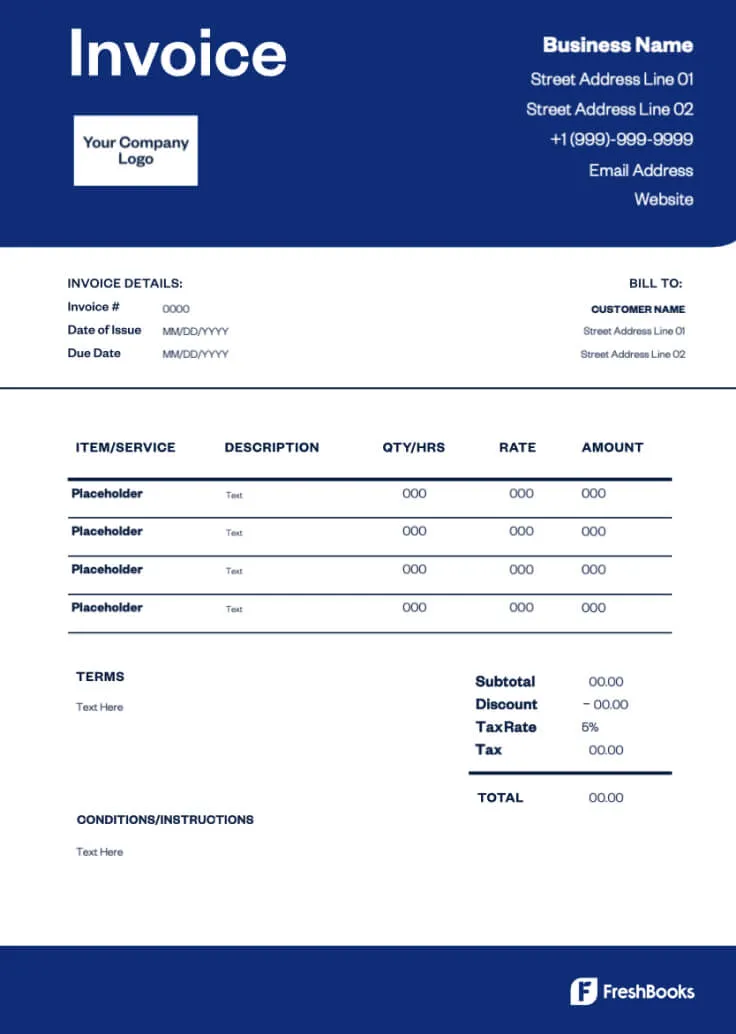

1

INVOICE HEADING

Stick with the standard template or opt for a more modern style. Change the colour of your blank invoice template, and add your business logo if you wish.

2

COMPANY NAME AND CONTACT INFORMATION

Include your company’s name, address, and phone number.

3

CLIENT NAME AND DETAILS

Add the client’s name, address, and phone number.

4

INVOICE NUMBER

Enter your own invoice number, or allow the invoice generator to choose it for you.

5

INVOICE DATE

Enter the date of the invoice.

6

DESCRIPTION OF SERVICES RENDERED

Fill out a single line item detailing each product or service sold and the quantity.

7

COST OF SERVICES AND VAT

Enter the rate or cost of the services or products provided along with GST/HST.

8

PAYMENT TERMS, CONDITIONS, AND INSTRUCTIONS

Include information in these optional fields, like notes you want to add to the invoice or the invoice terms and conditions.

9

PREVIEW YOUR INVOICE

Click the black “Preview Invoice” button near the top, and carefully review your work for accuracy. To exit preview mode, simply click outside of the invoice.

10

DOWNLOAD AND SAVE YOUR INVOICE

Once you’re satisfied with your work, click “Download Invoice.”

Confirm your email address, and click “Get My Invoice.” The download link for your invoice is automatically sent to your email address. The invoice will also open as a PDF on your computer screen.

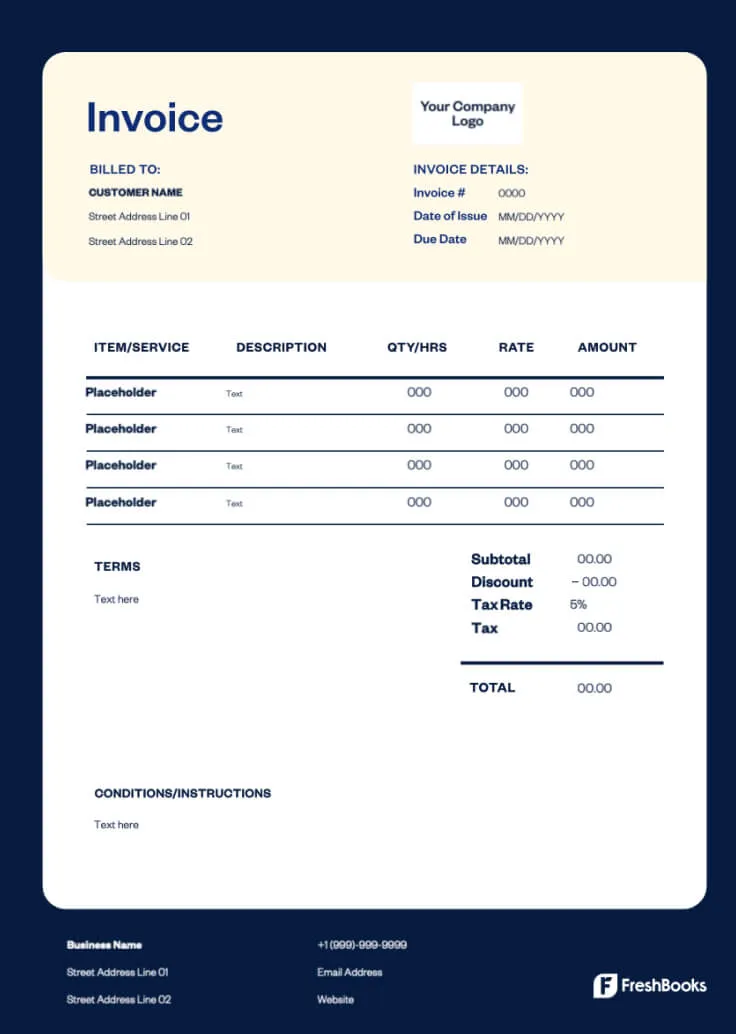

1

INVOICE HEADING

Stick with the standard template or opt for a more modern style. Change the colour of your invoice, and add your business logo if you wish.

2

COMPANY NAME AND CONTACT INFORMATION

Include your company’s name, address, and phone number.

3

CLIENT NAME AND DETAILS

Add the client’s name, address, and phone number.

4

INVOICE NUMBER

Enter your own invoice number, or allow the invoice generator to choose it for you.

5

INVOICE DATE

Enter the date of the invoice.

6

DESCRIPTION OF SERVICES RENDERED

Fill out a single line item detailing each product or service sold and the quantity.

7

COST OF SERVICES AND VAT

Enter the rate or cost of the services or products provided along with VAT.

8

PAYMENT TERMS, CONDITIONS, AND INSTRUCTIONS

Include information in these optional fields, such as notes you want to add to the invoice or the invoice terms and conditions.

9

PREVIEW YOUR INVOICE

Click the black “Preview Invoice” button near the top, and carefully review your work for accuracy. To exit preview mode, simply click outside of the invoice.

10

DOWNLOAD AND SAVE YOUR INVOICE

Once you’re satisfied with your work, click “Download Invoice.”

Confirm your email address, and click “Get My Invoice.” The download link for your invoice is automatically sent to your email address. The invoice will also open as a PDF on your computer screen.

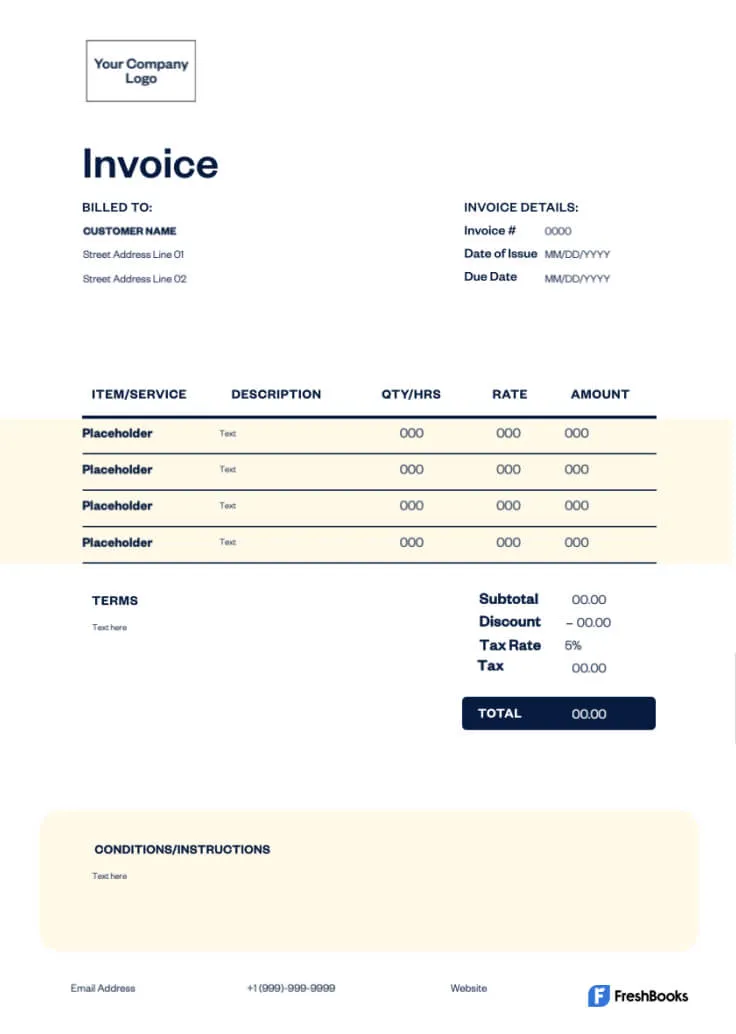

Key elements of a professional invoice

A professional UK invoice should contain these key elements:

- Business information: Clearly display your company name, address, and contact details.

- Invoice number and date: Include a unique invoice number and the date of issue.

- Customer information: Include the customer’s name, address, and contact details.

- Description of goods or services: Provide a detailed description of the products or services, including quantity and price.

- Subtotal, VAT, and total amount due: Clearly show the subtotal, the amount of VAT (if applicable), and the total due.

- Payment terms and due date: State the payment terms and the date payment is due.

Including these elements ensures your invoices are clear, professional, and easy to understand, contributing to a smooth billing process.

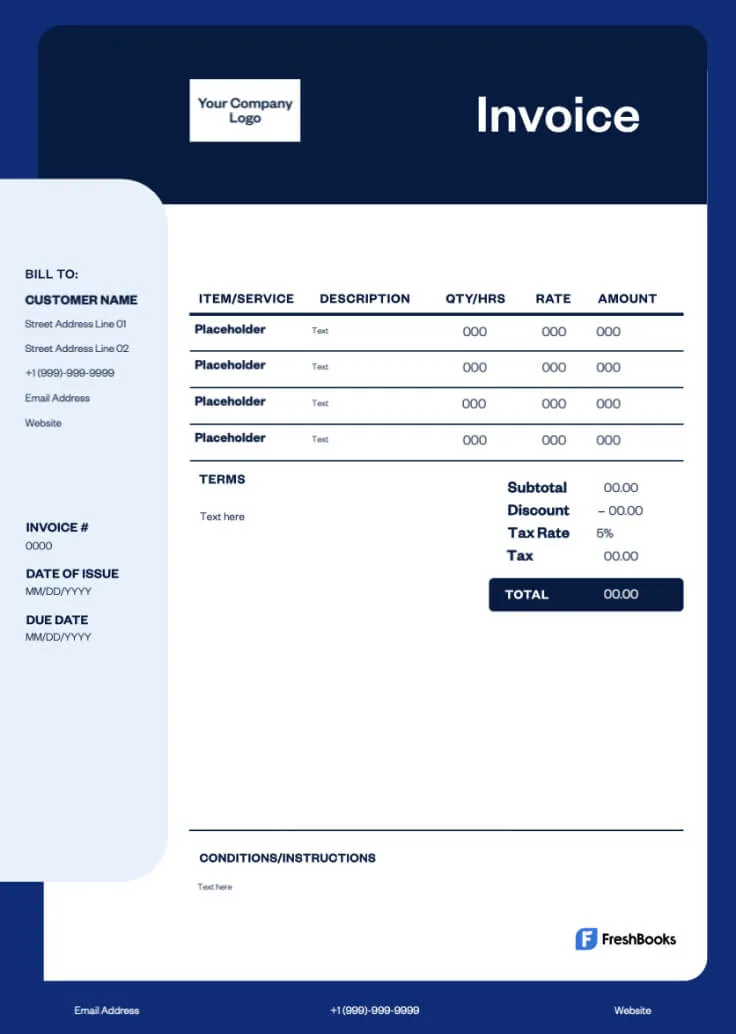

Customising your invoice with a free invoice maker

Using a free invoice maker allows you to create professional-looking invoices that reflect your brand. You can often add your company logo, choose a suitable template, and select brand-aligned fonts and colours. This custom invoice design helps create a consistent and professional image, making your invoices functional and visually appealing. Well-designed invoices positively impact clients, reinforcing your brand and professionalism.

Benefits of using an online invoice generator

Look Like a Pro

Create professional-looking invoices right out of the gate with customisation options that reflect your company’s colours and incorporate your logo. Since online invoices are templated, you’ll never leave out important information—it’s tough to make mistakes with an invoice maker.

Save Time

An online invoice maker does the heavy lifting for you—just enter the information already at your fingertips, and the generator creates the invoice number and performs the calculations. You can even have invoices created and sent automatically.

Save Money

Time is money, and online invoicing is a great way to streamline your accounting processes and reduce the time you spend creating and managing invoices. The accuracy and efficiency of online invoicing keeps your bookkeeping up-to-date and makes it easy to track payments.

Reduce Errors

As you will be submitting this to HMRC, you want to ensure there are no errors. Keep your invoices accurate and your books balanced with online invoicing. Online invoicing provides easy access to all the information you need to file your quarterly or annual tax payments and stay on track financially throughout the year.

Go Paperless

An online invoice generator makes quick work of sending your invoices electronically—no paper necessary. Keeping digital records also allows you to have your documentation on hand for the HMRC’s 6-year requirement. Create, send, edit, and manage your invoices all in one place, and save money on paper, ink, envelopes, and postage while reducing your impact on the environment.

Create Your Free Invoice Now or Try MTD Compliant FreshBooks Invoice Software for Free

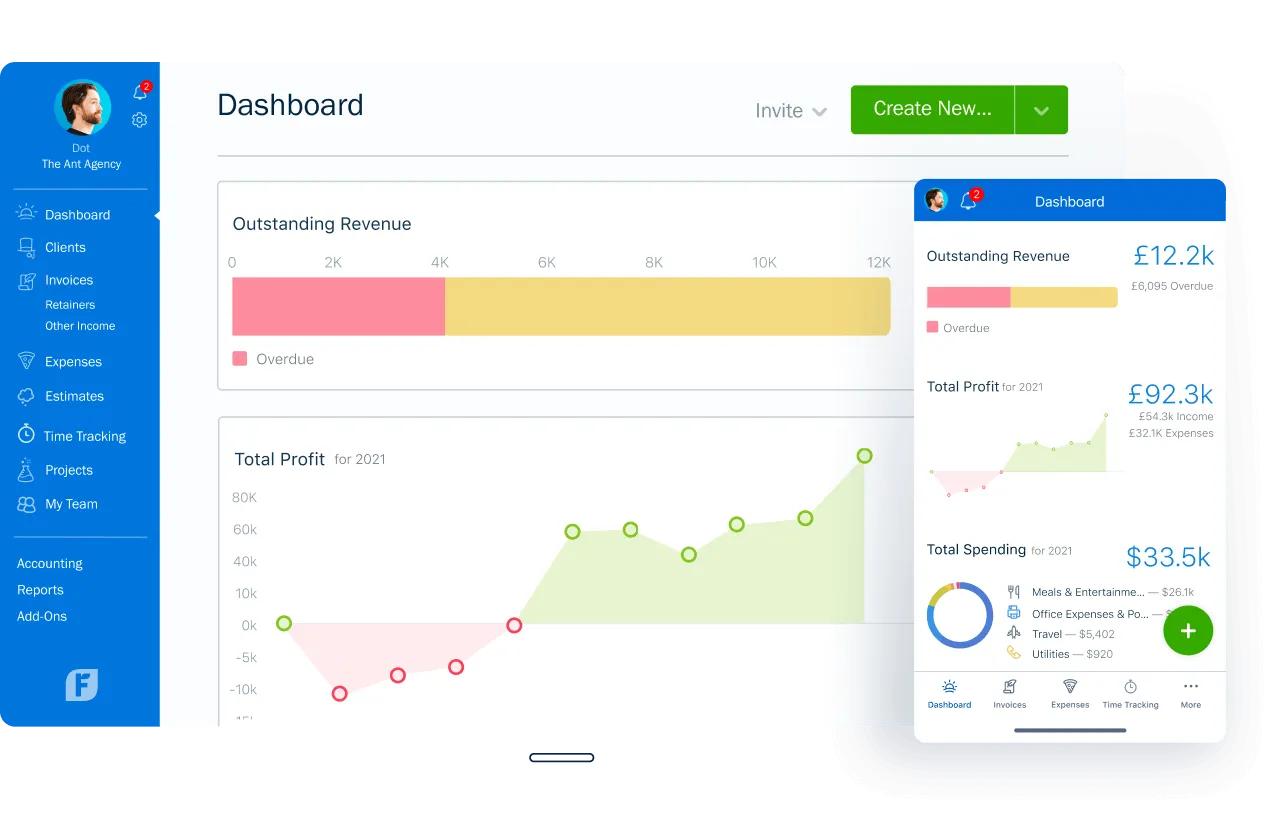

Free invoice generator vs. FreshBooks

Running a business is more than just invoicing. Payments, recurring invoices, and managing the full scope of each project all impact the future success of your business. With FreshBooks, you can ensure clients can pay invoices as quickly and easily as possible while managing client communication and setting your bookkeeping up for tax time success. Check out the comparison chart below to see if your business needs the full force of the FreshBooks platform.

Free Invoice Generator

VS

FreshBooks

Features

Free Invoice Generator

Customizable invoice templates

Printable for clients who love snail mail

Email invoices to clients for free

Accept safe and secure online credit or debit card payments on invoices

Add a payment schedule, automate late payment reminders and fees

Keep track at a glance of who will get paid and who has not

Easily set up deposits for projects

Easily add a discount to your next invoice online

Automate your invoices for recurring work in online payments and subscriptions

Submit VAT returns and review past submissions

Get a VAT return report

MTD Compliant

Create and send invoices from your mobile device

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

View Our Invoice Template Gallery

Choose from a range of invoice formats and templates, and customise them to suit your business.

Helpful Invoicing Resources

Check out these helpful pages and articles to learn more about HMRC invoice requirements and how VAT works, plus everything you need to know about Making Tax Digital.

HMRC Invoice Requirements

How Does VAT Work in the UK?

What Is Making Tax Digital: An Extensive Guide

Other Free Business Tools

ROI Calculator

Calculate your FreshBooks

ROI (return on investment).

Markup Calculator

Calculate your product markup

and margin

Business Loan Calculator

Calculate how much it will cost to take out a loan

VAT Calculator

Use this tool to take the effort out of VAT calculations

Have Questions? We Have Answers!

An invoice should contain the seller’s business name and address, the buyer’s name and address, a detailed list of all items or services purchased, an invoice number, an invoicing date, a due date, payment processing terms, VAT, and the total amount due upon receipt.

Yes—with an invoice generator, you can create and send mobile invoices from wherever you are and whatever device you’re on. FreshBooks allows you to generate and send a finished invoice from your mobile phone in minutes using the FreshBooks app, available on iOS 9.0 or higher or Android 4:2 or higher.

Yes. FreshBooks invoice template generators allow you to customise the colours of your invoices, add your company logo, choose your own font, or add background images. Invoice generators make it easy to design professional, branded invoices.

No. While you can create invoices using the FreshBooks invoice generator, there isn’t a specific option to designate an invoice as a proforma invoice. The system is designed for creating standard invoices.

Yes. You can use most invoice generators on your mobile device. As long as the generator is responsive (which just means they adjust its layout depending on the type of device you’re using). Some invoice generators have an app you can download to your mobile device for invoicing on the go, making these great for freelancers and those who work out of the office.

Yes. Many invoice generators, including the FreshBooks Invoice Generator, allow you to adjust the currency based on where your client is located. This feature is ideal for people who trade goods in multiple countries or have customers who live all over the world. Even better, some invoice generators will automatically convert your currency into the selected different currency based on the exchange rate at that time.

To make a VAT invoice MTD compliant, you’ll need to include the following:

- Your business name

- Your business’s main address

- The buyer’s name

- The buyer’s main address

- Date

- VAT numbers for the buyer and seller

- A description of the goods or services provided

- VAT and value of the goods or services

- The VAT rate charged

The Free Invoice Generator allows you to create one invoice, but customers can create an unlimited number of invoices using the FreshBooks invoice generator. FreshBooks invoice generator produces professional invoices that allow you to put your business on autopilot so you can focus your time on what matters most.