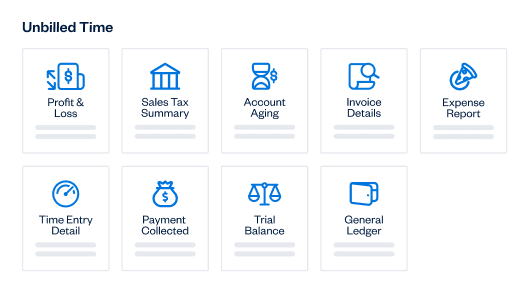

Keep tax time stress-free

Tax-ready reports

Stay on top of every number with detailed, tax-ready financial reports like your Profit & Loss, Expense, and Accounts Aging Reports. By tracking every dollar spent and keeping an eye on your finances, you’ll always be ready for tax time.

Switching made easy

Coming from another accounting platform? Currently using spreadsheets to track sales and expenses? Joining FreshBooks is simple with our easy-to-use platform and data migration services.

Work seamlessly with your accountant

FreshBooks lets you give your accountant free access to the platform (available on Plus plans & higher) so you can effortlessly collaborate in one central location for tax time and beyond.

The features you need.

All in one place.

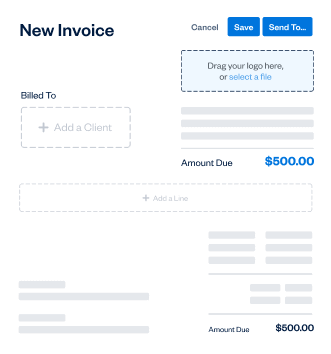

Invoicing

Create professional invoices in minutes. Automatically add tracked time and expenses, calculate taxes, and customize your payment options.

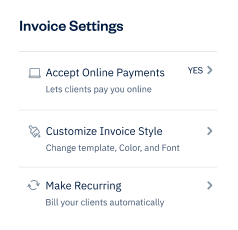

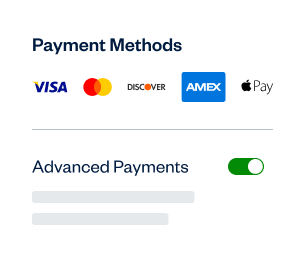

Billing and Payments

Bill fast, get paid even faster, and automate the rest with recurring invoices, online payments, and late payment reminders.

Expenses

Keep track of your expenses with mobile receipt scanning, bank account imports, and automated expense categorization.

Accounting

Know where you stand in real-time with double-entry accounting tools, powerful financial reports, and easy access for your accountant.

ALL-IN-ONE PLATFORM FOR ACCOUNTING, EXPENSES, AND MORE.

ALL-IN-ONE PLATFORM FOR ACCOUNTING, EXPENSES, AND MORE.